The 2024 Valencia Floods: The Ultimate Test for the Spanish Insurance System

Director of Operations

Consorcio de Compensación de Seguros

Introduction: Context and Nature of a Historic Risk

The cut-off low (DANA in Spanish) that struck the Region of Valencia at the end of October 2024 went beyond meteorological chronicles to become the largest flood-related loss ever managed by Consorcio de Compensación de Seguros (CCS). Between 29 October and 4 November, torrential rainfall not only overflowed rivers and ravines but also collapsed drainage networks and flooded vast residential, industrial and agricultural areas, severely affecting the metropolitan area of Valencia and numerous districts in its province.

The human, social and economic impact was extraordinary. Thousands of homes were rendered uninhabitable, entire fleets of private and company vehicles were destroyed, and economic activity ground to a halt in industrial estates and shops, in addition to severe damage to critical infrastructure such as roads and railways.

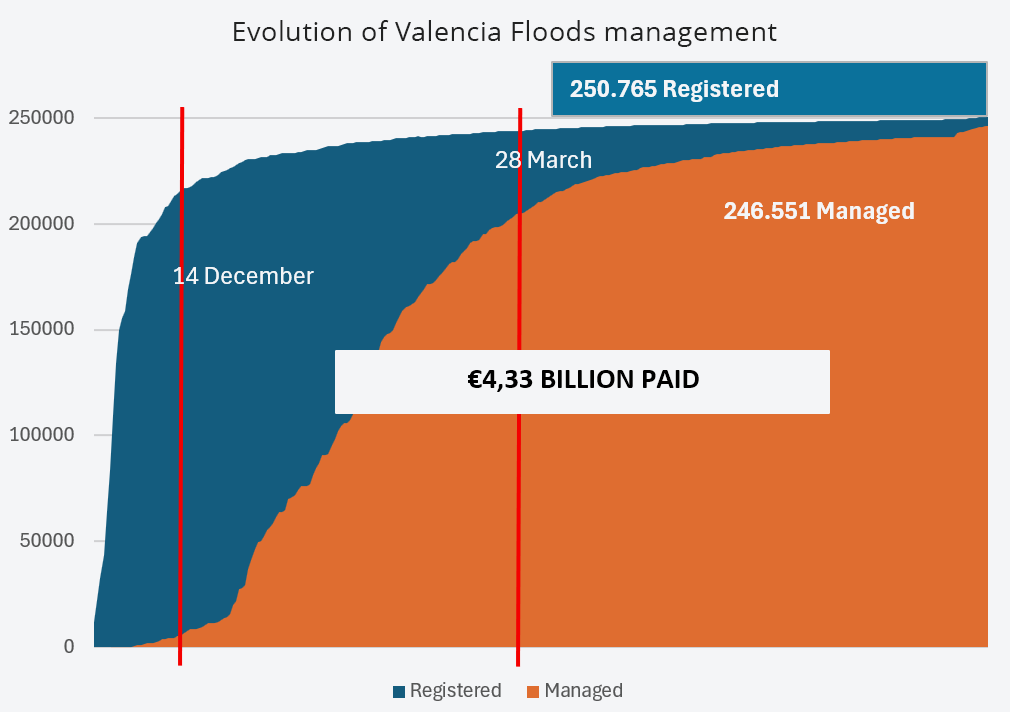

From a risk management perspective, this event tested the Spanish extraordinary risk coverage model like never before. The figures speak for themselves: CCS received more than 250,000 compensation claims, with over 95% concentrated in the Province of Valencia. As of 24 November 2025, more than a year after the tragedy, CCS had registered a total of 250,663 claims and paid out over €4 billion, with an estimated final cost of around €4.8 billion. In terms of volume, this is undoubtedly the largest payout in the institution’s more than 70-year history.

The Concept of “Extraordinary Risk”: The Key to the System

To understand the response to this catastrophe, it is essential to grasp the legal definition of “extraordinary risk”. According to Royal Decree 300/2004 of 20 February, which approves the Regulation on Extraordinary Risk Insurance, Consorcio compensates direct damage to persons and property — as well as business interruption — when these arise from extraordinary natural events (floods, earthquakes, sea surges, etc.) or events of political and social significance included in the regulation itself.

In the case of the 2024 Valencia Floods, the determining factor was not only the intensity of rainfall but the resulting “extraordinary flooding”. This technical concept encompasses inundation caused by the overflow of natural or artificial channels and violent runoff in urban areas.

The cornerstone of this protection system is its mandatory and complementary nature. Coverage is not optional: a surcharge in favour of CCS is automatically included in private insurance policies (home, life, motor, commercial, etc.), ensuring that virtually all insured property and people covered against “ordinary” events are protected against these extreme events too.

Management Mechanisms: The Operational “Stress Test”

The scale of the Valencia Floods served as the most demanding stress test for CCS’s operational machinery. Its response was built on a solid regulatory foundation, its own internal management and, crucially, on an intensive collaboration with the private sector.

As an extraordinary flood, the nature of the event automatically triggers Consorcio’s intervention. Unlike common loss events, where each insurer handles its own claims, CCS assumes direct control: registration, assessment, appraisal and payment.

Although previous experience in disasters, such as the La Palma volcanic eruption or other extraordinary floods, provided a basis, the geographical concentration of damage in the densely populated Valencia metropolitan area posed an unprecedented logistical challenge.

The bottleneck in any natural catastrophe is damage assessment (loss adjustment). Through the Special Operational Procedure, nearly 2,300 additional loss adjusters were mobilised exclusively for this flooding. The majority came from private insurers and expert firms, activated thanks to special collaboration agreements with CCS. This deployment was vital to inspect tens of thousands of assets within weeks.

CCS therefore established a set of loss adjustment criteria framed within the Special Operational Procedure for collaboration between CCS, UNESPA and the 38 insurers that adhered to it, aiming to ensure a swift and consistent response to an exceptional situation.

The loss adjustment criteria established by CCS for managing damage arising from extraordinary risks are not mere technical guidelines; they embody a philosophy focused on protecting the policyholder and ensuring operational efficiency in highly complex situations. The combination of technical rigour, flexibility in the face of exceptional circumstances, and the inclusion of digital tools ensures a swift, fair response tailored to market realities. In short, this model prioritises transparency, collaboration and equity, ensuring that compensation not only covers material damage but also facilitates the policyholder’s full recovery in the shortest possible time.

Assessment Criteria for Motor Claims Used in the 2024 Valencia Floods

This philosophy applies to all vehicles, regardless of their characteristics, that have a specifically contracted insurance policy 1All of them, as Extraordinary Risks Cover is linked with MTPL insurance, which is compulsory in Spain., based on the following principles:

Simplification in Determining Total Loss

One of the fundamental principles is efficient management. When a vehicle is a complete write-off, triage documentation (georeferenced representative photographs) is sufficient to confirm the assessment, without the need for an on-site inspection or videoconference. This measure speeds up the process and avoids unnecessary delays.

Clear and Secure Communication with the Policyholder

It is mandatory to immediately contact the policyholder via SMS, informing them of their claim assignment and the responsible loss adjuster. Furthermore, requesting bank details electronically is prohibited, prioritising security and data protection through in-person delivery or video assessment. This approach strengthens trust and transparency in the relationship with the policyholder.

Use of Technologies and Digital Evidence

The loss adjustment philosophy promotes video-adjusting and the acceptance of photographs or videos provided by the policyholder as sufficient proof to determine write-off. This commitment to digitalisation reduces time and costs while maintaining process reliability.

Economic Assessment Criteria

For vehicles insured solely for third-party liability, it is recommended to apply the used vehicle’s market value, adjusted according to its prior condition and increased by 20%, excluding accessories. For vehicles with comprehensive coverage, the contractual rules apply, respecting any improvements and exclusions. Furthermore, minimum compensation amounts are set for vehicles in working order with a valid MOT/roadworthiness certificate (ITV in Spanish): €750 for passenger cars, €400 for motorcycles and €150 for mopeds. These minimums ensure fair compensation, even in cases of low-value vehicles..

Treatment of Wrecks and Offers

The philosophy seeks to avoid unjustified reductions in compensation. If the policyholder provides proof of repair, no deduction for vehicle wrecks is applied. For write-offs, clear rules apply: no wreck deduction for vehicles taken to municipal storage yards and for those with a market value below €10,000; for values between €10,000 and €30,000, one offer is requested; and for values above €30,000, three offers are requested, applying the highest. Exceptionally, the value offered by the scrapyard is accepted, unless it is disproportionately low. Applying estimated values without documentary support is prohibited, ensuring transparency and fairness.

Cover for Additional Guarantees

The application of guarantees such as a replacement vehicle or immobilisation is recognised; provided they are included in the contract for ordinary risks and the corresponding surcharge has been paid. This criterion ensures contractual consistency and comprehensive protection for the policyholder.

Assessment Criteria for Non-Motor Claims

These criteria are applied to residential properties, commercial and industrial policies and infrastructures.

Assessment Principles and Pre-Existing Conditions

The underlying philosophy stems from the need to determine the real value of the affected property, respecting the assessment method agreed in the policy. For dwellings, the replacement value is generally applied, including VAT when the policyholder is not a taxable person. In calculating the value of existing properties at the time of the loss, construction cost modules, generally used in the Spanish building sector, are employed. These modules, developed by CYPE, are adjusted by type, location and quality, and include overhead, industrial profit, fees and taxes, allowing a replacement value to be reached. In the case of real value policies, depreciation is introduced according to age and useful life of the property (100 years for dwellings).

Inclusion of Taxes and Complementary Costs

An essential principle is the inclusion of VAT in compensation when the policyholder cannot deduct it, as well as the consideration of complementary costs (demolition, cleaning, mud removal) up to a limit of 4% of the total insured sum, both in total and partial losses. This approach seeks to cover not only direct damage but also the costs associated with restoring the asset.

Flexibility in Cases of Underinsurance

The loss adjustment philosophy is geared towards protecting the policyholder, avoiding disproportionate penalties. Therefore, the proportional rule is waived in certain cases, and it is established that the proportional rule will not apply for damages under €10,000 or capital shortfalls of up to 30% in simple risks and 15% in complex risks. This measure reflects a criterion of fairness and proportionality.

Adaptation to Market Reality

These criteria acknowledge the expected inflation in repair costs, increasing CYPE reference prices and rental costs for uninhabitable properties by 20%. Likewise, a substantial advance payment is envisaged without the need for an on-site visit, provided sufficient evidence exists, demonstrating a philosophy of agility and trust in the available information.

Innovation and Simplification in Management

The use of video-adjusting via platforms is encouraged, reducing time and costs. In addition, declarations of responsibility from the policyholder are accepted to assess contents removed without documentary support, applying the insured capital as a legal reference. These measures demonstrate a commitment to digitalisation and administrative simplification without undermining legal certainty.

Comprehensive Coverage and Specific Criteria

The philosophy is also reflected in the breadth of coverages: from business interruption due to impossibility of access to geological risks, damage for theft during cleaning and capital compensation between items within the same risk situation, even if not contemplated in the policy. Requirements such as rental contracts for compensating uninhability are removed, and cleaning with own means is recognised, valued at €12/hour.

Transparency and Coordination

Finally, coordination between loss adjusters and companies was promoted through regular meetings and tools such as the GIS viewer, which enabled the identification of areas and professionals involved. All of this reinforces the philosophy of collaboration and traceability in management.

Scale and Pace of Compensation: A Record Pay-out

The economic dimension of the catastrophe marks a turning point in the history of insurance in Spain. Both in terms of volume and speed of payment, the management of this flood is already a compulsory case study.

Payment Figures

By March 2025, barely four months after the event, CCS had already paid out more than €2.6 billion. By November 2025, the amount paid had exceeded €4 billion, with a claim resolution rate of 98.3%.

It is important to highlight, in the financial context, CCS’s ability to support recovery through the mass payment of insurance compensation.

Sector Breakdown: The Damage X-ray

The distribution of compensation reflects the economic and social structure of the affected area:

- Vehicles: More than 140,000 claims have been processed, with a cost close to €1.2 billion and an average compensation of €8,600–€8,700. Coverage was universal in practice thanks to the inclusion of the surcharge in all motor policies since 2016.

- Housing: Over 82,000 households have received compensation totalling around €1.1 billion. The high level of insurance in the Region of Valencia, above the national average, has been decisive for the large volume of claims handled.

- Businesses and Shops: Around 23,000 companies have received payments amounting to more than €1.7 billion. This sector presents the most complex claims (business interruption, major structural damage), which explains why, a year later, a significant volume of payments was still pending final adjustment.

Territorial X-ray: The Uneven Footprint of Disaster

A detailed analysis of municipal data reveals that the cut-off low was not a uniform blow, but a highly destructive phenomenon with very specific types of municipalities.

The Metropolitan “Ground Zero”: Density and Destruction

The bulk of the impact was concentrated in the metropolitan area of Valencia, where urban density exponentially multiplied the damage. Municipalities such as Paiporta, Catarroja, Algemesí, Aldaia and Alfafar form the epicentre of the tragedy.

- Paiporta stands out as the hardest-hit municipality in terms of the number of claims, with 23,992 filed.

- Catarroja and Algemesí account for 22,578 and 20,387 claims respectively.

- Nature of the damage: In these municipalities, the pattern is clear: thousands of vehicles destroyed (often more than half of all losses) and massive impact on ground-floor residential and commercial premises. The high population density turned the overflow of ravines into a major housing crisis.

The Stricken Industrial Heartland

Beyond residential properties, the Valencia Floods struck at the productive artery of the province. Municipalities with a strong industrial and logistics profile, such as Riba-roja de Túria, Beniparrell and Massanassa, suffered critical damage in their industrial estates.

- Around 42 industrial estates sustained high or very high-intensity damage.

- Thousands of industrial units were affected, compromising the operations of thousands of businesses.

Rural and Peri-Urban Vulnerability

Although with lower absolute figures, the relative impact on rural or peri-urban municipalities such as Chiva, Godelleta and Montserrat was highly significant. Here, damage mainly affected single-family homes and vital agricultural infrastructure. Lower insurance penetration and geographical dispersion have made recovery in these areas slower and more dependent on direct aid.

Lessons Learned and the Future of the Insurance Model

The Valencia Floods were not just a major loss event; it became a forced learning laboratory for disaster management in a changing climate context. Analysing what happened allows us to draw vital conclusions to strengthen the resilience of Spanish society against future events.

Insurance Culture as a Social Shield

The first major lesson is positive: high insurance penetration is a first-rate social protection tool. The fact that a high percentage of households and homeowners’ associations in the Region of Valencian were insured (and therefore covered by CCS) was decisive in cushioning the blow. Without this cover, the social impact would have been enormous.

However, the experience has left pending tasks:

- For families: The need to periodically review policies has become evident to avoid situations of underinsurance that reduce final compensation.

- For businesses: The urgency of taking out adequate business interruption cover is clear, as it is vital for surviving the halt in activity after the disaster.

Adapting to the New Climate Context: A New Map for a New Climate

Finally, this flood event makes it clear that flood risk in the Mediterranean is changing. Rainfall patterns are more explosive, concentrated and difficult to predict. Future insurance management could incentivise prevention.

- Incentives for mitigation: Deductibles play an important role in encouraging the adoption of preventive measures that reduce the damage caused by loss events.

- Conscious Urban Planning: Promoting the reuse of insurance information so that all public administrations take it into account when making decisions on land-use planning.

The economic dimension of the catastrophe marks a turning point in the history of insurance in Spain. Both in terms of volume and speed of payment, the management of this flood is already a compulsory case study.

By March 2025, barely four months after the event, CCS had already paid out more than €2.6 billion. By November 2025, the amount paid had exceeded €4 billion, with a claim resolution rate of 98.3%.