Loss Adjustment for the Valencia Floods: Challenges, Steps Taken, and Lessons Learned

María del Carmen Morales Olmedo - Senior Expert, Expertise Area

Francisco de Asís Navarro Ruiz - Senior Expert, Expertise Area

Mayca Rodríguez Toquero - Senior Expert, Expertise Area

Carlos Baños Gallego - Senior Expert, Expertise Area

Consorcio de Compensación de Seguros

The Province of Valencia is at high risk for flooding and has historically suffered frequent loss events of considerable size, some as devastating as the Great Flood in October 1957, which led to artificial diversion of the channel of the Turia River, and the Tous Dam Disaster in October 1982. Nevertheless, the DANA 1DANA is the Spanish acronym for the weather phenomenon termed a cut-off low. that took place from 28 October to 4 November 2024 is unquestionably the most catastrophic episode Consorcio de Compensación de Seguros has had to deal with in its more than 70 years' existence, and managing loss adjustment for that mega loss event has posed an unprecedented challenge.

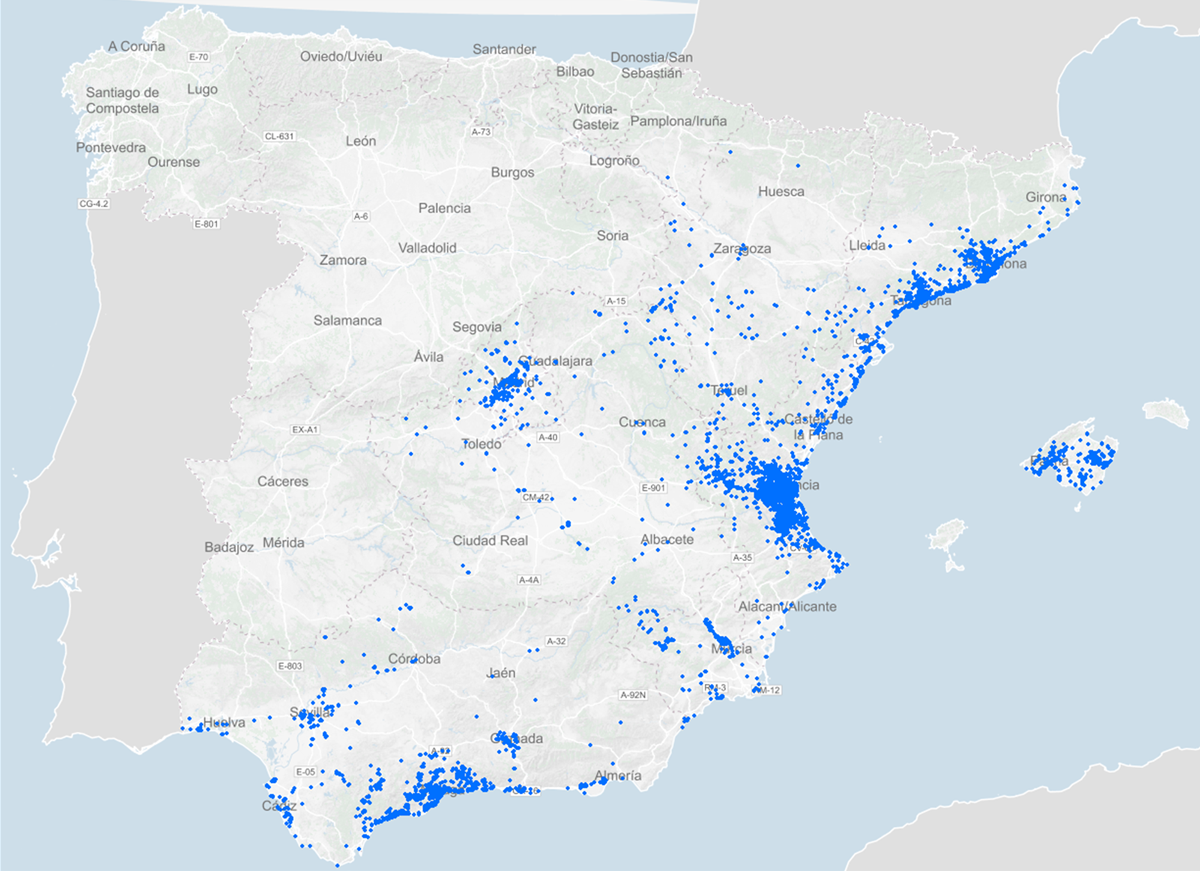

Map 1. Location of the claims for compensation from the October 2024 cut-off low.

Source: Instituto Geográfico Nacional [National Geographic Institute] and Consorcio de Compensación de Seguros.

The cut-off low lasted more than a week and impacted large areas of Spain, but the most severe damage was inflicted on Tuesday, 29 October, in Valencia as a result of overflowing of the Poyo Ravine, the Magro River, and other watercourses in L’Horta Sud, Ribera Alta, Camp de Túria, La Hoya de Buñol-Chiva, and Requena-Utiel districts and the municipalities south of the city of Valencia; plus the towns of Letur and Mira in the Region of Castile-La Mancha.

In conjunction with the floods, 10 tornadoes struck the Ribera Alta area in the afternoon and evening of 29 October and caused further damage from the combined action of wind and rain.

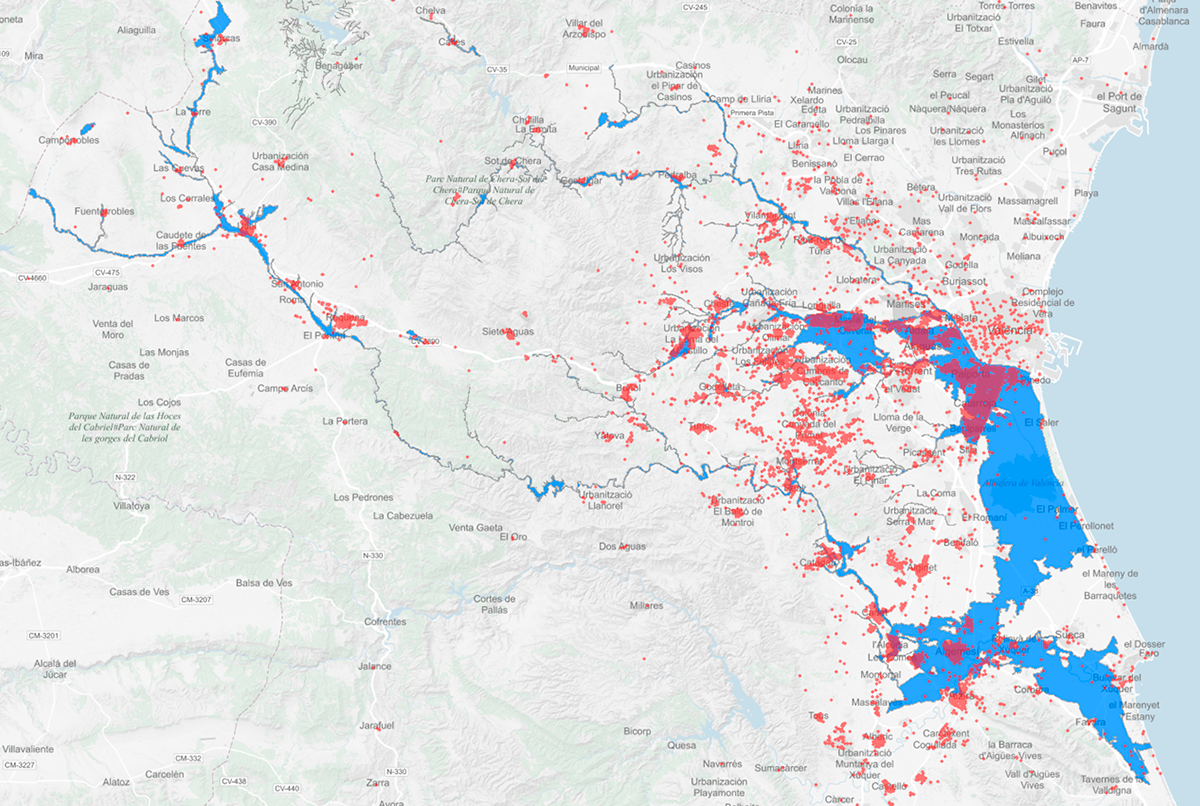

Map 2. The area hardest hit by the October 2024 cut-off low.

Source 1 (in blue, the flood plains of the watercourses and rivers that overflowed): Instituto Geográfico Nacional and Institut Cartogràfic Valencià [Valencia Cartographic Institute].

Source 2 (in red, georeferencing for the claims filed): Consorcio de Compensación de Seguros. Note that there have also been claims from areas located outside the fluvial flood plain from flooding in urban areas because the municipal storm drainage networks were overwhelmed.

This article describes the measures taken by Consorcio and its collaborating loss adjusters to cope with this loss event, unprecedented in terms of the number of claims, the severity of the damage, and its social and media impacts.

Description of the losses

Motor vehicles

One of the singular features of this event has been the extremely high number of motor vehicles that were damaged in Valencia (more than 131,000), 7% of all the motor vehicles registered in the province. More than 97,000 vehicles were inundated just in the area that was hardest hit, L’Horta Sud 2The municipalities of Paiporta, Catarroja, Aldaia, Alfafar, and Sedaví suffered the most losses in the region to the south of the Valencia metropolitan area. district, 33% of all the vehicles registered in that district 3Data on vehicle registrations taken from the Dirección General de Tráfico [Spain's Driver and Vehicle Licensing Agency]., accounting for 75% of all losses.

In most floods, motor vehicles usually make up somewhere between 20 and 35% of claims. The exact figure is higher or lower depending on the day and the time when each episode occurs and the time of concentration of the flood and thus on the amount of time available in which to activate early warning systems and civil protection recommendations and measures. The percentage in the October 2024 floods was extremely high, 57.90% (see Table 1).

| Oct 2024 floods | Sep 2019 floods | Sep 2023 floods | ||||

|---|---|---|---|---|---|---|

| No. | % | No. | % | No. | % | |

| Motor vehicles | 145,082 | 57.90% | 20,079 | 28.01% | 6,350 | 26.47% |

| Homes | 82,416 | 32.89% | 42,716 | 59.59% | 15,001 | 62.53% |

| Offices, businesses, industrial buildings, warehouses, and other simple risks | 17,710 | 7.07% | 7,299 | 10.18% | 2,240 | 9.34% |

| Industrial plant | 5,303 | 2.12% | 1,511 | 2.11% | 377 | 1.57% |

| Infrastructure | 74 | 0.03% | 76 | 0.11% | 24 | 0.10% |

| Total | 250,585 | 100.00% | 71,681 | 100.00% | 23,992 | 100.00% |

Table 1. Claims by risk category. The cut-off low from 28 October to 4 November 2024 (data as of 16/11/2025) is compared to two other severe and recent floods, namely, those of September 2019, that mainly impacted Murcia and Alicante and of September 2023, that mainly impacted Toledo and Madrid.

Source: Consorcio de Compensación de Seguros. Prepared in-house.

Motor vehicle write-offs made up 78.5% of all vehicle losses, an unusually high percentage, considerably higher than, for instance, the values of 48.1% for the September 2019 floods in Alicante and Murcia and 65.7% for the September 2023 floods in Toledo and Madrid (see Table 2).

Image 1. Inundated vehicles in Paiporta.

Source: Consorcio de Compensación de Seguros.

Another relevant aspect was the large amount of damage to lorries, coaches, and industrial and farm vehicles: more than 8,300 claims have been filed for these losses, 5.4% of all motor vehicle claims, higher than the 3.5% for the September 2019 floods in Murcia and Alicante and the 1.9% for the September 2023 floods in Toledo and Madrid (see Table 2).

Image 2. Damaged industrial vehicles in Riba-roja de Túria.

Source: Consorcio de Compensación de Seguros.

| Oct 2024 floods4 | Sep 2019 floods | Sep 2023 floods | ||||

|---|---|---|---|---|---|---|

| No. | % | No. | % | No. | % | |

| Motor vehicle losses | 134,293 | 100.00% | 17,476 | 100.00% | 5,669 | 100.00% |

| Passenger cars and motorcycles | 127,024 | 94.59% | 16,865 | 96.50% | 5,562 | 98.11% |

| Coaches, lorries, tractors,and industrial vehicles | 7,269 | 5.41% | 611 | 3.50% | 107 | 1.89% |

| Vehicle write-offs | 105,377 | 78.47% | 8,401 | 48.07% | 3,724 | 65.69% |

Table 2. Number of vehicles damaged by vehicle type and degree of loss.

Source: Consorcio de Compensación de Seguros. Prepared in-house.

The average age of motor vehicles registered in the region is quite high, over 13 years old, and consequently the compensations established in the insurance policies were in many cases less than the replacement cost. This disparity grows with vehicle age 5For vehicles that are more than two years old, policies usually calculate compensations for write-offs at the market value of a vehicle the same age, with the same characteristics, and in the same condition. Compensations for repairs are ordinarily limited to that market value..

Image 3. Inundated vehicles over 20 years old.

Source: Consorcio de Compensación de Seguros.

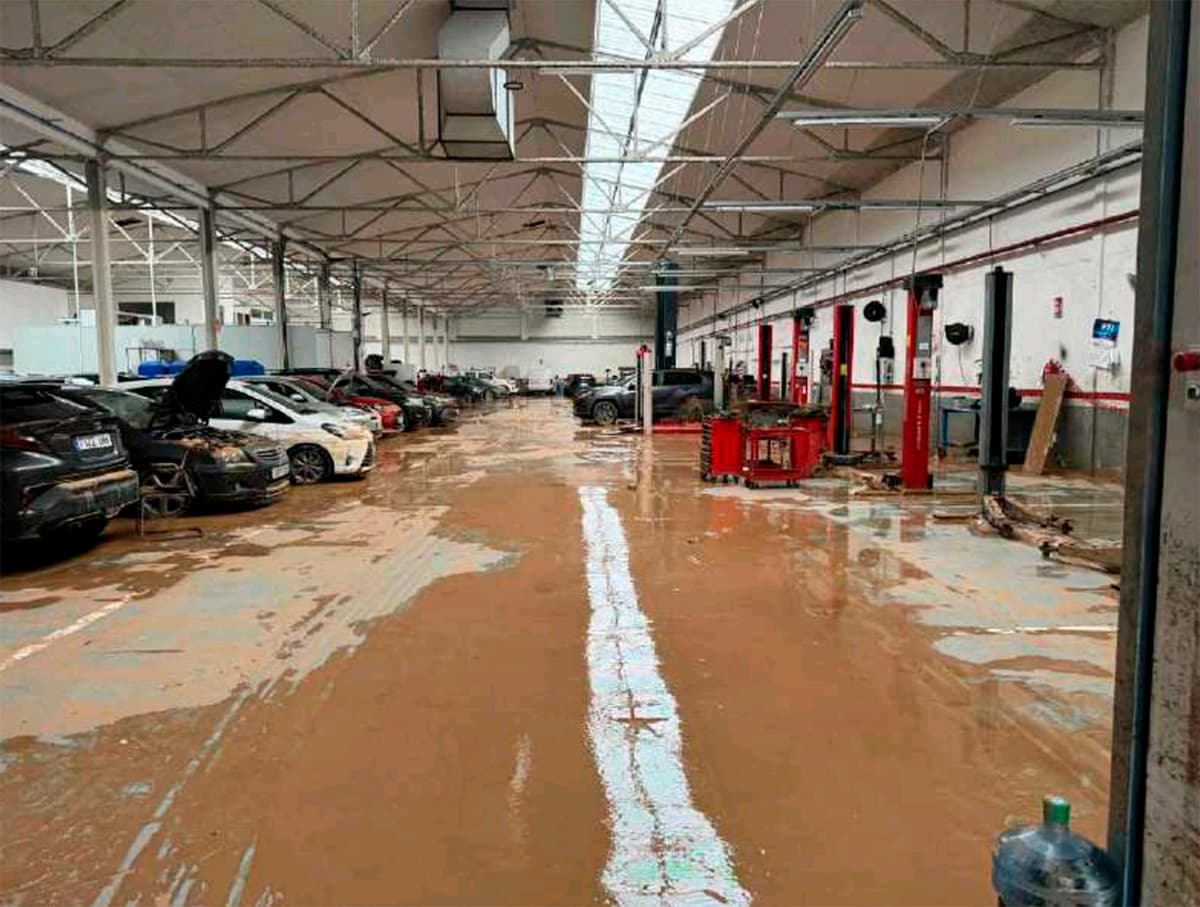

Vehicle repair shops were basically swamped in the months following the disaster because of the avalanche of work and because many workshops had themselves been severely damaged by the flooding and were not operating. For that reason, repair times for vehicles that were not write-offs have ballooned.

Image 4. Flooded automobile repair shop at the Silla motorway (V-31) axis.

Source: Consorcio de Compensación de Seguros.

Homes and businesses

Floodwater levels rose to more than one metre over most of the central part of the flooded area and caused serious structural damage to homes, businesses, and warehouses at or below street level. The belongings inside were completely destroyed, the premises were made unfit for occupancy, and businesses lost income for weeks or months.

In many cases the rule of proportional insurance had to be invoked because of underinsurance 6The proportional insurance clause stipulates that where the insured sum is less than an asset's value, in case of loss the insurer pays only a partial indemnity in the same proportion as the ratio between the sum insured and the value of the asset.. Most homeowner insurance policies contained a loss of use clause, but in contrast many insurance policies for businesses, warehouses, offices, and similar risks did not include a business interruption clause to cover lost profits.

Image 5. Inundated home façade in Paiporta, with a graffiti reading “Thanks for your efforts”.

Source: Consorcio de Compensación de Seguros.

Image 6. Damaged homes in Picanya near the Poyo Ravine.

Source: Consorcio de Compensación de Seguros.

Image 7. Detail of a restaurant in Picanya provisionally reopened a few days after the flood.

Source: Consorcio de Compensación de Seguros.

Image 8. Damage to a logistics centre at the Sur industrial estate in Riba-roja de Túria (A-3 motorway axis).

Source: Consorcio de Compensación de Seguros.

Industrial plants

Valencia is one of Spain’s most industrialised provinces. The industrial fabric in the area hit by the floods is highly developed and diversified, and many plants in the food product, electrical and electronic component, automotive aftermarket, wood and furniture, plastic, chemical, metalworking, and textile sectors were affected. Generally speaking, the damage was quite severe, and manufacturing activity had to be halted, in many cases for protracted periods. Not all had suitable insurance coverage.

In addition, in the first days and weeks following the event the affected areas faced major difficulties. Travel and accessibility were impacted, and there were restrictions on the availability of electricity, water, and telecommunications services. This made it difficult for the insured to take steps to remove standing water, eliminate damp, or recover damaged belongings, as well as the initial loss appraisal activity, which could have helped lessen the economic impact of the event.

Image 9. Damage to a Metrovalencia viaduct over the Poyo Ravine.

Source: Consorcio de Compensación de Seguros.

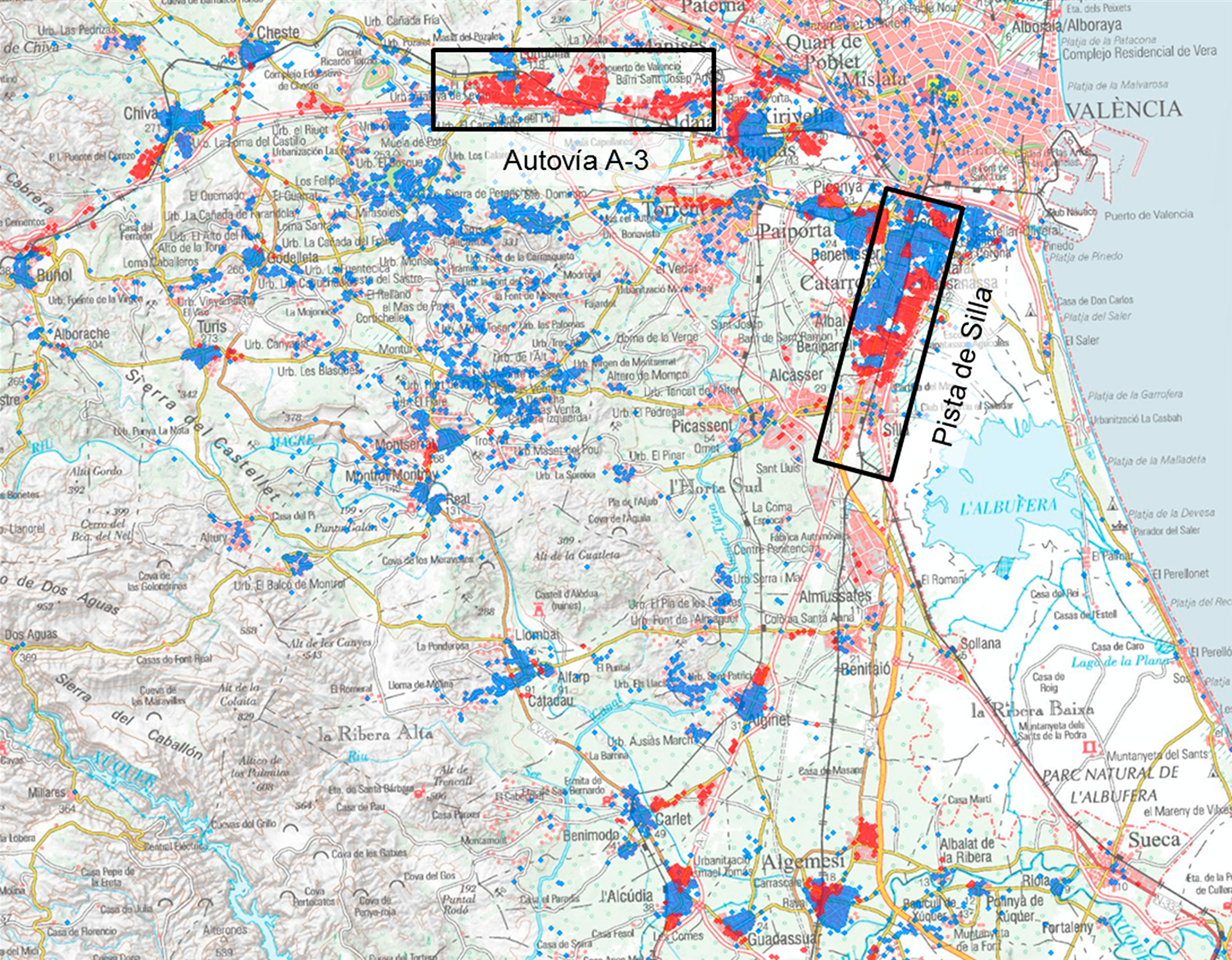

Map 3 shows the industrial areas that were hardest hit:

- Access route to the capital via the A-3 motorway (industrial and logistics area of Riba-roja de Túria and Quart de Poblet).

- Silla motorway axis (V-31) in municipalities south of the capital (Sedaví, Benetússer, Alfafar, Massanassa, Catarroja, Albal, Beniparrell and Silla).

- Industrial estates in towns located between the two aforementioned routes (Aldaia, Xirivella, Alaquàs, Torrent, Picanya and Paiporta).

- Industrial estates in other towns such as Chiva, at the head of the Poyo Ravine, or Algemesí, along the Magro River.

Map 3. Industrial areas hardest hit by the cut-off low. In red, claims for industrial plants; in blue, all other (non-industrial) claims; black rectangles: the two industrial zones with the highest concentration and severity of losses. Note that many industrial estates are located in flood-prone areas.

Source: Instituto Geográfico Nacional and Consorcio de Compensación de Seguros.

Image 10. Damaged food industry plant in Torrent.

Source: Consorcio de Compensación de Seguros.

Image 11. Damaged automotive supply plant in Riba-roja de Túria.

Source: Consorcio de Compensación de Seguros.

The table below lists the industrial estates that had the most losses:

| Watershed | Municipality | Industrial estate |

|---|---|---|

| Poyo Ravine | Albal | Albal Ind. Estate |

| Aldaia | El Pou | |

| La Lloma | ||

| Benetússer | Benetússer Ind. Estate | |

| Beniparrell | Carrascal | |

| Vereda | ||

| Catarroja | El Bony | |

| Cheste | Castilla | |

| Chiva | La Pahilla | |

| Loriguilla | Masía del Conde | |

| Massanassa | Massanassa Ind. Estate | |

| Paiporta | La Mina | |

| La Pascualeta | ||

| L'Estació | ||

| Picanya | Alquería de Moret | |

| Alquería de Raga | ||

| Quart de Poblet | Valencia 2000 | |

| A3 ind. develop. zone | ||

| Riba-roja de Túria | Casanova | |

| El Oliveral | ||

| Sector 12 | ||

| Sector 13 | ||

| Sector 14 | ||

| Sur | ||

| Sedaví | Sedaví Ind. Estate | |

| Torrent | Mas del Jutge | |

| Valencia | Forn d'Alcedo Ind. Estate | |

| Xirivella | Virgen de la Salud | |

| Zamarra | ||

| Magro & Júcar rivers | Algemesí | Cotes |

| Xara | ||

| L'Alcúdia | La Creu | |

| Cami Reial | ||

| Guadassuar | La Garrofera | |

| Alberic | La Marquesa | |

| Carlet | Ciutat de Carlet | |

| Sant Bernat | ||

| Alzira | El Pla | |

| Río Verde | ||

| Estació d’Alzira | ||

| Carretera d’Albalat | ||

| Polinyà de Xúquer | Polinyà de Xúquer Ind. Estate |

Table 3. Main industrial estates affected.

Source: Consorcio de Compensación de Seguros. Prepared in-house.

Mean cost

The mean cost per claim 7The total compensations paid out (as of 31 December 2024) divided by the claims filed and paid (rejected claims not included). for the October 2024 floods has amounted to 23,338 euros 8Data as of 16 November 2025. , much higher than for other recent floods like those of September 2019 in Alicante and Murcia (9,486 euros) and of September 2023 in Toledo and Madrid (8,698 euros) and comparable only to the average cost for the July 2023 flood in Zaragoza (25,939 euros), which produced extremely sizeable but localised damage to the industrial zones around that city.

Claims

A huge number of claims were filed in the days following the event. In the first 30 days more than 208,000 claims (6,950 per calendar day) poured in. In the 9 consecutive days between 31 October and 9 November more than 10,000 claims were filed daily, peaking at over 23,000 claims on 7 November, an all-time record for Consorcio.

These extreme circumstances overwhelmed Consorcio’s capacity to assess the damage by its regular means and called for special measures.

Solutions implemented

Enlarging Consorcio’s team of loss adjusters and technical staff

As a general rule Consorcio uses loss adjustment services hired from loss adjusting firms or free-lance experts, outside partners approved after being vetted to ensure that they meet certain standards of training and experience as specified in Consorcio’s hiring policies. Before the Valencia Floods, Consorcio’s regular team of collaborators comprised 337 loss adjusters.

The size of the disaster made it necessary for Consorcio to implement, for the first time, its internal emergency loss adjuster hiring procedure, which authorises Consorcio to hire loss adjusters directly without putting them through the vetting and approval process in cases of a catastrophic loss event or exceptional need. By this means 492 new loss adjusters were added. Together with the 337 regular collaborators, they made up an expanded team of 829 insurance adjusters, a number unprecedented in the history of Consorcio but still not enough to take on the daunting task of assessing the damage caused by the floods.

On 13 November 2024, just two weeks after the event, Consorcio and Unespa 9Unespa is the insurers’ business association. Most of the insurance companies operating in Spain are members., on behalf of the private insurance companies, signed a new cooperation agreement for the Valencia Floods arranging for a series of critical measures, including the immediate addition of 2,369 loss adjusters who ordinarily work for the main insurers.

This new procedure and the 2011 Agreement between those same two parties for handling windstorms are two outstanding public-private partnership initiatives in the field of insurance, both in Spain and internationally.

To be able to properly go about their loss appraisal duties, all those new loss adjusters had to go through an initial intensive training course in the extraordinary risk insurance scheme and Consorcio’s loss adjustment procedures, and frequent coordination meetings were held to answer questions and standardise the guidelines to be followed.

Supervising the work of that huge network of loss adjusters entailed major efforts by the technical and valuation services of the private insurers and of Consorcio itself, which had to enlarge its staff by temporarily hiring new technical personnel, partially outsourcing services for the least complicated claims, and increasing the staff assigned to manage billing by free-lance adjusters and loss adjusting firms.

Video-adjusting

Because of the impediments to travel in the weeks following the Valencia Floods, Consorcio advised its loss adjusters to make broad use of video-adjusting, either in place of in-person inspections for the most straightforward claims or as an additional tool pending subsequent in-person inspections for the more complicated claims.

To that end, a video-adjusting platform was placed at the disposal of the entire loss adjustment network free of charge for extensive use across the board.

Advance payments

The entire network of loss adjusters was told that Consorcio’s strategic goal was for them to issue adjustment reports immediately, on a mass scale, after verification of the insurance policies and a very preliminary estimate of the value of the loss, without need of an in-person inspection, so that advance payments could be paid out against the final settlements for claims that would otherwise not be able to be settled quickly.

The loss adjusters were advised to apply the objective guideline of making advance payments of no less than 80% of the sum insured contents for single-story homes or 50% for two-story homes when floodwater height had been above one metre. For storerooms at or below ground level, the recommendation was for interim payment of the indemnity sublimit set in the policy or a minimum of 500 euros where no sublimit had been set when floodwater height had been more than half a metre.

Adjusting prices for inflation

Loss adjusters were advised to use price tables that were widely employed in the region (e.g., the CYPE price generator or the Instituto Valenciano de la Edificación [Valencia Building Institute] Construction Database) plus 20% in anticipation of the inflation that would follow on the overload of work at repair shops.

Resolution of questions in favour of the insured

Where reasonable differences in interpretation concerning loss adjustment issues or insurance policies arose, loss adjusters were reminded that Consorcio’s traditional policy was to accept the interpretation most favourable to the interests of the insured party concerned. Specifically, loss adjusters were issued a standard declaration of responsibility to be filled out by the insured in the hardest hit areas in cases where the belongings claimed had gone missing or could not be retained before the loss adjuster’s inspection and adequate supporting documents were not available. Loss adjusters were told that Consorcio accorded those statements a presumption of truthfulness.

Loss adjusting for residential complexes

The above-mentioned cooperation agreement between Consorcio and Unespa and the insurers was without a doubt crucial to being able to expedite damage appraisals, even though it added a certain layer of complexity to the assessments.

There are often two insurance policies covering the building structure in the case of residential complexes: on the one hand the policy taken out by the homeowners association, and on the other the private policies taken out by each owner or tenant. For that reason, damage to the units, garages, and storerooms of a single complex should preferably be appraised by a single loss adjuster or loss adjusting firm to ensure that losses are neither omitted nor duplicated and that the entire sum insured is taken into account if the rule of proportional insurance has to be applied in cases of underinsurance.

In this case, appraisal by a single adjuster was not always possible, because Consorcio might assign a loss adjuster for the claims that it was processing directly while the private insurers might assign their own adjusters for claims that had been allocated to them, all at the same building.

As a result, the following loss apportionment policy was implemented:

Where the homeowners association had taken out an insurance policy:

- The claim under the homeowners association’s policy covered damage to common areas and the structure of units not covered by their own private insurance policy.

- For units covered by a separate structural damage policy, structural damage to those units was included under the corresponding individual claims.

Where there was no homeowners association insurance policy:

- The pro-rata share of structural building damage to common areas was added to the structural damage to the individual units for each separate claim filed under the private insurance policies.

- Units without a private insurance policy were not covered and neither was their pro-rata share of damage to common areas.

This enabled us to improve processing when there was double insurance and helped prevent losses from being omitted or duplicated.

Simplifying the assessment of loss of use

A procedure to simplify assessments of loss of use of homes was also implemented, enabling loss adjusters to calculate the applicable period based on the severity of the damage to the property and the estimated duration of repairs without requiring the insured to submit supporting documents concerning the cost of rentals.

Loss adjusters were also advised to increase the duration of their estimates of the period of loss of use by two months to account for processing delays not ascribable to the insured. They were issued a table of rental prices drawn up by Consorcio based on market prices from before the Valencia Floods, increased by 20% in anticipation of inflation in the wake of the disaster.

Adjusting the minimum value of vehicle write-offs

The minimum value of motor vehicle write-offs for purposes of compensation was taken as the value for each make, model, version, and year listed in the Used Motor Vehicle White Book published by GANVAM 10GANVAM is the Asociación Nacional de Vendedores de Vehículos a Motor, Reparación y Recambios [National Association of Motor Vehicle Dealers, Repairs, and Spare Parts]. The Association regularly releases its widely accepted White Book with used vehicle sales prices.. plus 20% for anticipated inflation in the used vehicle market.

Subtracting the residual value of certain vehicles

Compensations for write-offs are calculated by subtracting the residual value of the vehicle after the loss from the vehicle’s pre-loss value. Because of the drop in the residual values as a result of saturation of government approved vehicle scrap yards (CAT for its Spanish initials), it was decided not to subtract the residual value if the vehicle’s market value was less than 10,000 euros or when the vehicle had been taken to any of the collection points opened by the authorities for scrapping and was not available for retrieval by the owner.

Vehicle triage at the scrap collection points

Tens of thousands of vehicles appeared swept away by the waters on 30 October and were left scattered in disarray on the roadways, highways, pavements, parks, fields, and watercourses in the hardest hit areas, tens or hundreds of metres from where they had been parked. In the days following the disaster, the police and security forces, government authorities, and insurers began to remove those vehicles from the roadways using heavy machinery and breakdown trucks in an effort to clear the streets of cities and towns for transit in the shortest possible time.

Image 12. Vehicles washed away by the waters.

Source: Consorcio de Compensación de Seguros.

Initially the vehicles were removed from the roadways and provisionally piled up hastily in nearby areas. In the months that followed, the vehicles were transferred to the scrap collection points opened by the authorities or, if the collection points were full, to the surrounding streets. The severity of the damage, the unheard of number of vehicles involved, and the need to act quickly meant that this was done haphazardly with inadequate record-keeping and not always done with the knowledge of the vehicles' owners.

Image 13. Municipal collection point in Sedaví.

Source: Consorcio de Compensación de Seguros.

In these circumstances Consorcio de Compensación de Seguros began receiving tens of thousands of claims for vehicles whose whereabouts no-one, not the owner, not the insurer, not Consorcio itself, knew. But they had to be located to be able to determine the cause of the loss and appraise the damage.

Consorcio made arrangements to address this extremely complicated situation as follows:

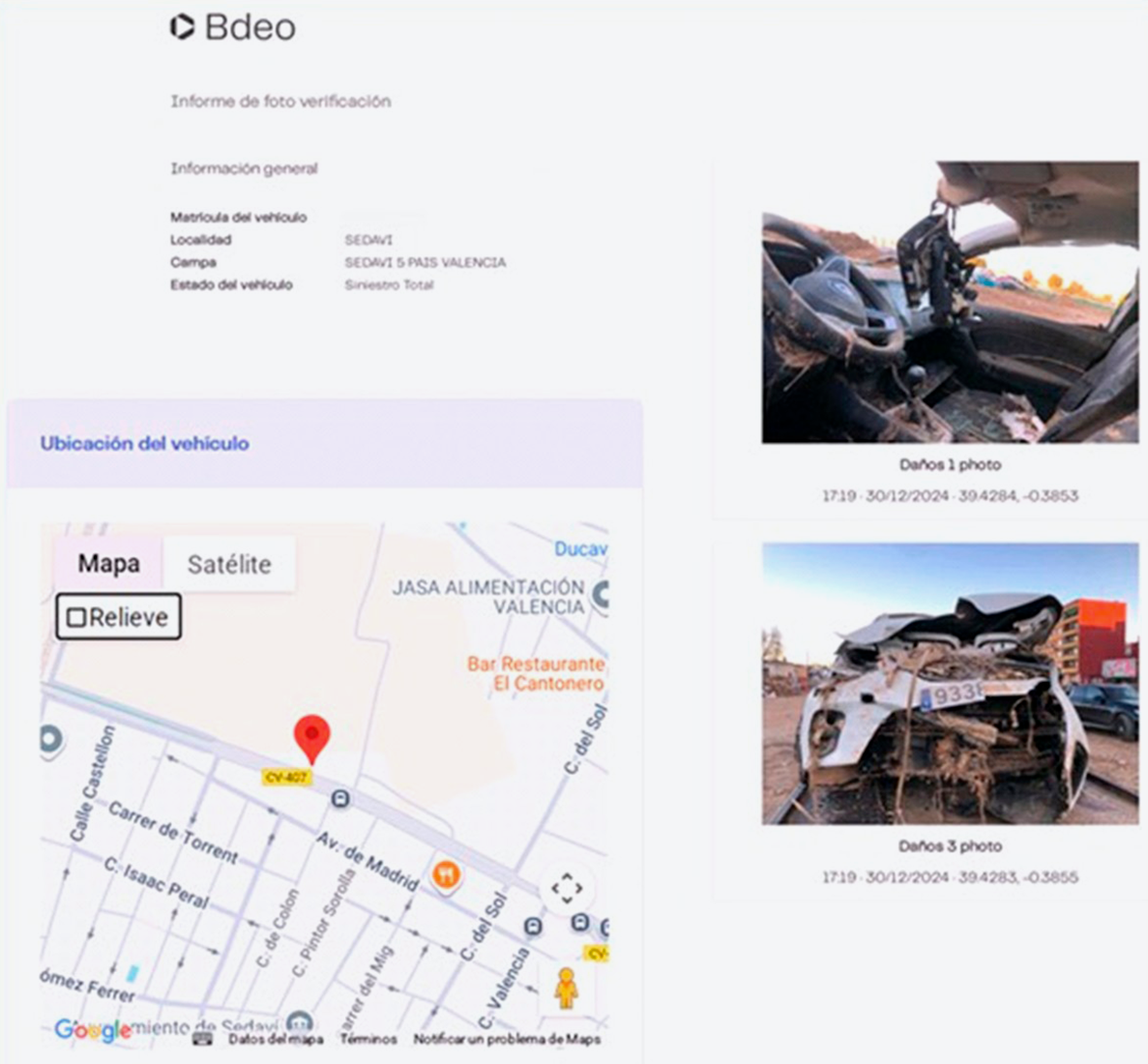

- An application for taking inventory of and georeferencing the vehicles at the collection points was developed taking the registration plate or the vehicle identification number where the registration plate were missing as input. Photographs showing vehicle condition were taken, and the condition was classified in one of three categories: write-off, repairable, or uncertain.

- Starting on 11 November, 90 technical personnel were assigned to inventory all the vehicles on hand at the collection points, a task that took six months.

- The inventory of vehicles on the triage application was cross-checked against the claims that had been filed daily, and when a match was found, the triage data were added to the claim file for use by the loss adjuster who had been assigned to make the final appraisal of the loss.

- Based on the available data, loss adjusters could confirm write-offs, in which case an immediate appraisal of the loss was issued. Or if deemed necessary, thanks to the georeferencing by the triage technicians, loss adjusters could inspect the vehicles that were repairable or potentially repairable.

Figure 1. Specimen triage report.

Source: Bdeo.

This novel procedure worked well and was able to bring order and clarity to an exceptionally muddled situation. A total of 78,109 triages were performed, resulting in 69,305 vehicles (88.7%) preliminarily classified as write-offs, 2,469 as repairable, and 6,335 as uncertain. In addition, all this valuable information was made available to the different government authorities because of its obvious usefulness in managing the Valencia Floods.

Lessons learned

The severity of the losses produced by the floods has in many cases pushed the sums insured to their limits and has brought to light more than a few issues connected with the insurance policies. In resolving these issues, efforts have been made to favour the insured insofar as possible whenever there have been reasonable interpretations of the policy that benefit the insured.

Some of the deficiencies disclosed are:

- Underinsurance and application of the rule of proportional insurance 11Consorcio does not invoke the rule of proportional insurance where the shortfall in the sum insured calculated by the loss adjuster does not exceed 30% of the sum insured for homes and small businesses or 15% for industrial plant and large retail outlets..

- Inaccuracies, omissions, and errors in defining the risk or in the scope of the insurance coverage.

- Conditions of insurance of industrial machinery at actual value 12The actual value of an asset is its replacement value less depreciation for its state of use or obsolescence immediately prior to the loss. that in all cases or in the case of machinery with a certain length of time in service result in lower indemnities for write-offs due to depreciation.

- In floating insurance policies 13Floating insurance policies are commonly used in Spain and are suitable for insuring industrial or merchant inventories that can fluctuate appreciably. A fixed or minimum sum is specified at the start of the annual premium period. At the close of each month, the insured are to report their actual inventories during the month; the insurer, in turn, is to issue the corresponding adjusted premiums quarterly or as otherwise specified. Lastly, for each adjustment period the insured must pay any additional premiums owed depending on the excess above the fixed sum., errors in or omission of reporting of actual monthly inventories by the insured and subsequent adjustment of the premium by the insurer, with the resulting reduction in the sum insured and possible application of the rule of proportional insurance.

- Insufficient business interruption insurance penetration in the industrial sector.

As of this writing 99.0% of motor vehicles and 98.1% of homes, together with a large proportion of businesses, warehouses, and other similar risks (94.6%) and industrial risks (89.7%) have been appraised; but a substantial portion of the most complicated and costly claims accounting for 21% of the total expected cost of overall losses are still in the adjustment phase 14Data as of 16 November 2025..

The assessments still pending are the most complex and severe business interruption claims, because we have had to wait for the period of impact to end for the insured or the loss adjusters they have appointed to be able to suitably document the losses sustained.

At the same time, there are still missing motor vehicles for which there is no evidence that can be used to establish the cause and value of the loss.

The time periods needed to assess the losses are definitely longer than for other losses caused by extraordinary risks. The delay has in many cases been due to the extremely high workload burden on Consorcio’s collaborating loss adjusters and on its own supervisory and control services. Other reasons have been the complexity of many of the losses, the extended periods of business interruption, and the heavy workload on the loss adjusters appointed by the insured.

Extraordinary risks inherently include an uncertainty component, and unfortunately there are no measures that can be taken to completely ward off these risks. Every so often nature sends us a wake-up call that catastrophic events that eclipse all projections and outstrip the preventive measures that have been taken will always be with us. The scientific consensus is that extreme hydrometeorological phenomena are going to become stronger and more frequent in the future. This makes it necessary to reduce exposure and vulnerability by taking measures at different levels, from urban planning to self-protection measures by the insured at their homes, businesses, and industrial facilities, including increasing the level of insurance coverage and improving insurance policies to enhance their precision and make them better suited to each specific risk.

The insured need to take out insurance policies with sums insured that are sufficient, and they must keep those policies up to date in terms of both their covers and the sums insured and the limits of indemnity. Insurers themselves and insurance intermediaries have a big role to play in this, and their involvement and advice are important.

The October 2024 floods have showcased the value of teamwork, all the more necessary the more complex the task. It has also shown that no single organisation is capable of handling this type of loss event alone. Finally, it has demonstrated that strengthening and improving public-private partnership is the best way to dependably tackle future disasters.

Fortunately, Spain’s system of coverage of extraordinary risks has proven to be robust and resilient, and we most assuredly have reason to be confident and optimistic about our ability to cope with new challenges as they arise.

The DANA that took place from 28 October to 4 November 2024 is unquestionably the most catastrophic episode Consorcio de Compensación de Seguros has had to deal with in its more than 70 years' existence, and managing loss adjustment for that mega loss event has posed an unprecedented challenge.