X-ray image of Agroseguro and the Spanish multi-peril agricultural insurance scheme: linchpins of crop and livestock farming in Spain

Aitor Moriyón - Communications Department

Jéssica Hernández - Communications Department

Agroseguro

Taking an x-ray of an enterprise’s situation is no easy matter when it is growing in size year by year and when its impact on society grows along with its size. Furthermore, Agroseguro’s impact can be said to have multiple benefits, since the focus of its insurance, crop and livestock insurance for farms, is essential to the survival of most Spanish towns and to food production to feed all those of us who live both in rural areas and in city centres. Not to overlook the impact on rural living, the economy, employment, and the country’s balance of trade.

The choice to buy a farm or agricultural insurance comes after strategic thinking about exposure to risk, long-term financial planning, and relying on protection with a view to the future. This is because crop and livestock farmers are not just producers but people who run businesses and have to manage uncertainty and take strategic decisions about the sustainability of their business activities.

In this context multi-peril agricultural insurance in Spain is a national government policy based on a private-public scheme that has proven to be a national success and is regarded as a touchstone internationally. The scheme’s existence ensures the stability, continuity, and resilience of the primary sector by protecting not just producers but also the country’s food-production system as a whole.

Spain’s Multi-peril Agricultural Insurance scheme is well established, with a track record going back 45 years. It is managed prudently with a view to its long-term stability. Though its funding has been taking hits from growing loss rates caused by weather conditions in the throes of climate change, its engagement with all parties involved – Agroseguro, co-insurers, government bodies, and farmers' organisations and cooperatives – has led it to set to work to bring forth ideas and improvements to safeguard future stability.

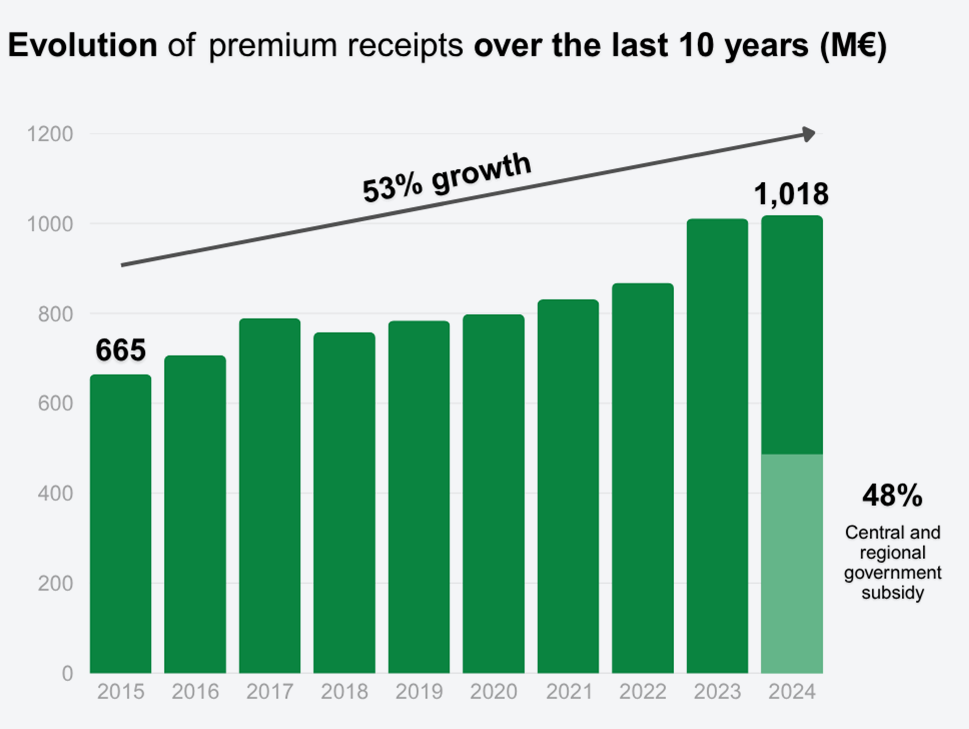

The amount of agricultural insurance purchased in Spain has reached more than 17 million policies over the course of its 45-year history. Growth has been ongoing, exceeding the milestone of 400,000 policies purchased in one year. At the present time, the sector is going through a process of concentration that has lowered the number of policies purchased each year to between 300,000 and 400,000. This downturn has not, however, kept Agroseguro and multi-peril agricultural insurance from continuously breaking insurance records. In 2024 premiums passed the billion euro mark for the second year in a row, growing by yet another 1% over the astounding 16% recorded in 2023, testimony to the sector’s increasing reliance on this risk management tool.

Going back a little further for a look at the volume of premiums issued over the past 10 years shows 53% growth over the level in 2015. Sums insured, too, have exceeded their peak, growing by 7% to 18.16 billion euros in 2024.

Overall production insured by Agroseguro has been at record levels in 35 of the multi-peril agricultural insurance scheme’s 45-year history. In the past 10 years in particular, growth has been constant and has increased by up to 50% over that period.

Figure 1. Agroseguro premium receipts, 2015-2024.

Source: Agroseguro.

As Pedro Vicente, Director of MAPFRE España’s Agro line, has said, “These figures describe the success achieved by Agroseguro and its co-insurers and by Spain’s Multi-peril Agricultural Insurance scheme itself and all of us who are involved in it, because over 45 years we have all, working shoulder to shoulder, put together a mechanism that, while there is certainly still room for improvement, has become one of the mainstays supporting the primary sector and a source of added value for the insurance sector.” The basis for this growth is the national government’s commitment to the scheme, providing support to the tune of 500 million euros, even more if the sums paid in by ENESA [Spanish Agency for Agricultural Insurance], an independent agency of Spain’s Ministry of Agriculture, Fisheries, and Food, and Regional Governments are added.

It would be wrong to think that Agroseguro and Spain’s multi-peril agricultural insurance scheme have reached the upper limits to growth. While insurance penetration has reached high levels for certain crops like fruits, e.g., seed and stone fruits, persimmons, bananas, table grapes, wine grapes, and citrus fruits, and herbaceous crops, all pillars of our country’s primary sector, there is still room for considerable growth by insurance for vegetables (continuously on the rise), almonds, olives, or in livestock disease insurance. The volume of carcass removal and destruction insurance purchases by farms stands at over 90% nationwide.

Pablo González de Castejón, Managing Director of Seguros Generales Rural has noted that “taking out insurance or not taking out insurance may have been an option a number of years ago, but at the present time it is purely a question of business survival, because multi-peril agricultural insurance is not only an effective tool, it is a genuine lifeline in today’s increasingly more complex climate scenario.” With this in mind, potential strains on the stability of Spain’s Multi-peril Agricultural Insurance scheme caused by climate change are one of the main focal points drawing the attention of everyone involved in managing multi-peril agricultural insurance.

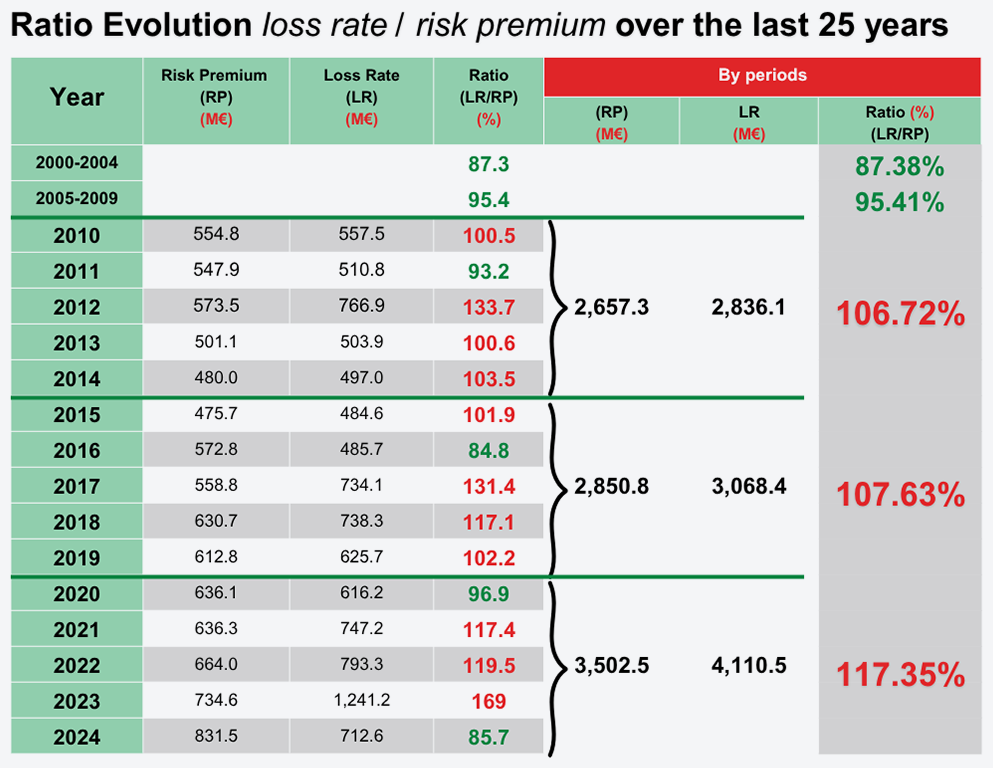

Loss rates have grown exponentially over the past 25 years, as can be seen in the following table. The table shows that in the first 10 years of this century loss rate/risk premium ratios were technically in balance, that is, less than 100% (87.3% in 2000-2004 and 95.4% in 2005-2009), but starting in 2010 the incidence of years that were especially hard hit rose spectacularly:

Figure 2. Loss rate/risk premium ratios, 2000-2025.

Source: Agroseguro.

More specifically, the insurance has achieved technical balance in only 3 of the last 10 years. According to Santiago Duro, Agroseguro’s Claims Handling Director, “today’s climate reality has become the main challenge faced by multi-peril agricultural insurance, because both the frequency and intensity of frost, hailstorms, and rainstorms are on the rise, while at the same time periods between droughts are growing shorter and droughts are becoming more severe.” Indeed, an absence of precipitation has been a common feature marking every one of the years in this century when the farm and agricultural insurance scheme has achieved its worst results (2012, 2017, 2018, 2023). The drought in 2023 was the worst recorded since the multi-peril agricultural insurance scheme’s inception, with damage to 60% of the entire land area insured and nearly 500 million euros in compensation paid out for that peril alone. In the end total losses for 2023 as a whole were a completely out of the ordinary historical record, 1.24 billion euros, the result of a combination of severe events, namely, prolonged, extreme drought and paradoxically widespread hail, a source of intense strain to the multi-peril agricultural insurance scheme’s technical balance. At the same time, this situation has highlighted Agroseguro’s outstanding management capabilities.

Spain’s Farm and Agricultural Combined Insurance scheme was only able to absorb an amount that size thanks to the public reinsurance provided by Consorcio de Compensación de Seguros, whose capacity is likewise finite. At the close of 2023 its multi-peril agricultural insurance reserve and the reserves of the co-insurers stood at levels far below what would be considered advisable. Sergio de Andrés, Director General of Agroseguro, said, “although Spain’s multi-peril agricultural insurance scheme is robust, its financial linchpins, i.e., its reserves and reinsurance, are showing signs of strain from the impact of rising loss rates caused by climate change. This makes it imperative to take steps to ensure long-term sustainability and bolster its ability to respond to increasingly extreme scenarios and growing uncertainty.”

Fortunately, and surprisingly, loss rates in 2024 were much more moderate, and the highly positive technical results have allowed the business’s stabilisation reserve to be restored. Félix Novoa, Director of Agroseguro’s Technical Department, has pointed out that “the insurance business cannot be based on luck, nor can we rely on the fact that luck will hold in the near future, and this makes necessary, as well, an ongoing process of adapting products to the changing reality and risks faced by farms. Agroseguro has always based its decision-making on actuarial principles, on the balance of the system as a whole and of each of its insurance lines.”

At the present time Agroseguro’s technical efforts are largely aimed at customising coverage, because each policy holder’s circumstances are different and as a result the terms of their insurance must also be different. At the same time, work under way is aimed at continuously assessing and adjusting unsuitable covers, on improving time series and current coverage, and on bringing in new guarantees, because insurance has to stay useful, to be an ally of farming communities and an attractive product for the insurance sector.

Cruz Vallés, Director of Agroseguro’s regional office in Aragón, with nearly 30 years' experience in the field of multi-peril agricultural insurance, continues to be surprised at the ability of weather to “make the livelihoods of those in the primary sector more difficult, especially for farmers, because severe losses are relentless and unforeseeable. Droughts are growing more severe, frosts can no longer be anticipated, and hail events no longer come with a date, no longer occur exclusively in summertime, because as we have seen this year, in 2025, hailstorms now come as early as April, take place every week, and can devastate the crops of entire towns.” In fact, hail has come to be a constant concern, “since heavy hail can fall and destroy a farm in a matter of minutes or can fall day after day over an entire growing season.”

This high uncertainty weighing on farmers is shared by Agroseguro’s Coordinator in Castilla-La Mancha, Javier González, who worked as a loss adjuster for over ten years and now works on coordinating loss assessment management at the regional office. He emphasises “the resilience of crop and livestock farmers, who spend a large part of their time not only tending to their crops and their orchards but also looking up at the sky and at weather information and forecasting apps.” Ramón Nadal, Technical Director of Caser-Grupo Helvetia, has backed up that view: “multi-peril agricultural insurance is a basic tool for all those who work outdoors exposed to the risks posed by weather. It should not be looked at as an expense but as a strategic investment to safeguard the stability and continuity of farming. With this in mind, buying this insurance should be fully integrated into their business planning by crop and livestock farmers who, like any other businessperson, are responsible for protecting their livelihoods. Experience has shown farm and agricultural insurance to be the most effective option to mitigate the impact of uncertainty in most cases.”

The social value of farm and agricultural insurance is undeniable, and it has become an essential ally in guaranteeing the continuity of agricultural activity, which produces food, is a source of employment, and is the backbone for life in the countryside. Furthermore, this type of insurance is a source of prestige for Spain, whose multi-peril agricultural insurance scheme is one of the best developed schemes in the world and as a result of its public-private model, its wide-ranging covers, and its scope stands as a genuine example highly regarded by the international community. “Spain’s multi-peril agricultural insurance scheme is the top-ranked scheme in Europe in volume of premiums (25% of the total), product range, level of coverage, and perils covered, and the third-ranked scheme worldwide”, notes Elsa Sánchez, Head of Agroseguro’s Corporate Governance and Strategic Service and its International Business Coordinator.

For that reason, Agroseguro is continuously receiving visits by international delegations and is active as a consultant internationally and as a member of such international associations as the International Association of Agricultural Production Insurers (AIAG for “Association Internationale des Assureurs de la Production Agricole”), currently serving as its vice-president and chairing its Loss Adjusters Committee, and the Asociación Latinoamericana para el desarrollo del Seguro Agropecuario (ALASA) [Latin American Association for the Development of Agricultural Insurance], sitting on its Board of Directors and participating as a member of its Technical Advisory and Training Committee.

Figure 3. Agroseguro Headquarters in Madrid.

Source: Agroseguro.

Commitment to quality

Agroseguro has always been committed to providing top-quality service to its co-insurers and sales networks, not to mention crop and livestock farmers themselves. To know their opinions about the scheme, during the past 10 years Agroseguro has had an outside consultant specialised in customer experience conduct an annual survey, the Perceived Quality Index [Índice de Calidad Percibida], a measure of satisfaction surveying more than 2,000 crop and livestock farmers from all production sectors and regions. The survey is aimed at evaluating specific aspects of the insurance scheme, e.g., coverage and price, as well as the attention dispensed when a loss is reported and the amount of compensation and time to payment.

The main findings of the survey are used to calculate average overall customer ratings for the multi-peril agricultural insurance scheme and Agroseguro. Since 2020 the score has in all cases been better than 7 out of 10, attesting to the high level of satisfaction of crop and livestock farmers with their multi-peril agricultural insurance policies and with Agroseguro’s handling. In 2024, the last survey done, customers gave highly positive scores to certain management aspects like fast payment of compensation (8.05) and quality of the information furnished (8.68), especially the information provided by Agroseguro’s telephone customer service and website.

The great loyalty to the multi-peril agricultural insurance scheme shown by crop and livestock farmers backs up the data compiled in the 2024 Perceived Quality Index. Indeed, the survey has concluded that 85% of the crop and livestock farmers surveyed expressed their intention to renew their multi-peril agricultural insurance policies in the coming year, a percentage that has consistently remained at very high levels. In addition, the NPS (Net Promoter Score) index in 2024 was +20. This internationally known metric is an indicator used to gauge the likelihood of customer recommendations.

To assess the farm and agricultural insurance scheme’s response to the devastating torrential rains and consequential floods in Valencia in October 2024, Agroseguro included a specific section to enable ratings by Valencian farmers and customers from thirty some towns in the area referred to as “ground zero”. The multi-peril agricultural insurance scheme’s average rating was 7.38. Speed of payment after a loss (8.90) and intention to renew in the coming year (90%) scored particularly high. In the view of Agroseguro’s Director General, Sergio de Andrés, these results are unquestionably “a source of pride for the whole Agroseguro team, which went into high gear to handle claims from the torrential rainstorm and enable the primary sector in Valencia to get a fresh start.”

This storm resulted in damage to farms from rainfall, flooding, hail, and wind, affecting more than 53,000 insured plots covering 29,000 hectares, mainly citrus fruits and persimmons, with compensation for claims reaching nearly 53 million euros, an extremely high amount for a weather event that lasted just a few hours.

As Manuel González Corral, Agroseguro’s Regional Director for south-eastern Spain, recalled, the claims adjustment work entailed “one of the most complex tasks faced in the multi-peril agricultural insurance scheme’s 45-year history because of the enormous logistical challenges faced just to be able to reach the affected areas, contact policy holders who had suffered losses, appropriately coordinate 138 loss adjusters who had come in from all over Spain, and so on.”

Two co-insurance entities are based in the Valencia region, and both are associated with farmers' organisations. According to Rafael Sarrión, Director General of Agropelayo, the multi-peril agricultural insurance scheme “has shown itself to be sensitive, capable, and sensible. We can look for ways to improve, and I’m sure we can find them, but the scheme is still something worth defending because of the security it affords crop and livestock farmers. In the case of the DANA in Valencia, the multi-peril agricultural insurance scheme has proved to be an instrument that operates quickly and effectively.” Celestino Recatalá, a farmer and president of Mutua Arrocera de Seguros [Rice Growers' Mutual Insurance Society], considers the scheme’s fast handling, with hardly any red tape, to be one of its most salient features, “because after a loss, crop and livestock farmers need to know that the loss adjuster will show up without delay, that a proper adjustment will be made, and that compensation will be paid without long waits. Our multi-peril agricultural insurance flawlessly met all these requirements after the DANA.”

In recent years, management efforts have taken aim at ensuring short payment times after a loss. The Spanish Act 50/1980 on Insurance Contract [Ley 50/1980, de Contrato de Seguro] stipulates that “insurers are to pay the minimum sum for which they could be liable within forty days of receipt of a report of a claim.” Agroseguro has bettered that time. Its average payment time has been under 30 days since 2022, and in the past year it has even dropped down to 25 days for crop losses and 26 days for livestock losses.

Knowledge and innovation

Agroseguro’s digitalisation process has been moving rapidly ahead in recent years, and this has been key in enabling it to fulfil its commitments to policy holders. “This has been no easy task”, says Manuel Rodríguez, Agroseguro’s Processes and Technology Director, “because we have to meet the challenge of dealing with three different time frames, the insurance sector’s, the public sector’s, and the farming sector’s, each with its own priorities and goals, and aligning it with our own business strategy and with the processes and innovations we knew would be fundamental for Agroseguro’s growth.”

The enterprise’s online services are a good example of its technical scale. They have to handle data entry for policies for 45 different multi-peril agricultural insurance lines and a much higher number of different products by 16 different insurance companies, and at the same time they have to apply all the legislation regulating the purchase of insurance and calculate the subsidies to which each policy holder is entitled, both the national government subsidy granted by ENESA and the regional government subsidies provided by 15 Autonomous Regions and 1 provincial council, which under the agreements signed between the various government bodies and Agroseguro are discounted automatically at the time policies are purchased. As Agustín de la Cuerda, Director General for Iberia of Allianz Commercial, has pointed out, “Co-insurers and our sales network value the high level of technical efficiency attained by the multi-peril agricultural insurance scheme, which benefits everyone, including our network of intermediaries and our customers.”

A model of management of a highly complex matter, made possible thanks to ongoing investments in technology, training, and staff in recent years. “Agroseguro currently employs 273 people; and the number of personnel has been growing gradually but steadily”, says Nerea García, Director of Staff and Finance, who has also highlighted the main challenge faced by her department: “We are at the point of generational change and a shift in corporate culture, because an entire generation that joined us in the 1980s and 1990s is retiring or is fast approaching retirement age.” Therefore, transferring knowledge to the younger generation of staff members and combining that knowledge with the opportunities held out by new technologies like artificial intelligence is opening up new pathways and prospects for developing the business.

“The current juncture is not a simple one, but we have accumulated 45 years of experience”, says Sergio de Andrés, the Director General. “Today’s climate situation is compounded by economic strains, geopolitics, and international conflicts” which do not bear directly on Agroseguro but do affect its customers and the government entities that are intrinsic components of the farm and agricultural insurance scheme as a whole. Still, he remains optimistic about the present and the future. “Agroseguro’s business is at the highest point in its history; premiums and sums insured are continuously growing; we have the trust of our customers, insurers, and government; and we have intrepid, qualified employees. We are all wholly committed to the future of multi-peril agricultural insurance.”

Pablo González de Castejón, Managing Director of Seguros Generales Rural has noted that "taking out insurance or not taking out insurance may have been an option a number of years ago, but at the present time it is purely a question of business survival, because multi-peril agricultural insurance is not only an effective tool, it is a genuine lifeline in today's increasingly more complex climate scenario." With this in mind, potential strains on the stability of Spain's Multi-peril Agricultural Insurance scheme caused by climate change are one of the main focal points drawing the attention of everyone involved in managing multi-peril agricultural insurance.