An analysis of the Consorcio de Compensación de Seguros' reinsurance scheme for the Multi-Peril Agricultural scheme over the past 20 years.

Time series for 2005 – 2024

María de los Ángeles Horrillo Muñoz - Senior Expert, Technical and Reinsurance Subdirectorate

Consorcio de Compensación de Seguros

Introduction

The Consolidated Text of Estatuto Legal del Consorcio de Compensación de Seguros [Consorcio de Compensación de Seguros Enabling Act] (the Enabling Act) enacted by Spanish Royal Legislative Decree 7/2004 of 29 October 2004 and amended by the Amending Acts 12/2006 of 16 May 2006, 6/2009 of 3 July 2009, 12/2011 of 27 May 2011 and 20/2015 of 14 July 2015 addresses a number of issues, including the functions to be performed by Consorcio in the field of insurance.

More specifically, as it relates to the Multi-Peril Agricultural Insurance Scheme, section 10 Enabling Act provides that Consorcio de Compensación de Seguros (CCS) is to act as reinsurer for risk coverage in the manner and for the amount decided by the Spanish Ministry of Economy, Trade, and Business.

Similarly, section 45 of the Reglamento de los Seguros Agrarios Combinados [Spanish Multi-Peril Agricultural Insurance Implementing Regulations] enacted by Spanish Royal Decree 2329/1979 of 14 September 1979, as subsequently amended, provides that CCS is to serve as the captive reinsurer for all crop insurance lines in the manner and for the amounts decided by the Spanish Ministry of Economy, Trade, and Business.

In addition, Spain’s Plan Anual de Seguros Agrarios [Annual Multi-Peril Agricultural Insurance Plan] approved by the Government each year (the 2025 Plan was made public by the decision of the Ministry of Agriculture, Fisheries, and Food’s Office of the Undersecretary dated 23 December 2024) states that the Ministry of Economy, Trade, and Business is to specify the reinsurance scheme under the Plan and that it may assign different coverage for each group of lines depending on their respective needs for more or less financial support and similarly that certain risks may be dealt with individually.

Within that same legal framework the Ministry of Economy, Trade, and Business has been publishing ministerial decrees that lay the groundwork for the reinsurance arrangements for the agricultural insurance scheme run by CCS each year.

CCS’s reinsurance within the FACI scheme

CCS has been providing reinsurance for the crop insurence scheme from the inception of farm and agricultural combined insurance coverage, that is, since 1980, although this article focuses on the last 20 years, namely, the time series for 2005-2024, setting out data on reinsurance premiums, compensation paid out by the CCS, and changes in the CCS’s agricultural activity stabilisation reserve, because in our opinion going back further to earlier times will be of little help in elucidating the data and in drawing possible conclusions.

Here is a list of the ministerial decrees that set the framework for reinsurance by the CCS in the period considered:

-

MINISTERIAL DECREE EHA [Economy & Finance]/1210/2005 of 6 April 2005 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Multi-Peril Agricultural Insurance Plan for 2005.

-

MINISTERIAL DECREE EHA/657/2006 of 23 February 2006 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Multi-Peril Agricultural Insurance Plan for 2006.

-

MINISTERIAL DECREE EHA/444/2007 of 15 February 2007 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Multi-Peril Agricultural Insurance Plan for 2007.

-

MINISTERIAL DECREE EHA/358/2008 of 1 February 2008 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Multi-Peril Agricultural Insurance Plan for 2008.

-

MINISTERIAL DECREE EHA/434/2009 of 12 February 2009 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Multi-Peril Agricultural Insurance Plan for 2009.

-

MINISTERIAL DECREE EHA/977/2010 of 6 April 2010 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under Multi-Peril Agricultural Insurance Plan for 2010.

-

MINISTERIAL DECREE EHA/565/2011 of 9 March 2011 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Farm Combined Insurance Plan for 2011.

-

MINISTERIAL DECREE ECC [Ministry of Economy and Competitiveness]/548/2012 of 15 March 2012 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Multi-Peril Agricultural Insurance Plan for 2012.

-

MINISTERIAL DECREE ECC/530/2013 of 21 March 2013 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Multi-Peril Agricultural Insurance Plan for 2013.

-

MINISTERIAL DECREE ECC/1391/2014 of 25 June 2014 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Multi-Peril Agricultural Insurance Plan for 2014.

-

MINISTERIAL DECREE ECC/1022/2015 of 20 May 2015 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the Multi-Peril Agricultural Insurance Plan for 2015, and extended for 2016.

-

MINISTERIAL DECREE EIC [Ministry of Economy, Industry, and Competitiveness]/746/2017 of 18 July 2017 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the 38th Multi-Peril Agricultural Insurance Plan for 2017 and extended for 2018.

-

MINISTERIAL DECREE ECE [Ministry of Economy and Business]/497/2019 of 22 April 2019 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the 40th Multi-Peril Agricultural Insurance Plan for 2019 and extended for 2020, 2021, 2022, 2023, 2024 and 2025.

-

MINISTERIAL DECREE ETD [Ministry of Economy and Digital Transformation]/492/2020 of 18 May 2020 amending Ministerial Decree ECE/497/2019 of 22 April 2019 setting out the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the 40th Multi-Peril Agricultural Insurance Plan for 2019 and extended for 2020, 2021, 2022, 2023, 2024 and 2025.

-

MINISTERIAL DECREE ETD/600/2022 of 29 June 2022 supplementing the reinsurance scheme to be operated by Consorcio de Compensación de Seguros under the 43rd Multi-Peril Agricultural Insurance Plan and other regulations for 2022 and extended for 2023, 2024 and 2025.

This reinsurance scheme is an excess of loss reinsurance (also called stop loss reinsurance) in which the cedents are the insurance entities that are members of the Agroseguro pool as a whole.

Each reinsurance decree:

-

Classifies the various lines of insurance set out in the corresponding Plan into reinsurance groups and specifies the risk, module, and cover exclusions, i.e., insurance lines that belong to a given group for which the risks, modules, and covers are covered under another group.

-

Sets the reinsurance premium rate or rates for each reinsurance group.

-

Defines the direct insurance losses and excess of loss for which CCS will provide partial compensation.

-

Specifies the formula for calculating CCS’s compensation for excess of loss for each of the groups.

-

Specifies the formula for profit sharing by CCS.

Classification of the lines into reinsurance groups has remained relatively stable over the time series considered. Basically, new lines have been assigned to the existing groups, while the other variables, premium rates, excess of loss, the corresponding compensation, and profit sharing have changed over time.

The sections below discuss the following aspects for the time series considered, 2005-2024:

-

Changes in reinsurance premium rates.

-

Changes in reinsurance coverage: losses, excess of loss, compensation by CCS, and profit sharing and how they have been specified.

-

The results of the analysis.

-

Conclusions and outlook.

Changes in reinsurance premium rates

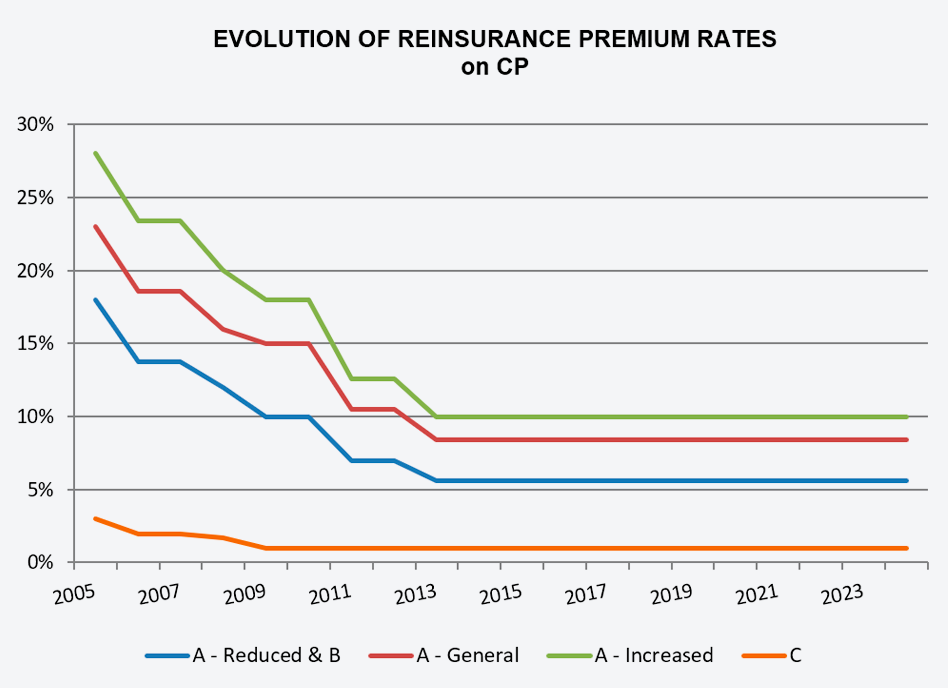

The following table sets out the changes in the reinsurance premium rates in 2005-2024:

| PLANS | % on/ | Block A (experimental) | Block B (viable) | Block C (RyD) | ||

|---|---|---|---|---|---|---|

| Reduced | General | Increased | ||||

| 2005 | CP | 18.0 % | 23.0 % | 28.0 % | 18.0 % | 3 % (Gr.A) |

| 2006 | CP | 13.78 % | 18.61 % | 23.42 % | 13.78 % | 1.95 % (Gr. A) |

| 2007 | CP | 13.78 % | 18.61 % | 23.42 % | 13.78 % | 1.95 % (Gr. A) |

| 2008 | CP | 12.0 % | 16.0 % | 20.0 % | 12.0 % | 1.7 % |

| 2009 | CP | 10.0 % | 15.0 % | 18.0 % | 10.0 % | 1.0 % |

| 2010 | CP | 10.0 % | 15.0 % | 18.0 % | 10.0 % | 1.0 % |

| 2011 | CP | 7.0 % | 10.5 % | 12.6 % | 7.0 % | 1.0 % |

| 2012 | CP | 7.0 % | 10.5 % | 12.6 % | 7.0 % | 1.0 % |

| 2013 | CP | 5.6 % | 8.4 % | 10.0 % | 5.6 % | 1.0 % |

| 2014 | CP | 5.6 % | 8.4 % | 10.0 % | 5.6 % | 1.0 % |

| 2015 | CP | 5.6 % | 8.4 % | 10.0 % | 5.6 % | 1.0 % |

| 2016 | RP | 7.3 % | 11.5 % | 13.7 % | 7.3 % | 1.2 % |

| 2017 | RP | 7.3 % | 11.5 % | 13.7 % | 7.3 % | 1.2 % |

| 2018 | RP | 7.3 % | 11.5 % | 13.7 % | 7.3 % | 1.2 % |

| 2019 | RP | 7.3 % | 11.5 % | 13.7 % | 7.3 % | 1.2 % |

| 2020 | RP | 7.3 % | 11,5 % | 13.7 % | 7.3 % | 1.2 % |

| 2021 | RP | 7.3 % | 11.5 % | 13.7 % | 7.3 % | 1.2 % |

| 2022 | RP | 7.3 % | 11.5 % | 13.7 % | 7.3 % | 1.2 % |

| 2023 | RP | 7.3 % | 11.5 % | 13.7 % | 7.3 % | 1.2 % |

| 2024 | RP | 7.3 % | 11.5 % | 13.7 % | 7.3 % | 1.2 % |

CP: Commercial premium for the insurance included in each Plan.

RP: Risk premium, net of reinsurance, for the insurance included in each Plan.

The above table shows that:

-

At the present time there are three reinsurance blocks:

– Block A comprises the empirical risk lines with the highest rates, associated with higher reinsurance protection, as will be seen below. This group has a general rate that for certain lines, modules, or covers can be lowered (bringing it into line with the rates for the next group, the viable risk group) or raised, based on their characteristics. – Block B comprises the viable risk lines and has a single rate for all the lines in the group. – Block C comprises the farm carcass removal and destruction line, with a single rate for all the lines in the group; it was part of the empirical risk group until the end of 2007.

-

Until 2015 the calculation rates were applied to the commercial premium for each line of insurance covered in each Plan. The basis for calculation was changed to the risk premium starting in 2016, when new, lower premium rates were set, to offset the reduction in the basis for calculation by using higher rates, but this did not raise CCS’s reinsurance premiums overall.

The Figure below plots the bases for calculating the reinsurance premiums adjusted for purposes of comparison and shows that premium rates were on a downward track until 2013, when they levelled off and have held steady until today.

Changes in reinsurance coverage: losses, excess of loss, compensation by CCS, and profit sharing

In the 20-year period considered, the reinsurance scheme has used six different methods to calculate excess of loss, compensation by the CCS, and profit sharing, as described below:

One: For the 2005 Plan.

What first needs to be defined is what “losses” should be taken to mean for purposes of determining the coverage of the reinsurance by the CCS. Losses were calculated separately for each group using the following formula; in 2005 there were two reinsurance groups, A and B:

Yearly losses for each reinsurance group (A and B separately) =

= Indemnities +

+ internal and external costs of case handling and management -

- inputs from the stabilisation provision as at 31 December of the previous year.

That is, funds from the requisite co-insurer companies' stabilisation provision (today, the stabilisation reserve) as at 31 December of the previous year were discounted for each reinsurance group.

The excess of loss for the year was calculated as follows:

Excess of loss for each reinsurance group (A and B separately) =

= Yearly losses -

- adjusted risk premiums +

+ unadjusted loading for contingencies.

That is, the ceding insurers could only draw down the stabilisation provision for each group to offset the negative difference between the risk premiums and the losses for each group.

Compensation for excess of loss by CCS, thus defined, was:

Block A:

The CCS compensated 100% of the excess of loss above 601,012.10 euros, i.e., that amount was taken as the fixed deductible.

This group included the farm carcass removal and destruction lines that were split off as Group C in 2008.

In 2005 the compensation paid by CCS for the excess of loss came to 148,108,612 euros, one of the highest amounts in the time series.

Block B:

The compensation payable by CCS was calculated using the following table bearing in mind the respective percentages for each tranche:

| Loss rate band | Compensation percetage on excess |

|---|---|

| From LRP to 90% CP | 50% |

| More than 90% CP up to 130% CP | 95% |

| More than 130% CP up to 160% CP | 90% |

| More than 160% CP | 100% |

LRP: Loaded Risk Premiums.

CP: Commercial Premiums.

The calculation for 2005 is set out below as an aide in interpreting this table:

Block B – 2005:

Excess of loss = 166,386,677 – 25,219,378 – 133,140,202 = 8,027,097 euros

Compensation payable by CCS: Since the losses (after inputs from the reserve), 141,167,299 euros, were higher than the loaded risk premiums but less than 90% of the commercial premiums (147,024,700 euros), they fell in the first tranche, and for that reason the CCS compensated 50% of the excess of loss, i.e., 4,013,549 euros.

Profit sharing was as follows: When CCS has to compensate one block of lines and another block has made a profit (adjusted risk premiums plus the unadjusted loading for contingencies less adjusted losses), part of the profit will be deducted from the excess to be compensated according to the following distribution:

| Percentage representing the profit on accrued risk premiums plus the non-accrued security surcharge | Percentage of profit to be deducted from the excess to be compensated by CCS |

|---|---|

| Up to 10%% | 5% |

| More than 10% up to 30% | 10% |

| More than 30% up to 60% | 15% |

| More than 60% | 20% |

Where both blocks have earned a profit, CCS’s share in the profits was 7%.

There was no profit sharing in 2005.

Two: For the 2006 and 2007 Plans.

The definitions of losses for the year and excess of loss stayed the same, but the formulas for calculating compensation by CCS were changed.

Compensation for excess of loss in 2006 and 2007 was calculated as follows:

Block A:

The compensation payable by CCS was calculated according to the following table:

| Loss rate tranche | Compensation percentage on excess | |

|---|---|---|

| From LRP up to 90% CP | 72.5% | If 27.5 % > M€ X → + excess on M€ X |

| More than 90% CP | 100% | |

2006 → X = €3,000,000

2007 → X = €3,081,000

LRP: Loaded Risk Premiums.

CP: Commercial Premiums.

This change meant that in years with a substantial excess of loss, the cedents had to pay a larger portion, though limited to 3,000,000 euros in 2006 and 3,081,000 euros in 2007.

In other words, 27.5% of the first tranche served as a proportional excess with an absolute cap.

The farm carcass removal and destruction lines were still included in this block.

As will be discussed in the Results section, no compensation was paid by CCS for Block A in 2006 or 2007.

Block B:

The compensation payable by CCS was calculated according to the following table (the percentage compensation for the second tranche was lower than in the previous year):

| Loss rate tranche (each tranche has its own percentage applied) | Compensation percentage on excess | |

|---|---|---|

| From LRP up to 90% CP | 50% | |

| More than 90% CP up tp 130% CP | 80% | |

| More than 130% CP up to 160% CP | 90% | |

| More than 160% CP | 100% | |

LRP: Loaded Risk Premiums.

CP: Commercial Premiums.

As will be discussed in the Results section, no compensation was paid by CCS for Block B in 2006 or 2007.

Profit sharing was as follows:

Profit sharing when there was profit in one group and an excess of loss in the other continued, but the percentage loading for contingencies changed:

| Profit percentage on accrued risk premiums WITHOUT the security surcharge. Each tranche has its own percentage | Percentage of profit to be deducted from the excess to be compensated by CCS | |

|---|---|---|

| Up to 10% | 10% | |

| More than 10% up to 50% | 15% | |

| More than 50% | 25% | |

When both blocks earned a profit, besides changing the percentage loading for contingencies, the percentage share in the profits was raised from 7% as shown in the table below:

| Profit percentage for the two groups on the accrued risk premiums WITHOUT the security surcharge. Each tranche has its own percentagea | Percentage of profit to be deducted from the excess to be compensated by CCS | |

|---|---|---|

| Up to 10% | 10% | |

| More than 10% up to 50% | 15% | |

| More than 50% | 25% | |

The calculation for profit sharing in 2006 is set out below (there was no profit sharing in 2007):

| BLOCK | RISK PREMIUM | LOSS RATE (prior Rve appl.) | Loss Rate EXCESS in charge of CCS | PROFIT | % Premium | CCS' Profit |

|---|---|---|---|---|---|---|

| A | 321,224,934 | 324,575,418 | - | - | - | - |

| B | 124,966,302 | 93,234,950 | - | 31,731,352 | - | - |

| 446,191,236 | 417,810,369 | - | 31,731,352 | 7% | 3,173,135 |

Based on the values of the premiums and losses in the cedents' business, Block B earned a profit of 31,731,352 euros, and applying the table, CCS’s share was 10%.

Three: For the 2008, 2009, 2010, 2011, and 2012 Plans.

The definitions of losses for the year and excess of loss stayed unchanged. What changed was:

- The farm carcass removal and destruction lines were split off into a separate group, Block C.

A co-insurance table differentiating Blocks A and B from Block C was created in 2008, and for that reason the farm carcass removal and destruction lines were taken out of Block A.

- The formulas for compensation by CCS were changed.

Compensation for excess of loss for the five-year period 2008-2012 was as follows:

Block A:

The compensation payable by CCS was calculated according to the following formula:

That is, the cedents were responsible for a deductible of 95% of 2% of the commercial premiums.

The only excess of loss for Block A compensated by CCS during that period was in 2012. The data are set out in the Results section.

Block B:

The compensation payable by CCS was calculated according to the following table (the percentage compensation for the last tranche was lowered):

| Loss rate tranche (each tranche has its own percentage) | Compensation percentage on excess |

|---|---|

| From LRP up to 90% CP | 50% |

| More than 90% CP up to 130% CP | 80% |

| More than 130% CP up to 160% CP | 90% |

| More than 160% CP | 95% |

LRP: Loaded Risk Premiums.

CP: Commercial Premiums.

As will be discussed in the Results section, no compensation was paid by CCS for Block B in those years.

Block C:

The compensation payable by CCS was calculated according to the following formula:

CCS compensation = 95% x (Excess of loss – 2% Commercial Premiums)

That is, the cedents were responsible for a deductible of 95% of 2% of the commercial premiums.

The farm carcass removal and destruction lines were split off from Block A and the same compensation formula was applied to them.

The only excess of loss for Block C compensated by CCS during that period was in 2008. The data are set out in the Results section.

Profit sharing was as follows:

There was no change from the previous period. The definition of profit, the distinction between profits for some or all of the groups, and the table of percentage shares all stayed the same.

There was profit sharing in 2008, 2009, 2011, and 2012. The calculation of the share of the profit in 2012 is detailed below, because that was a particularly significant year in which compensation by CCS for excess of loss of more than 187 million euros in Block A was combined with profit sharing in Blocks B and C:

| BLOCK | RISK PREMIUM | LOSS RATE (prior Rve appl.) | LOSS RATE EXCESS in charge of CCS | Loss Rate EXCESS UNCOMPENSATED | PROFIT | % Premium | CCS' Profit |

|---|---|---|---|---|---|---|---|

| A | 276,604,353 | 541,113,516 | 187,655,040 | 17,257,722 | - | - | |

| B | 136,311,013 | 123,889,761 | - | - | 12,421,252 | - | |

| C | 109,245,687 | 101,875,126 | - | - | 7,370,561 | - | |

| 522,161,054 | 766,878,403 | 187,655,040 | 17,257,722 | 9,791,813 | 0.5% | 253,409 |

= 10% ( 19,791,813 - 17,257,722 ) = €253,409

Four: For the 2013, 2014, 2015, 2016, 2017, and 2018 Plans.

After the high losses in 2012, an especially significant qualitative and quantitative restructuring of the arrangements for reinsurance by CCS was carried out for 2013 and the following years, namely:

The definition of losses was changed from:

Losses for the year for each reinsurance block (A, B, and C separately) =

= Indemnities +

+ internal and external costs of case handling and processing -

- inputs from the stabilisation provision as at 31 December of the previous year.

To:

Losses for the year for each reinsurance block (A, B, and C separately) =

= Indemnities +

+ internal and external costs of case handling and processing

In other words, the ceding insurance entities now ceded more losses to the reinsurance and kept their stabilisation reserves to cover excess of loss that was not compensated by CCS.

This change was made together with some adjustments to the compensation formulas, as shown below:

Block A:

Compensation by CCS was reduced from 95% to 90%:

CCS compensation = 90% x (Excess of loss – 2% Commercial Premiums)

That is, the cedents were responsible for a deductible of 90% of 2% of the commercial premiums.

During that period there were excesses of loss for Block A compensated by CCS in 2014, 2017, and 2018. The data are given in the Results section.

Block B:

The compensation payable by CCS in the final tranche was reduced as follows:

| Loss rate tranche (each tranche has its own percentage) | Compensation percentage on excess |

|---|---|

| From LRP up to 90% CP | 50% |

| More than 90% CP up to 130% CP | 80% |

| More than 130% CP | 90% |

LRP: Loaded Risk Premiums.

CP: Commercial Premiums.

As will be discussed in the Results section, CCS paid compensation for Group B in all the years except 2016.

Block C:

Compensation by CCS was reduced from 95% to 90%:

CCS compensation = 90% x (Excess of loss – 2% Commercial Premiums)

That is, the cedents were responsible for a deductible of 90% of 2% of the commercial premiums.

During that period there were excesses of loss for Block C compensated by CCS in 2014, 2015, 2016, and 2018. The data are given in the Results section.

Profit sharing was as follows:

The definition of the profits in which CCS had a share included a new variable, namely, the part of the excess of loss not compensated by CCS that was covered by the ceding insurance entities' stabilisation reserve.

+ Inputs cedents' Reserve

The percentage share of the profits was unchanged:

| Total profit percentage on the accrued risk premium WITHOUT the security surcharge. Each tranche has its own percentage | Share percentage on total profit |

|---|---|

| Up to 10% | 10% |

| More than 10% up to 50% | 15% |

| More than 50% | 25% |

Profit sharing took place in 2013 and 2016.

Five: For the 2019, 2020, and 2021 Plans.

The only difference with respect to the previous arrangements was pooling of the ceding insurance entities' stabilisation reserves, which until 2018 had been separate for each of the reinsurance Blocks A, B, and C and from 2019 were reduced to two, one reserve for Blocks A and B and another separate reserve for Block C.

The compensation scheme was unchanged, and this change only indirectly affected the calculation of the profit, which depended on inputs from the cedents' reserve.

In these three years there was excess of loss compensated by CCS for Blocks A and C in 2019 and for Blocks A and B in 2021, while 2020 ended with neither compensation for excess of loss nor profit sharing.

Six: For the 2022, 2023, and 2024 Plans.

The existing coverage scheme continued, though in 2022, after five years of high loss rates that depleted the ceding insurance entities' stabilisation reserve for Blocks A and B, a measure was taken to stabilise the Multi-peril Agricultural Insurance scheme and ensure that the system of coverage would remain sustainable over time by establishing a second layer of reinsurance for those groups of lines to supplement the reinsurance in effect at the time.

This is a dynamic protection mechanism that addresses the actual change in the ratio between the ceding insurance entities' stabilisation reserve for Blocks A and B and the sums insured in Blocks A and B occurring each year. This second layer of reinsurance is automatically increased if the scheme becomes impaired (if the ratio between the reserve and the sum insured decreases), otherwise it is moderated, and it is deactivated if the ratio is above 0.7%.

Combined coverage by the first and second layers is:

| Block A: Experimental | Block B: Viables | |||

|---|---|---|---|---|

| TRANCHES: % Reserve / Capital insured A +B of the year | Coverage percentage: % ( Loss rate excess - % P") | Deductible priority: % ( Loss rate excess - % P") | Coverage percentage 2nd Tranche: 90% P" < Loss rate ≤ 130% P": % x (Loss rate - 90% P") | |

| 1st | R / CI ≤ 0.1% | 95% | 0.5% | 83% |

| 2nd | 0.1% < R / CI ≤ 0.4% | 95% | 1% | 83% |

| 3rd | 0.4% < R / CI ≤ 0.5% | 94% | 1% | 82% |

| 4th | 0.5% < R / CI ≤ 0.7% | 93% | 1% | 81% |

| 5th | R / CI > 0.7% | 90% | 2% | 80% |

R: Equalisation Reserve.

P": Commercial Premium.

CI: Capital Insured.

For the empirical risk lines block (Block A), coverage was expanded by modifying the percentages (90% and 2%) in the compensation formula. The current formula is:

CCS compensation = 90% x (Excess of loss – 2% Commercial Premiums)

The formula for the second layer (e.g., for tranche 2) is:

CCS compensation = 95% x (Excess of loss – 1% Commercial Premiums)

For the Viable lines block (Block B), coverage was expanded by increasing the percentage compensation (80%) when losses come to between 90% and 130% of the commercial premium:

Current formula:

CCS compensation =

= 80% x (minimum (loss; (130% Commercial Premium – 90% Commercial Premiums))

The formula for the second layer (e.g., for tranche 2) is:

CCS compensation =

= 83% x (minimum (loss; (130% Commercial Premium – 90% Commercial Premiums))

Data on excess of loss for Blocks A and B covered by CCS for layers 1 and 2 from the time this arrangement was first used in 2022 up to the present time:

| 2022 | FIRST LAYER | SECOND LAYER | % | TOTAL |

|---|---|---|---|---|

| A | 147,802,364 | 12,790,268 | 8% | 160,592,632 |

| B | - | - | - | - |

| A + B | 147,802,364 | 12,790,268 | 8% | 160,592,632 |

| 2023 | FIRST LAYER | SECOND LAYER | % | TOTAL |

| A | 400.238.293 | 27,609,677 | 6% | 427,847,970 |

| B | 32,371,118 | 969.137 | 3% | 33,340,256 |

| A + B | 432,609,411 | 28,578,815 | 6% | 461,188,226 |

| 2024 | FIRST LAYER | SECOND LAYER | % | TOTAL |

| A | - | - | - | - |

| B | 7,531,094 | 8,106 | 0.10% | 7,539,201 |

| A + B | 7,531,094 | 8,106 | 0.10% | 7,539,201 |

| 2022 - 2024 | FIRST LAYER | SECOND LAYER | % | TOTAL |

| A | 548,040,657 | 40,399,945 | 7% | 588,440,603 |

| B | 39,902,213 | 977,244 | 2% | 40,879,456 |

| A + B | 587,942,870 | 41,377,189 | 7% | 629,320,059 |

Values in nominal euros.

The amounts for layer 2 have been held steady irrespective of how high losses have been each year, as anticipated up to around 8% additional losses to CCS.

As can be seen, 2023 was the worst year in the history of the scheme, with losses for Block B and especially for Block A at unprecedented levels that required an extremely large financial contribution by CCS as reinsurer for the scheme.

The CCS’s stabilisation reserve was able to bounce back somewhat in 2024, presumably thanks to the measures taken in connection with the direct insurance in combination with better weather conditions. The data are shown in the Results section.

To help in comparing the different models, the basic elements of each coverage scheme are set out below leaving aside profit sharing, because its economic impact has been quite limited, as will be seen later:

| REINSURANCE MODELS | PLANS | LOSS RATE EXCESS | CCS COMPENSATION | |||

|---|---|---|---|---|---|---|

| A % by tranches | B % by tranches | C % by tranches | ||||

| 1 | 2005 | Loss rate - Premiums - Equalisation reserve | > 601,012.10 € | 50%; 95%; 90%; 100% | - | |

| 2 | 2006-07 | Loss rate - Premiums - Equalisation reserve | from 72.5%; 100% | 50%; 80%; 90%; 100% | - | |

| 3 | 2008-09-10-11-12 | Loss rate - Premiums - Equalisation reserve | 95% - 2% | 50%; 80%; 90%; 95% | 95% - 2% | |

| 4 | 2013-14-15-16-17-18 | Loss rate - Premiums | 90% - 2% | 50%; 80%; 90% | 90% - 2% | |

| 5 | 2019-20-21 | Loss rate - Premiums | 90% - 2% | 50%; 80%; 90% | 90% - 2% | Rve A+B |

| 6 | 2022-23-24 | Loss rate - Premiums | 90% - 2% | 50%; 80%; 90% | 90% - 2% | + 2nd LAYER |

Results of the analysis

| SERIES | VIABLE | EXPERIMENTAL | R & D | (a) | (b) | (c) | (c)+(b)-(a))> | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Incr. Risk Premiums | Loss rate | CCS EXCESS | Incr. Risk Premiums | Loss rate | CCS EXCESS | Incr. Risk Premiums | Loss rate | CCS EXCESS | CCS EXCESS TOTAL | CCS Profit Sharing | REINSURANCE PREMIUMS CCS Allocated | RESULT CCS Reinsurance | CCS Rve | |

| AGROSEGURO | AGROSEGURO | AGROSEGURO | AGROSEGURO | AGROSEGURO | AGROSEGURO | TOTAL | CCS | CCS | CCS | |||||

| 2005 | 133 | 166 | 4 | 280 | 429 | 148 | - | - | - | 152 | - | 81 | -71 | 355 |

| 2006 | 144 | 93 | - | 350 | 325 | - | - | - | - | - | 3 | 91 | 94 | 443 |

| 2007 | 145 | 129 | - | 355 | 331 | - | - | - | - | - | - | 77 | 77 | 509 |

| 2008 | 158 | 113 | - | 272 | 273 | - | 134 | 138 | 1 | 1 | 3 | 86 | 88 | 622 |

| 2009 | 148 | 130 | - | 257 | 293 | - | 139 | 133 | - | - | 0 | 69 | 70 | 730 |

| 2010 | 152 | 167 | - | 256 | 259 | - | 133 | 132 | - | - | - | 67 | 67 | 782 |

| 2011 | 146 | 155 | - | 265 | 241 | - | 126 | 114 | - | - | 1 | 58 | 59 | 844 |

| 2012 | 147 | 124 | - | 303 | 541 | 188 | 113 | 102 | - | 188 | 0 | 51 | -136 | 744 |

| 2013 | 129 | 148 | 12 | 275 | 249 | - | 91 | 82 | - | 12 | 1 | 43 | 32 | 777 |

| 2014 | 121 | 122 | 1 | 282 | 300 | 10 | 70 | 75 | 3 | 13 | - | 37 | 23 | 797 |

| 2015 | 128 | 131 | 2 | 281 | 282 | - | 66 | 73 | 5 | 7 | - | 35 | 29 | 830 |

| 2016 | 138 | 101 | - | 359 | 310 | - | 68 | 74 | 4 | 4 | 5 | 46 | 47 | 886 |

| 2017 | 139 | 160 | 13 | 349 | 502 | 130 | 72 | 72 | - | 143 | - | 44 | -99 | 792 |

| 2018 | 149 | 181 | 22 | 399 | 480 | 64 | 75 | 77 | 1 | 87 | - | 51 | -36 | 770 |

| 2019 | 157 | 126 | - | 376 | 422 | 34 | 76 | 78 | 0 | 34 | - | 49 | 15 | 801 |

| 2020 | 162 | 157 | - | 387 | 377 | - | 82 | 81 | - | - | - | 50 | 50 | 858 |

| 2021 | 163 | 212 | 36 | 385 | 449 | 49 | 85 | 84 | - | 85 | - | 50 | -35 | 833 |

| 2022 | 167 | 123 | - | 406 | 580 | 161 | 88 | 89 | - | 161 | - | 52 | -109 | 744 |

| 2023 | 166 | 212 | 33 | 474 | 930 | 428 | 94 | 95 | - | 461 | - | 59 | -402 | 348 |

| 2024 | 186 | 200 | 8 | 544 | 404 | - | 104 | 96 | - | 8 | 6 | 67 | 66 | 441 |

| TOTAL | 2,978 | 2,950 | 130 | 6,856 | 7,976 | 1,212 | 1,616 | 1,595 | 13 | 1,355 | 19 | 1,163 | -172 | 441 |

Amounts in millions of euro not adjusted.

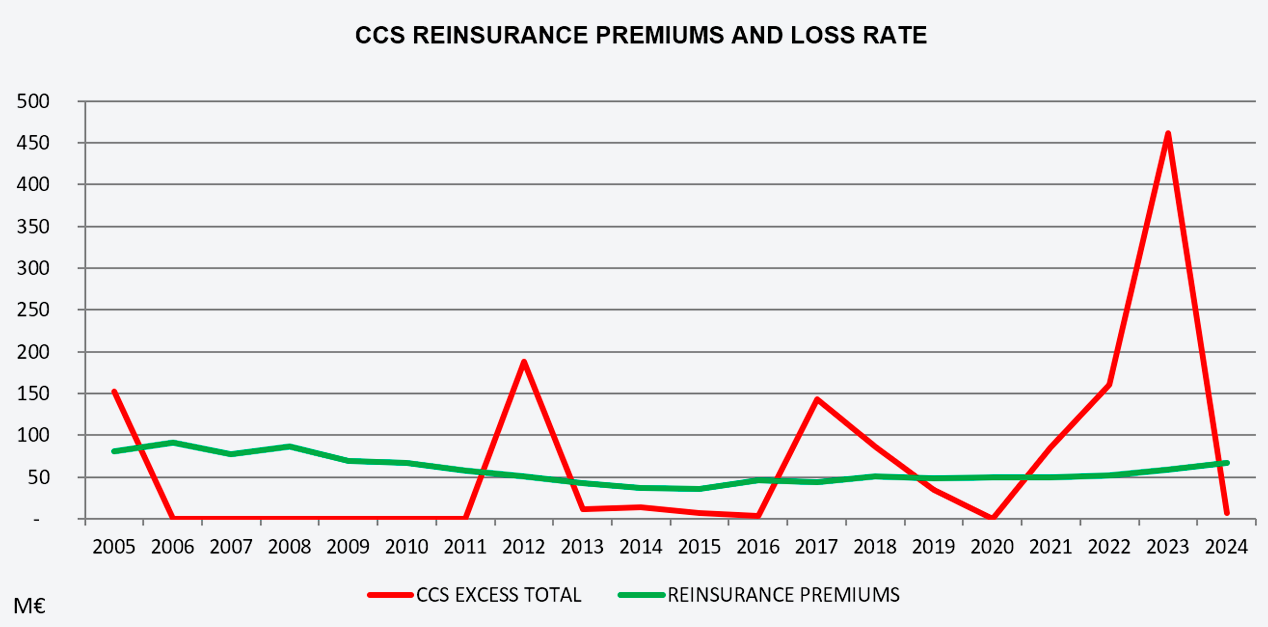

A plot depicting CCS’s reinsurance scheme appears below:

Premium revenues declined until 2014 as a result of reductions in the reinsurance rates that were not offset by increases in the direct insurance premiums. Starting in 2015, though reinsurance rates stayed the same, premium income rose because direct insurance premiums increased.

Losses show that reinsurance served as an exceptional instrument until 2012, but since that time, with the new definition of “losses for reinsurance purposes”, and presumably because of worsening climate conditions, every year except 2020 CCS has had to expend amounts that have often exceeded the premiums.

The CCS’s five-year loss ratios as the scheme’s reinsurer are:

| SERIES | CCS EXCESS TOTAL | (b) CCS Profit Sharing | (c) CCS Allocated REINSURANCE PREMIUMS | (c) + (b) - (a) CCS RESULT | CCS Loss Rate Ratio |

|---|---|---|---|---|---|

| SERIE: 2005 - 2009 | 153 | 6 | 405 | 259 | 36% |

| SERIE: 2010 - 2014 | 213 | 2 | 255 | 44 | 83% |

| SERIE: 2015 - 2019 | 275 | 5 | 225 | 45 | 120% |

| SERIE: 2020 - 2024 | 714 | 6 | 278 | 430 | 255%. |

Values in millions of nominal euros.

The results can be seen to have continually grown worse, and this worsening would be still more pronounced if the results were grouped into two periods according to the differing definitions of “losses for reinsurance periods”:

| SERIES | CCS EXCESS TOTAL | (b) CCS Profit Sharing | (c) CCS Allocated REINSURANCE PREMIUMS | (c) + (b) - (a) CCS RESULT | CCS Loss Rate Ratio |

|---|---|---|---|---|---|

| SERIE: 2005 - 2012 | 340 | 7 | 581 | 248 | 57% |

| SERIE: 2013 - 2014 | 1.0 | 12 | 583 | 420 | 172% |

Values in millions of nominal euros.

On the other hand, excluding 2023 from consideration, the current scheme could be said to be relatively in balance:

| SERIES | CCS EXCESS TOTAL | (b) CCS Profit Sharing | (c) CCS Allocated REINSURANCE PREMIUMS | (c) + (b) - (a) CCS RESULT | CCS Loss Rate Ratio |

|---|---|---|---|---|---|

| SERIE: 2013 - 2024 WITHOUT 2023 | 553 | 12 | 524 | 17 | 103% |

Values in millions of nominal euros.

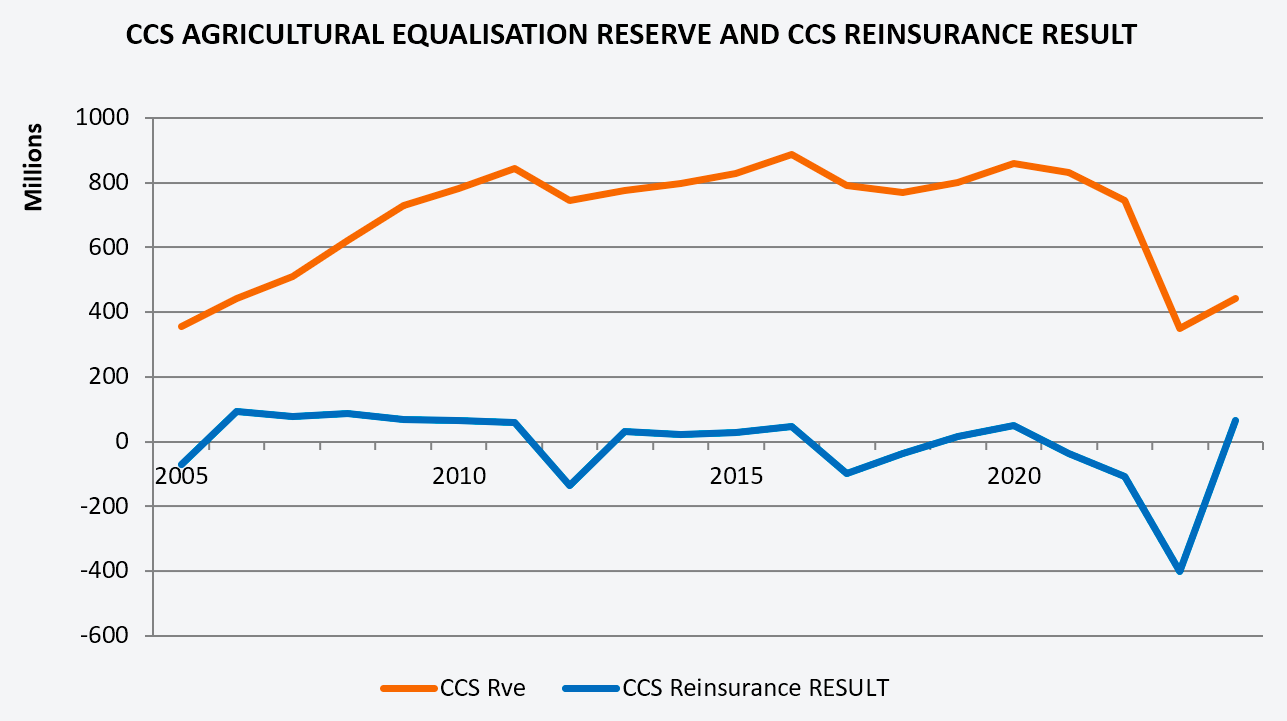

Lastly, the figure below plots the time series for the CCS’s agricultural stabilisation reserve with allocations based on revenues from the activities as agricultural reinsurer and co-insurer and from other insurance functions with a lesser economic impact together with the reinsurance results:

In 2023 there was a sharp drop in the CCS’s stabilisation reserve, which in three years fell by more than 59%, from 858 million euros at the close of 2020 to 348 million euros at the close of 2023, followed by a slight rebound in 2024.

Conclusions and outlook

The CCS has served as the linchpin for the insurance scheme’s stability and sustainability since the inception of Multi-Peril Agricultural Scheme. Up to the present time, its function as captive reinsurer has enabled the scheme to withstand extreme weather events without compromising the financial and technical viability of the scheme.

One of the characteristic features of Spain’s crop insurance scheme is that it is based on public-private participation in insurance activity, with contributions by both the public sector through the ENESA - Entidad Estatal de Seguros Agrarios [National Agricultural Insurance Agency], Spain’s Regional Goverments, and CCS and the private sector (insurance entities, Agroseguro, and agricultural associations and cooperatives).

Thanks to that cooperation, the scheme and all its participants have together set out on the path of adapting to worsening climate risks after the loss events of recent years, especially the 2023 loss, and that is something that will have to continue if the scheme is to assure its viability over the long-term.

The CCS has served as the linchpin for the insurance scheme's stability and sustainability since the inception of the Multi-Peril Agricultural Scheme. Up to the present time, its function as captive reinsurer has enabled the scheme to withstand extreme weather events without compromising the financial and technical viability of the scheme.