The Consorcio de Compensación de Seguros' support for the Multi-peril Agricultural Insurance scheme

Marta Piniés de la Cuesta – Senior Expert, Subdirectorate for Agricultural Insurance

Marina Martínez Ríos – Senior Expert, Subdirectorate for Agricultural Insurance

Consorcio de Compensación de Seguros

A bit of background:

Spain’s present successful multi-peril agricultural insurance scheme started out with the 1978 Spanish Multi-peril Agricultural Insurance Act [Ley 87/1978, de 28 de diciembre, de Seguros Agrarios Combinados(se abrirá nueva ventana)] (in Spanish) and has just marked the 45th anniversary of the creation of Agroseguro 1Agroseguro is responsible for the management of agricultural insurance in the name and on behalf of insurance companies that are part of the co-insurance pool. It is not, therefore, an insurance company, but a management entity. (Agrupación Española de Entidades Aseguradoras de los Seguros Agrarios Combinados, S.A.), Multi-peril Agricultural Insurance Providers, PLC on 17 April 1980.

The scheme’s success is rooted in a political consensus which was reached at the outset of our country’s current democratic system and has continued unchanged over time irrespective of the political majority in government. The above-mentioned Multi-peril Agricultural Insurance Act envisaged a system of public-private partnership that assigned to each of the participants in the scheme very clear functions, in which each of them is a specialist. At the same time, it set up a common operating procedure for all the participants with a view to the continuous improvement of our system of multi-peril agricultural insurance. Enhancements to the scheme have often not been made unanimously, but decision-making has always ultimately rested with the authorities in charge after a consultation and discussion phase involving all stakeholders.

The main stakeholders in Spain’s multi-peril agricultural insurance scheme are:

-

Government agencies, which subsidise the cost of insurance. This includes Spain’s Autonomous Regions and primarily its Ministry of Agriculture, Fisheries, and Food through ENESA (Entidad Estatal de Seguros Agrarios [Spanish National Agency for Agricultural Insurance]), whose General Commission is tasked with approving the Annual Multi-peril Agricultural Insurance Plan and with the extremely important mission of coordinating overall operation of the scheme. ENESA also has working groups and regulatory groups with the participation of all stakeholders that meet regularly to tailor the insurance offered to the requirements of producers and changing circumstances.

-

Agricultural producers that buy the insurance, represented by their business associations and by their agrifood cooperatives. At the serial meetings held to continuously improve the various types of insurance, these representatives communicate all the varied needs of the sector, and at the same time they contribute their knowledge regarding the insurance to be offered, since in many cases they act as insurance intermediaries.

-

Private insurers grouped together as coinsurers represented by Agroseguro. Agroseguro’s main functions are to draw up the terms and conditions and calculate the corresponding premiums based on actuarial criteria and all available information to be able to offer the insurance covers that the sector needs at a cost commensurate with the assumed risks. It also manages the claims that are made, maintains a large team of independent adjusters to assess losses, and pays out the relevant compensation while continuously shortening payout times.

-

Reinsurers, mainly Consorcio de Compensación de Seguros (hereinafter “Consorcio” or “CCS”), whose support for Spain’s Multi-peril Agricultural Insurance scheme will be considered in depth in this article.

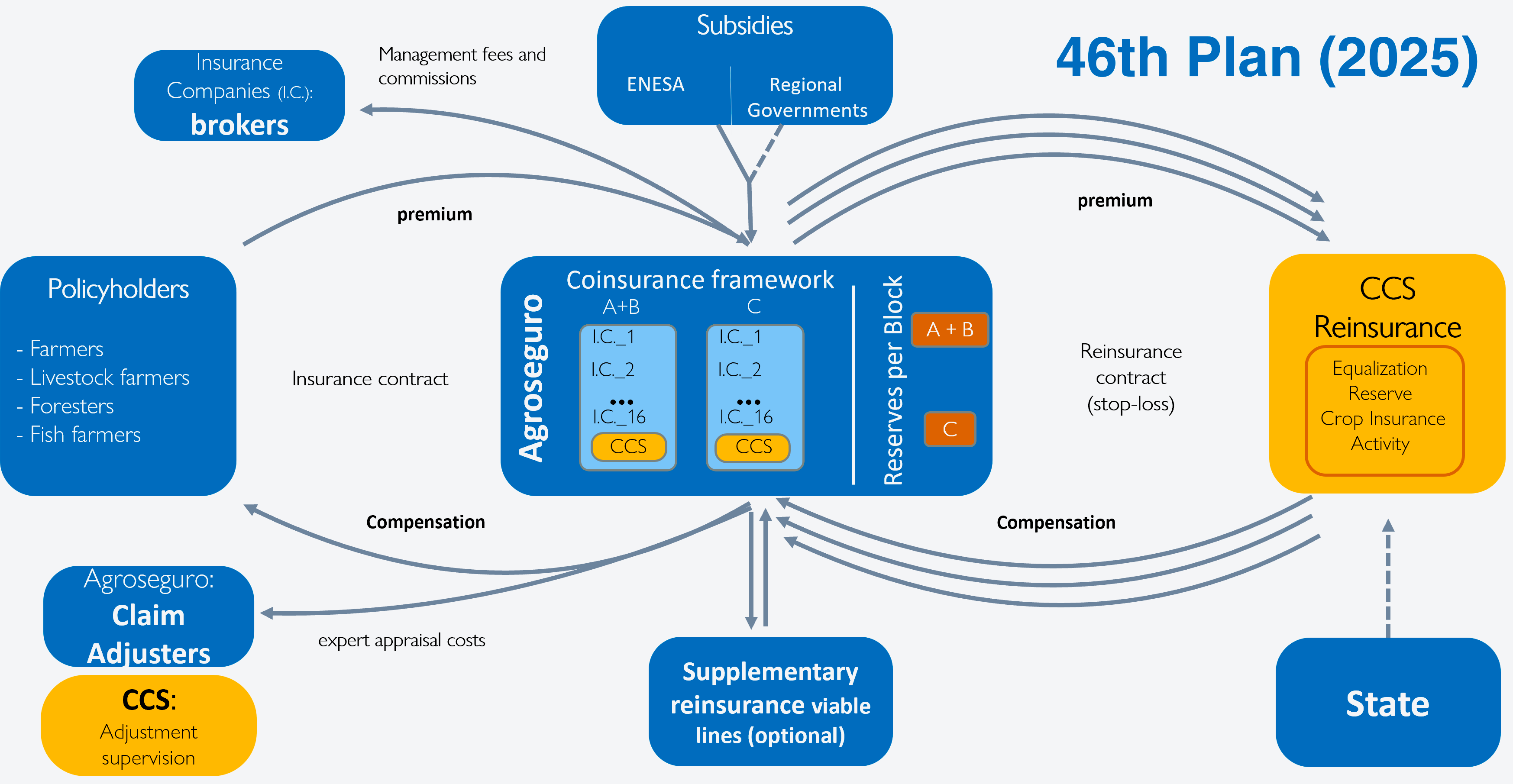

Figure 1 diagrams the main economic flows among the four main participants and some others in our country’s scheme. Consorcio’s functions under the scheme are depicted in yellow. As we will see later on, though its functions have remained in place over the years, they have evolved to adapt to the circumstances that have taken place over our scheme’s now protracted lifetime in the interest of endowing it with greater economic and financial stability.

Figure 1. Economic diagram of the Multi-peril Agricultural Insurance scheme in year 46.

Source: Prepared by the authors.

The Consorcio’s support for the Multi-peril Agricultural Insurance scheme

Consorcio is assigned the following functions under the Multi-peril Agricultural Insurance scheme by law:

To serve as the scheme's mandatory reinsurer by virtue of section 45 of the Implementing Regulations to Act 87/1978 [the Multi-peril Agricultural Insurance Act] and section 10(1) of Consorcio's Enabling Statute [Estatuto Legal(se abrirá nueva ventana) 2Spanish Royal Legislative Decree 7/2004, of 29 October [Consolidated Text of the Spanish Consorcio de Compensación de Seguros Enabling Statute.].] (in Spanish). Section 24(2) of the aforementioned Enabling Statute specifies that Consorcio must set up a technical provision to stabilise the scheme. That provision is usually referred to as the equalisation reserve as discussed below.

To serve as coinsurer where the pool of insurers fails to provide the full coverage planned. This mandate is set out in section 18(3) of Act 87/1978, section 45 of the Implementing Regulations to that Act, and section 10(1) of the Consorcio’s Enabling Statute.

To supervise loss adjustment, according to section 45 of the Implementing Regulations to the Multi-peril Agricultural Insurance Act [Reglamento de la Ley 87/1978(se abrirá nueva ventana)] (in Spanish) and section 10(3) of Consorcio’s Enabling Statute.

Let us now delve somewhat deeper into some qualities of Consorcio as an institution and the decisions in relation to the above three functions that it has taken over the course of time in the interest of providing full support for the scheme and helping ensure its economic and financial viability and hence its resilience.

A. Consorcio’s reinsurance function

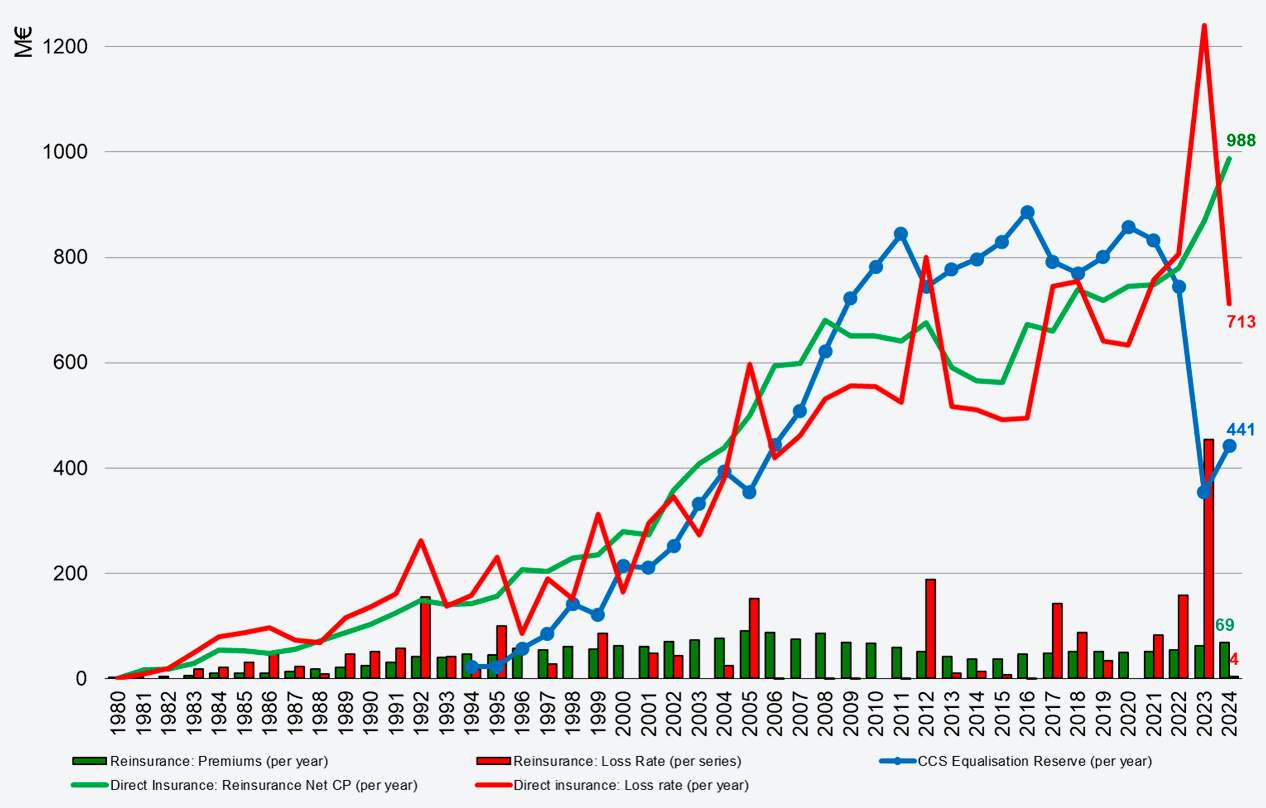

To illustrate the discussion that follows, Figure 2 plots changes in direct insurance and reinsurance premiums and losses and changes in Consorcio’s equalisation reserve over time.

Figure 2. Changes in direct insurance and reinsurance premiums and losses for the Multi-peril Agricultural Insurance scheme and changes in Consorcio’s equalisation reserve over time.

Source: Prepared by the authors.

- Consorcio is a state-owned enterprise, a subsidiary body of the Ministry of Economy, Commerce, and Business serving Spain’s insurance sector. There are two salient features of the reinsurance services for the Multi-peril Agricultural Insurance scheme Consorcio provides.

First, Consorcio is the mandatory reinsurer for the Multi-peril Agricultural Insurance scheme. This function is a basic feature affording stability to the scheme in Spain and enabling it to gear up for challenges and enhancements over the medium and long term in the assurance that if there is a year with exceptionally high losses, there will be no lack of reinsurance, as could occur if the scheme depended on private reinsurance. And as a state-owned enterprise, Consorcio is extremely careful about raising its reinsurance premium rates, to keep insurance costs as affordable as possible for producers, even after years with highly adverse loss rates, like 2023.

Furthermore, while Consorcio is a state-owned enterprise, it is not for profit. This means that all the income earned from its farm and agricultural insurance-related activities, namely, the premiums it earns as a reinsurer, the revenues it earns as a coinsurer, and the finance income earned by investing those funds, is allocated to its equalisation reserve in its entirety. That is, every euro earned by Consorcio from its operations in this connection is placed at the disposal of the scheme and its economic and financial stability.

- At the time of the scheme’s inception, when it had limited experience and little information, Consorcio charged a reinsurance premium (ordinarily referred to as a surcharge) of 20% on the commercial premiums. This amount soon proved insufficient, and it was gradually increased up to an average surcharge of 32% of the commercial premiums in 1994.

As the number of lines and the perils covered by the scheme grew, the need for reinsurance safeguards was found to differ for the lines covering systemic risks (e.g., drought and frost) compared to other lines covering more occasional risks (e.g., hail or fire). Therefore, since the 1988 Plan, the lines covering systemic risks have been classified in the group A (Experimental) subject to greater reinsurance coverage and higher surcharge, while the lines covering occasional risks have been classified in the group B (Viable). A number of years later, under the 2008 Plan, the farm carcass removal and destruction line was separated out into a new group, group C (R&D), subject to a much lower surcharge commensurate with the lower risk attaching to that line.

At the end of the first 14 years of operation of the scheme, with the benefit of more experience and more in-depth data, results began to improve, and Consorcio was in a position to start to make appropriations to its equalisation reserve. In these circumstances Consorcio gradually began to charge lower surcharges to make insurance more affordable to producers, a trend that has continued up to the present time, when the average surcharge on commercial premiums is around 6.8%. Clearly, the protections currently offered by Consorcio to Agroseguro are not the same as the ones that were offered at the outset of the scheme. Still, insurers feel comfortable with them, and since they cost less, the insured can buy insurance at a more affordable price.

In short, over time Consorcio has modified the reinsurance protections it provides and the surcharges it charges for them in the interest of achieving lower costs for producers while concomitantly increasing the level of insurance take-up, making the scheme stronger by mutualising the risk among a larger pool of insured parties. - We have already pointed out above that in the scheme’s early years results were rather uneven. Claims nearly always outpaced premiums, and the Consorcio was unable to pay funds into its equalisation reserve. This situation was overcome thanks to the mechanisms envisaged in the legislation for this specific case. For one thing, under the insurance plan for each year ENESA’s budget included certain appropriations earmarked for the Consorcio’s Stability Fund. And for another, ENESA had the backing of the Public Treasury to enable it to meet its obligations as the scheme’s mandatory reinsurer.

Consorcio had to make prudent use of those mechanisms in those difficult early years of our country’s scheme, when Consorcio was working to bring the scheme into economic and actuarial balance without recourse to its equalisation reserve, which it had not yet been able to fund. - Between 1994 and 2016 insurance results were much more satisfactory thanks to restructuring of the lines based on the experience gained and the data that had become available; to the volume of insurance purchased, which helped spread the risk; and to reasonable behaviour by loss rate trends. Only four years during that period had high loss rates when Consorcio’s reinsurance activities yielded losses, but in most years the equalisation reserve was consistently increased up to 886 million euros by the end of 2016. This made it possible to lower surcharges considerably, as mentioned above, and it began to look like nothing would be able to stand in the way of the scheme’s success.

Unfortunately, the picture changed drastically starting in 2017. Loss rates repeatedly climbed substantially. In the eight years between 2017 and 2024, the Consorcio’s reinsurance activities brought in losses in five, sometimes catastrophic losses, as in 2023.

These high loss rates resulted in a series of problems, e.g., an alarming drop in the coinsurers' equalisation reserves, so much so that in late 2021 Agroseguro considered the option of raising the loading for contingencies used to set rates, to be earmarked for the reserve. Had this been done, it would have raised the cost of insurance just when the production sector’s economic and financial situation was under particular stress, and the costs of all inputs were going up (COVID-19, higher energy costs, the war in Ukraine, etc.). Lastly, early in 2022 the Office of the Undersecretary for Agriculture, Fisheries, and Food asked Consorcio to take over additional reinsurance measures to increase the reserves of the coinsurers without raising insurance costs.

The Consorcio’s response was to design new, transitional reinsurance coverage supplementary to the existing coverage for group A (Experimental) and group B (Viable), raising the coverage for coinsurers inversely to the level of their reserves. This supplemental reinsurance coverage was activated in 2022 for group A, in 2023 for groups A and B, and in 2024 for group B. In other words, Consorcio has paid higher amounts to Agroseguro for excess losses in all years since this enhancement was implemented but has not been paid higher reinsurance premiums.

Once again, Consorcio responded quickly to a threat to our scheme, namely, possible reluctance on the part of coinsurers to offer sufficient Multi-peril Agricultural Insurance coverage because of the low level of the coinsurance equalisation reserve.

The four aspects set out above show that the Consorcio's reinsurance scheme and its equalisation reserve are the main pillars supporting the economic and financial stability of Spain's Multi-peril Agricultural Insurance scheme. That stability is essential to the long-term viability of the scheme and sends a message to producers that the scheme is robust, in that way contributing to the upward growth trend we have been observing for the past 10 years.

B. Consorcio’s coinsurance function

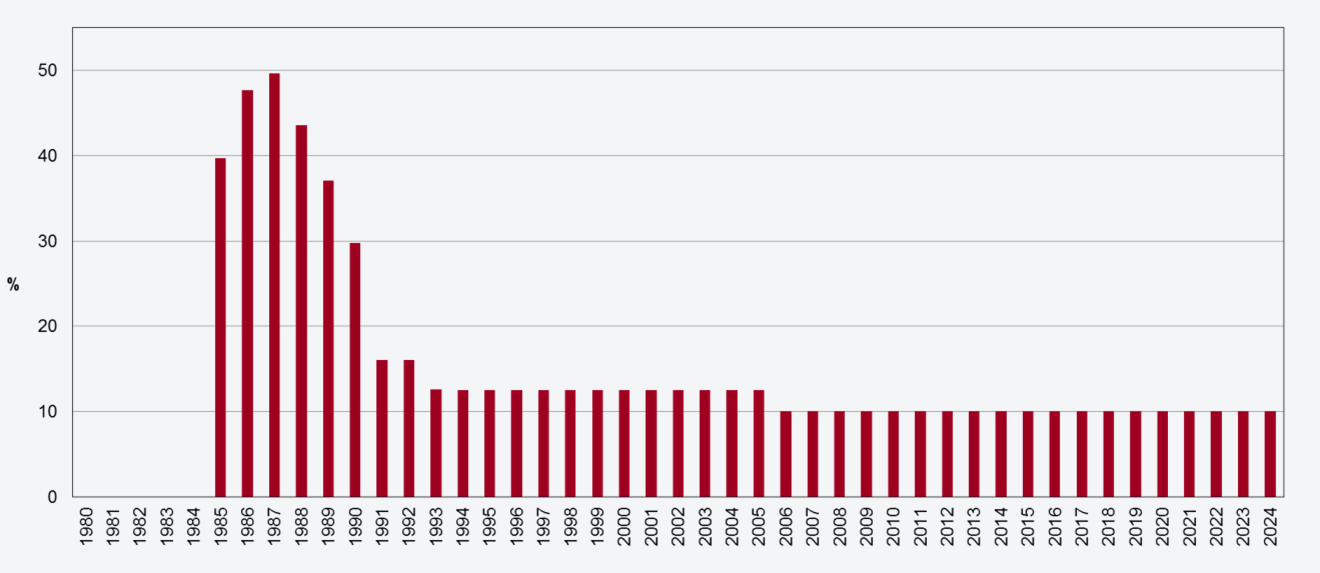

We have already mentioned that the Multi-peril Agricultural Insurance scheme’s early years were difficult. Even so, private insurers assumed 100% of coinsurance in the first five years (1980 to 1984), most likely because of the low volume of premiums, and in that way they provided backing for a future system in which they would account for a major share. However, starting in 1985 insurers began to reduce their participation in Agroseguro because of persistent losses. They still issued insurance contracts, but they did not cover the entirety of the risk.

In these circumstances the legislation stipulated that Consorcio was to step in with coinsurance to provide the rest of the planned coverage. Accordingly, in 1985 the Consorcio’s share of coinsurance was nearly 40%, and that percentage kept rising, to nearly 50% in 1987. The scheme was fast becoming a primarily public scheme, something that was to be avoided at all costs because of the repercussions that would entail.

Finally, the measures taken for the lines existing at that time, especially in respect of guaranteed yields under the Comprehensive Dryland Winter Grain Insurance programme [SICIS, for its Spanish initials] and changes affecting reinsurance to provide greater protection for coinsurers, gradually raised coinsurers' confidence in the system and in the support provided by the government, and their participation began to grow again.

Consorcio was slowly able to lower its share of coinsurance (the time series is shown in Figure 3), down to its current share of 10%.

Figure 3. Consorcio’s share in coinsurance over time.

Source: Prepared by the authors.

That share could perhaps have dwindled to zero. However, the national government considered the Consorcio’s continued participation as a coinsurer to be strategic, because it entitled Consorcio to appoint officials from the Ministries of Agriculture and Economy to sit on the Supervisory Board of Agroseguro, and that contributed to better coordination between the private insurance sector and the government supporting the scheme economically through both subsidies and the reinsurance system itself. The Consorcio’s entitlement to appoint members of Agroseguro’s Supervisory Board was set out in section 41(2) of the Implementing Regulations to the Multi-peril Agricultural Insurance Act by means of Royal Decree 288/2021, of 20 April [Real Decreto 288/2021, de 20 de abril(se abrirá nueva ventana)] (in Spanish).

In summary, through its participation as one of the coinsurers within Agroseguro, Consorcio can be said to have helped overcome the difficult beginnings in the scheme’s early years, when the scheme could have failed. Today its participation as a coinsurer helps coordinate cooperation in the scheme by the public and private sectors through the government’s representatives appointed by Consorcio sitting on Agroseguro’s Supervisory Board.

C. Consorcio’s insurance adjustment function

The lawmakers' intent when assigning supervisory functions for insurance loss adjustment to Consorcio was to enable it to more effectively carry out its reinsurance functions (section 45 of the Implementing Regulations to the Multi-peril Agricultural Insurance Act). They further provided that Consorcio could take the exclusionary measures referred to in section 27(3).

Section 27(3) provides that Within the scope of the safeguards it provides, Consorcio may reject loss valuations performed by loss adjusters with a record of poor professional performance at Consorcio or reported by the above-mentioned Ministry (the Ministry of Agriculture).

Consorcio has never had to reject any valuation made by any loss adjuster under the safeguards it provides. Neither Consorcio nor the Ministry of Agriculture have ever documented any improper performance of their professional duties by any loss adjuster. This is unsurprising. Agroseguro’s loss adjustment supervision services are much more likely to disclose any instances of improper performance, which are very few and far between, inasmuch as it has detailed information concerning all loss adjustments that are carried out, while Consorcio is only involved in supervising a very small number of them.

Despite this, performance of this function by Consorcio is not only very helpful, it is a source of a series of benefits to Spain’s Multi-peril Agricultural Insurance scheme as discussed below.

-

Supervision of loss adjustments by Consorcio tangentially provides a safeguard both for the insured and for Agroseguro (the two parties to the insurance contract), in that an independent body makes sure that the legislation in force is being followed and that the best available technical criteria are applied. In this connection it should be pointed out that the aim of Consorcio is not and never has been intended to reduce appraisals of compensation for claims. The very few mistakes reported to loss adjusters (or to Agroseguro) have ended up increasing and decreasing compensation in equal measure.

-

Agroseguro occasionally, though extremely infrequently, asks us to be present when some particularly contentious claims are being adjusted and other times requests a report by a Consorcio surveyor for an adjustment simply as a means of verifying that the loss adjuster has done their job well. Doing this tends to be highly beneficial because it gathers data both on loss adjusting and on the lines of insurance themselves, so whenever we receive this type of request, we always agree to do this, in all cases acting entirely as a wholly independent agent.

-

Other times, also not very often, ENESA approaches us for information concerning some aspect of a loss adjustment or asks for a report in response to a claim it has received to enable it to answer appropriately. Where we already have the matter on record, we send ENESA the requested information straight away. Otherwise, we look into the matter, which ordinarily entails reviewing the loss adjustment records and asking Agroseguro for any necessary technical explanations to be able to respond to ENESA’s request.

-

While as a rule, supervision or inspections tend to be regarded with suspicion by the party being checked on, we have always done our best to get loss adjusters working for Agroseguro to view our surveyors as colleagues who have a different but equally important role in adjustment. We make an effort to have loss adjusters view the evaluations sent out each year as something intended to help them in their future work. While exceptions are always possible, since supervising loss adjusters in most cases entails personal interaction between two professionals, we believe that the loss adjusters who work for Agroseguro view the work of the surveyors sent by Consorcio as something that positively impacts their own work (since in most cases it validates their findings) and the scheme as a whole.

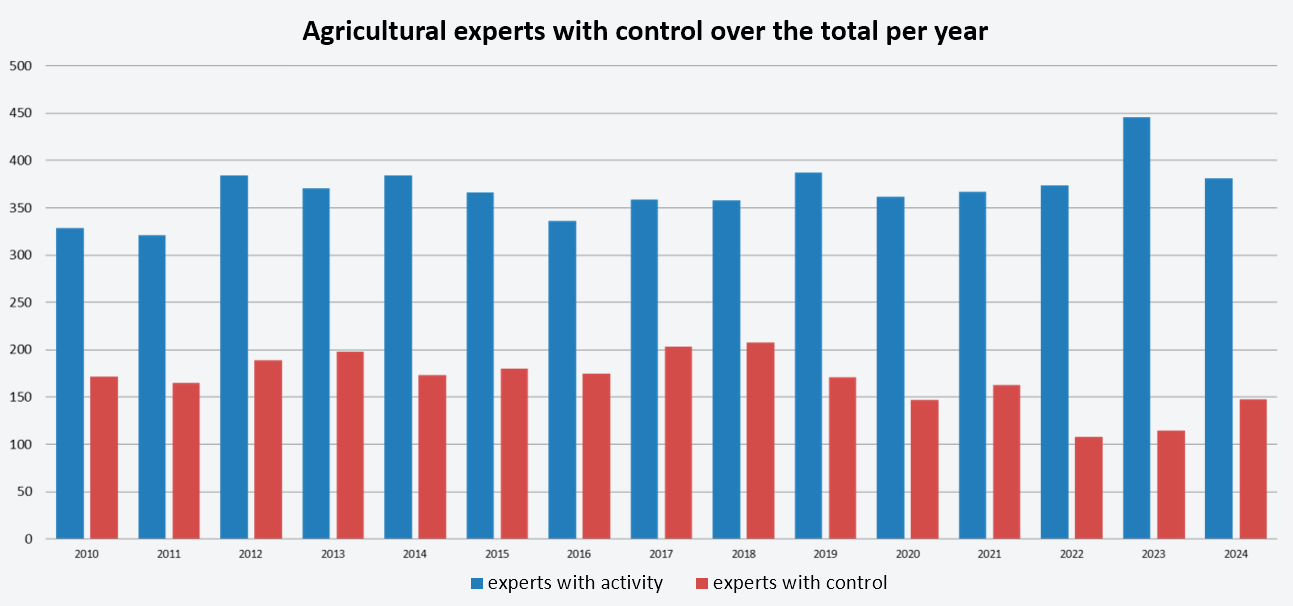

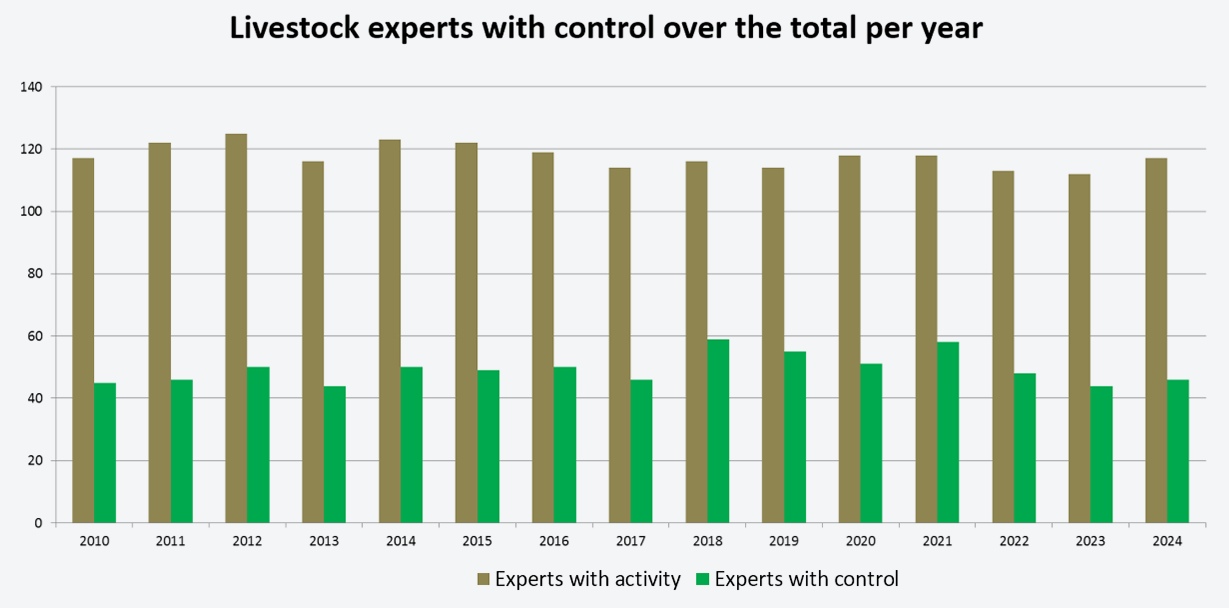

To conclude, Figures 4 and 5 set out the number of crop and livestock insurance loss adjusters whose work has been reviewed by Consorcio at some point in recent years. They show that this involves roughly 40% of loss adjusters who have carried out either a crop or a livestock insurance adjustment during a given year.

Figure 4. Agricultural experts who have been inspected compared to all loss adjusters by year.

Source: Prepared by the authors.

Figure 5. Livestock experts who have been inspected compared to all loss adjusters by year.

Source: Prepared by the authors.

Conclusions:

Let us finish up by highlighting another essential factor responsible for the success of Spain’s Multi-peril Agricultural Insurance scheme, namely, cooperation among all of the stakeholders involved in the scheme, each one, through the persons in their ranks, past and present, bringing to bear all their knowledge and enthusiasm continuously over the years. This article has focused on the role played by Consorcio, but they have all played their part. Congratulations!

The Consorcio's reinsurance scheme and its equalisation reserve are the main pillars supporting the economic and financial stability of Spain's Multi-peril Agricultural Insurance scheme. That stability is essential to the long-term viability of the scheme and sends a message to producers that the scheme is robust, in that way contributing to the upward growth trend we have been observing for the past 10 years.