New Zealand’s natural hazards insurance scheme is based on lessons of the past

Chief Executive | Te Tumu Whakarae

Natural Hazards Commission Toka Tū Ake

New Zealand’s natural hazards insurance scheme is our unique response to our unsettled geographical environment.

Like Spain, the forces that shape our beautiful country mean we live alongside a range of natural hazards. Building our resilience to volcanic eruptions, earthquakes, tsunamis, geothermal activity, storms, floods and landslides and strengthening our homes and communities to reduce their impact is an important part of living in New Zealand.

As a former prime minister once said “sometimes it does us a power of good to remind ourselves that we live on two volcanic rocks where two tectonic plates meet, in a somewhat lonely stretch of windswept ocean, just above the roaring forties . If you want drama, you’ve come to the right place”.

New Zealand created the first natural hazards insurance risk pool scheme in the world in 1945, following a decade of damaging earthquakes.

The scheme, managed by Natural Hazards Commission Toka Tū Ake, sees all insured homeowners pay a set levy that is based on extensive research and modelling of possible risks and costs. The levies are then ‘pooled’ in a fund which is used to pay out on claims for residential damage, up to a cap determined by legislation.

By absorbing the first layer of risk for initial losses, the scheme helps distribute the financial burden around the country and helps New Zealand support the availability and uptake of private insurance to top up the cover. As a result, New Zealand has very high levels of insurance penetration.

For NZ$480 (€268) a year, insured homeowners receive up to NZ$300,000 (approximately £€168,000) of cover for their homes for damage from natural hazards. The scheme also provides limited cover for the land immediately around and under their home, along with retaining walls, bridges and culverts.

The Canterbury earthquakes and the Natural Hazards Insurance Act 2023

New Zealand’s scheme was originally set up to cover damage from earthquakes and any damage from WWII. Over time, other hazards have been added, and the scheme now covers volcanic eruptions, earthquakes, tsunamis, geothermal activity, storms, floods and landslides.

The most significant natural disaster to occur in New Zealand was the Canterbury earthquakes in 2010 and 2011. In total, six significant earthquakes occurred between September 2010 and June 2011, as well as over 11,000 aftershocks. A total of 500,000 claims were made to the scheme and some of the impacts to structural elements and drains continue to be seen even now, 14 years later.

The financial response to the earthquakes for the scheme was very strong but the scale of the disaster meant the claims experience was often drawn out and stressful. This prompted a series of government reviews in the years that followed, culminating in a new operating model and a review of the legislation.

The operating model changed in 2021. Previously the Commission managed all claims for damage itself. Under the new model, all insurance claims are managed by private insurers, including claims made to the scheme. This provides a ‘one stop shop’ for homeowners and ensures we have scalable claims management resources if a major disaster occurs.

The aim of the legislative review was to consolidate the lessons learnt after the significant earthquakes in Christchurch in 2010-11 and to future-proof the scheme for the years ahead. The Natural Hazards Insurance Act was passed in 2023 and came into effect on 1 July 2024.

A new name – it’s not just earthquakes

The new legislation changed the name of the scheme from the Earthquake Commission (EQC) to the Natural Hazards Commission. The new name is an important signal to homeowners that cover is available for a range of natural hazards, not just earthquakes. There is no additional hazards covered – the new name is just to make it clear that the cover available is for a range of hazards.

Our Māori name, Toka Tū Ake, means ‘the foundation from which we stand strong, together’. It expresses an age-old truth that the best way to be prepared for adversity is for communities to come together to share their knowledge and resources as support for one another.

Many of the key features of the scheme have been retained

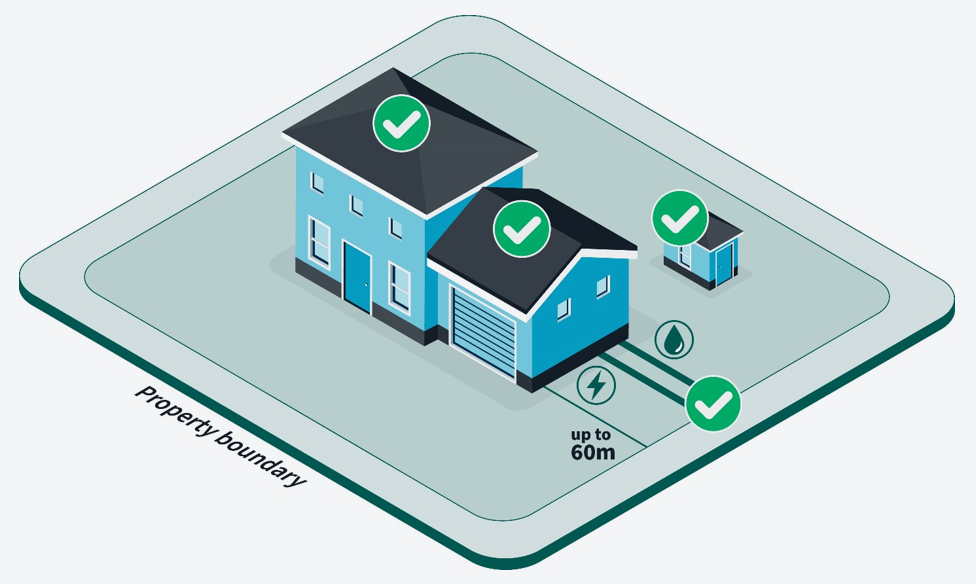

The cover provided is NZ$300,000 plus tax per dwelling in most cases. This is for damage to residential homes and essential services to the home, such as electricity and water supply.

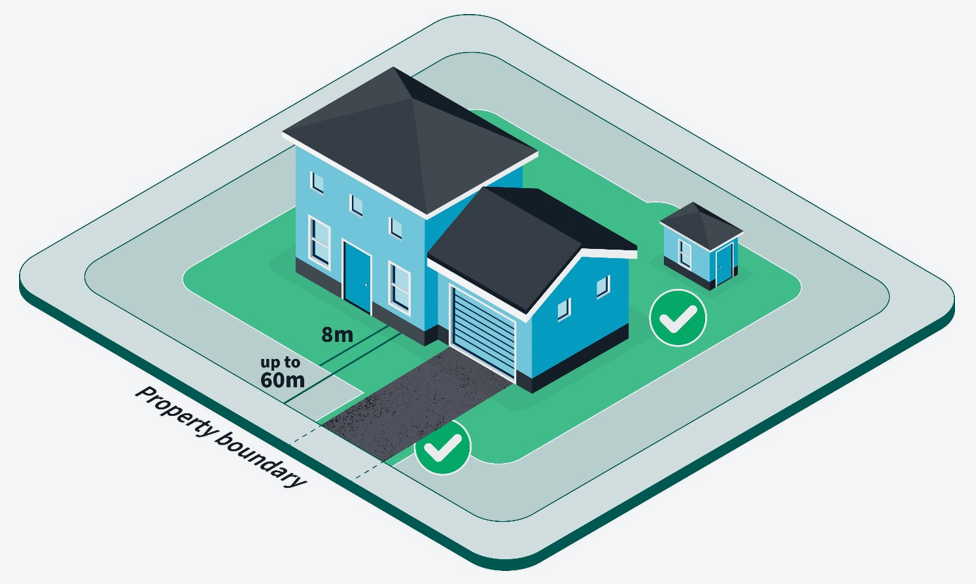

The scheme also provides cover for damage to land which is a unique feature globally. However, the cover is limited to 8 metres around a home and up to 60 metres of a driveway, plus some limited cover for retaining walls, bridges and culverts. The entitlement is capped at the value of the insured, damaged land.

A renewed focus on resilience

Another unique aspect of New Zealand’s scheme is the role of the Commission in facilitating research and education on natural hazards.

The Natural Hazards Insurance Act 2023 further strengthens that role and requires the Commission to actively share so information and knowledge about natural hazards and how damage might be prevented or reduced. By raising awareness across government, industry and homeowners, and advocating for ‘stronger homes on better land’, the Commission is contributing to the long-term resilience of communities.

Clearer definitions to keep pace with the way people live

Although most New Zealanders live in stand-alone houses, apartment living is on the rise. Under the new Act, building owners have increased cover in buildings containing a mix of uses, such as commercial buildings containing apartments.

Protecting the right to complain

In the aftermath of the Canterbury earthquakes, many of the legal boundaries of the scheme were tested in the courts and the importance of learning from complaints was highlighted.

The new Act applies those lessons by introducing a new complaints process and independent review system that is free for homeowners to access. This avoids the costs and delays of using the courts.

It also introduces a Code of Insured Persons’ Rights, which sets out the standard of service a homeowner can expect to receive from the Commission. This is an additional avenue for complaint that focuses on fairness and conduct, over and above the specifics of claim decisions, and also includes the ability to have situations independently reviewed.

These new complaints processes are a vital part of our commitment to getting it right for homeowners by putting them at the heart of our work.

Ensuring the long-term financial sustainability of the Natural Hazards Insurance scheme

Another new requirement of the new Act is the publication of a Ministerial Funding and Risk Management Statement (FRMS) at least every five years which sets out how the financial risks of the scheme will be shared between the Government and insured homeowners. This covers aspects such as the mandatory levy paid by homeowners (currently NZD$480), the cap for cover (currently NZD$300,000) and any excesses.

By regularly reviewing the financial settings, the Government can ensure that the scheme remains financially sustainable for the long term and that a good balance is struck between the costs of the scheme now and the impacts for future generations.

Looking forward to the next 80 years

With a new Act, a new operating model, a new name, and a renewed focus on sharing knowledge, the scheme is well placed to deliver on its role of reducing the impact of natural hazards on people, property and the community in the years to come.

In a country with a high natural hazard risk profile, but a small population, it is important that we use our resources as efficiently as possible and that we constantly adapt for the future – not just in the way we provide insurance cover but in the way we build houses and choose where to place communities.

Some of the most insightful information comes from sharing lessons with other schemes around the world that are facing similar challenges. We very much appreciate the strong relationship we have with Consorcio de Compensación de Seguros.

We express our compassion for those in Spain affected by the recent catastrophic flooding in Valencia and the surrounding region. Know that we stand with you as you recover. As we say in te reo Māori: He waka eke noa: We are all in this together.

As of 1 July 2024, our name changed from the Earthquake Commission to the Natural Hazards Commission Toka Tū Ake.

Find out more about our organisation and insurance scheme on this link(se abrirá nueva ventana).

The new legislation changed the name of the scheme from the Earthquake Commission (EQC) to the Natural Hazards Commission. The new name is an important signal to homeowners that cover is available for a range of natural hazards, not just earthquakes. There is no additional hazards covered – the new name is just to make it clear that the cover available is for a range of hazards.