Australia’s cyclone pool: the journey so far, and what its data is telling us

Head of Public Affairs and Communications

Australian Reinsurance Pool Corporation

Since 2003, the Australian Reinsurance Pool Corporation (ARPC) has been the Australian Government’s provider of catastrophic reinsurance cover – first, for terrorism risk, and since 2022, for cyclone and cyclone related flooding risk. This paper focuses on the cyclone pool – from the creation of ARPC over two decades ago, the nature of cyclone risk in Australia, the commencement of the cyclone pool in 2022, its accepting risk from customers for the first time in January 2023, and official and community responses to its operations since then.

ARPC’s creation - the terrorism pool

The need for ARPC arose from the terrorist attacks in New York on 11th September 2001. These attacks led to the withdrawal of terrorism cover by insurance and reinsurance companies and motivated the Australian Government at the time to intervene in the market to make eligible commercial properties insurable for terrorism losses again. The attacks also came just a few months after the collapse of what was then Australia’s second largest insurer – the largest corporate failure in Australian history at that time.

To make commercial property insurance for terrorism viable again, as part of a broader policy commitment to make general insurance more affordable and accessible, the Australian Government secured the passage through parliament what later became known as the Terrorism and Cyclone Insurance Act 2003 (the Act(A new window will open)).

The Act created ARPC as the government entity to provide reinsurance cover to insurers for eligible terrorism losses via its terrorism reinsurance pool, providing reinsurance for commercial property and associated business interruption losses, in the event of a declared terrorist incident. The terrorism pool continues to successfully operate to this day.

Cyclone risk in Australia

As the frequency and severity of natural disasters continues to rise, a growing number of individuals and businesses are finding it increasingly difficult to access affordable insurance. Cyclone risk is a heavy cost burden for both insurers and consumers in Australia, especially the high cyclone-prone regions, which can be broadly defined as those parts of Australia north of the Tropic of Capricorn - particularly coastal areas.

Since the first insurers joined the cyclone pool in January 2023, there have been several declared cyclone events across Australian territory. Below is a table of those cyclone events since the commencement of the cyclone pool.

| Season | Cyclone | Event Detail | |||

|---|---|---|---|---|---|

| Event Start | Event End | Claim Period End Date | Hours ARPC on Risk | ||

| 2024 Cyclone Season | Jasper | 10/12/2023 4:00PM | 13/12/2023 11:59PM | 15/12/2023 11:59PM | 128 |

| Anggrek | 15/01/2024 10:00PM | 31/01/2024 4:00PM | 2/02/2024 4:00PM | 426 | |

| Kirrilly | 24/01/2024 4:00PM | 26/01/2024 4:00AM | 28/01/2024 4:00AM | 84 | |

| Lincoln | 16/02/2024 10:00AM | 16/02/2024 10:00PM | 18/02/2024 10:00PM | 60 | |

| Megan | 16/03/2024 4:00PM | 19/03/2024 7:00AM | 21/03/2024 7:00AM | 111 | |

| 2023 Cyclone Season | Darian | 18/12/2022 5:00PM | 30/12/2022 10:00PM | 1/01/2023 10:00PM | 341 |

| Ellie | 22/12/2022 7:00PM | 23/12/2022 10:00AM | 25/12/2022 10:00AM | 63 | |

| Gabrielle | 9/02/2023 11:00AM | 12/02/2023 3:00AM | 14/02/2023 3:00AM | 112 | |

| Ilsa | 11/04/2023 4:00PM | 14/04/2023 9:00PM | 16/04/2023 4:00PM | 125 | |

Additionally, this map illustrates their trajectories across Queensland, the Northern Territory and Western Australia, and shows the cyclone pool to be of most importance in the north.

These areas are at much greater risk of suffering cyclone damage than the rest of Australia. Cyclone events can cause significant damage to homes and businesses, with a major effect on the lives of many. The most significant cyclone event in recent years was Tropical Cyclone Yasi(A new window will open) in 2011, which was one of the most powerful storms to hit the region on record.

Because of this elevated cyclone risk, and the potential damage that can occur, insurance premiums can be significantly more expensive in northern Australia, compared to lower premiums paid in the remaining half of the country. In addition, some insurers showed a greater reluctance to accept risk in areas of greater cyclone risk. Fewer market participants also meant fewer options for consumers to choose from.

With insurers reluctant to accept risks in high cyclone areas, this led to cover becoming less affordable and accessible for consumers in the region. The Australian Competition and Consumer Commission (ACCC) in 2018-19 found(A new window will open) that the average combined home and contents insurance premium was about AUD 2,500 in northern Australia, compared to about AUD 1,400 for the rest of Australia.

The creation of the cyclone pool

On 4 May 2021, the Australian Government announced(A new window will open) its intention to establish a reinsurance pool to cover cyclone and related flood damage. The cyclone pool would deliver reinsurance at a lower cost than the private market by leveraging a AUD 10 billion annually reinstated Commonwealth guarantee which enables the cyclone pool premium rates to exclude margins for profit and return on capital.

The announcement came after a decade of government inquiries and parliamentary committees. All noted insurance premium increases in northern Australia due to cyclone risk, and all considered how to address this gap.

Consultation on the proposed cyclone pool, legislation and commencement

A government taskforce consulted with industry and community representatives(A new window will open), as well as other interested parties, on the cyclone pool.

The taskforce recommendations were considered by the government and resulted in the current pool being created by legislation(A new window will open) amending the Act. The legislation was passed unanimously by the Australian parliament, with the cyclone pool coming into effect on 1st July 2022.

The pool is the latest policy initiative pursued by successive Australian governments since 2001 to achieve its wider goals on improving accessibility and affordability.

Design features of the cyclone pool

The cyclone pool is a reinsurance arrangement between insurers and ARPC. The cyclone pool covers household, strata, and small business property insurance policies. It operates Australia wide, but targets support to cyclone-prone areas and provides reinsurance for insurers operating in those areas.

The cyclone pool covers 100% of cyclone and related flood damage. This includes wind, rain, rainwater, rainwater run-off, storm surge, and riverine flood damage caused by a cyclone.

Like the terrorism pool, the cyclone pool is backed by a AUD10 billion government guarantee. If the guarantee is likely to be exceeded in a single year, the Australian Government will increase the guarantee to support the cyclone pool to meet all its obligations.

Australia’s weather agency, the Bureau of Meteorology (BoM), observes the date and time when a cyclone begins and ends, and in some cases re-intensifies. Based on the BoM notification, the ARPC must then declare the start or end of a cyclone event.

The cyclone pool covers claims for cyclone and related flood damage arising during a cyclone event, which lasts from the time a cyclone begins until 48 hours after the cyclone ends – this is known as the cyclone event period.

The cyclone pool covers home, strata, and small business policies. This includes:

-

residential home and contents, including landlord insurance and farm residential cover;

-

residential strata, including mixed-use strata schemes (where 50 per cent or more of floor space is used mainly for residential purposes); and

-

commercial property policies with AUD 5 million or less total sum insured across risks covered by the pool (property, contents, and business interruption).

Participation is mandatory for general insurers with eligible policies. Policyholders have complete freedom to choose their insurer, and insurers will continue to manage all claims, in accordance with their underlying policy document.

This chart shows the coverage of the market by the cyclone pool, as at 1 July 2024:

How the cyclone pool prices risk

The pricing formula uses property-level data such as geography, building characteristics, and mitigation. It has been developed in line with the principles that the cyclone pool will:

-

be cost-neutral to government over the longer term;

-

lower the reinsurance cost for most policies with medium-to-high exposure to cyclone risk;

-

have minimal impact on policy premiums for lower cyclone-risk properties; and

-

maintain incentives for risk reduction and offer discounts for properties that undertake mitigation.

The original pricing rates came into effect from 1st October 2022, three months before the first insurers joined the cyclone pool on the 1st January, 2023.

During June-July 2024, ARPC conducted a pricing review of the cyclone pool premium rates to ensure the premium rates remain in line with the principles above, and to create premium discounts for strata properties that have undertaken risk mitigation activities. The conclusion was that the legislative objectives of the cyclone pool continue to be met. ARPC subsequently released revised premium rates for the cyclone pool that come into effect from 1st April 2025.

The role of the ACCC in analysing the cyclone pool’s performance

Ultimately, the purpose of the cyclone pool is to put downward pressure on insurance premiums paid by policyholders in cyclone-prone regions, and the agency tasked with the responsibility of monitoring its effect is the ACCC.

The ACCC collects data from insurers, consumers and other interested parties to assess the impact of the cyclone pool and determine whether the savings from the cyclone pool are being passed through to policyholders. It then publishes an annual insurance monitoring report(A new window will open).

The third report, which was released on 19th September 2024, utilising data up to 30 September 2023, found the cyclone pool has begun delivering lower premiums in regions facing higher risk of cyclones.

The September report recognised that the cyclone pool has resulted in some cost savings for insurers writing policies in higher cyclone risk regions and that insurers are making changes to allow savings they have received from the cyclone pool to flow through to consumers.

It also noted that economic and environmental factors beyond the control or remit of the cyclone pool are adversely influencing overall premiums facing consumers and offsetting savings from the pool. These costs include the broader hardening of global reinsurance markets, extreme global weather events, and price increases of building materials and labour.

In its report, the ACCC compared how premiums changed following insurers’ entry into the cyclone pool. It also assessed insurers’ approaches to implementing the cyclone pool, including recognition of cyclone mitigation measures.

Of those policies that had renewed after their insurer joined the cyclone pool, the ACCC found that 27% of combined home and contents policies in areas of medium to high cyclone risk experienced decreases to their premiums. For comparison, for those home and contents policies in medium to high risk areas that renewed before their insurer joined the pool, only 12% experienced a decrease.

Similarly, the ACCC found that 16% of strata policies in medium to high cyclone risk areas experienced a premium decrease upon renewal after their insurer had joined the cyclone pool, compared to 10% that renewed before their insurer had joined the pool.

ARPC evidence of improving affordability and accessibility

In May 2024, ARPC released its own analysis(A new window will open) of home insurance premiums in cyclone-prone regions of Australia, which also suggested that general insurance affordability is improving. The report was based on online quote data from before insurers joined the cyclone pool and compared to more recent data (January 2024). Key findings from the report included:

-

parts of northern regional centres such as Broome, Townsville, Proserpine, and Mackay were generating quotes for home insurance cover up to 38 per cent lower than they were prior to the cyclone pool’s creation in 2022;

-

small business insurance quotes for those same areas were reporting average premium reductions of 38 per cent; and

-

various parts of Cairns, Ingham, and Cape York in Far North Queensland (FNQ) were also reporting average reductions up to 22 per cent for home insurance and 24 per cent for small business cover.

This followed earlier research suggesting accessibility is also improving for people living in cyclone-prone regions, in ARPC’s first financial outlook report(A new window will open) (FOR), which was released in December 2023.

These reports have shown that the cyclone pool is working as intended – greater premium savings are being felt in those areas with the greatest cyclone risk, as those regions have a heavier burden needing relief. For example, Table 1.2 of the FOR shows how much cyclone pool premium can vary between Australia’s third largest city, Brisbane (AUD146 for home insurance cyclone cover) and Townsville (AUD709), which is a city of almost a quarter-million people, about 1,350 km north of Brisbane by road.

Early signs of significant underinsurance

With participation in the cyclone pool being mandatory for insurers, ARPC is able to review the number of properties with cover in cyclone-prone regions under the cyclone pool, against other data sources that identify the number of homes (either freestanding, or a strata development), or small businesses, such as the census.

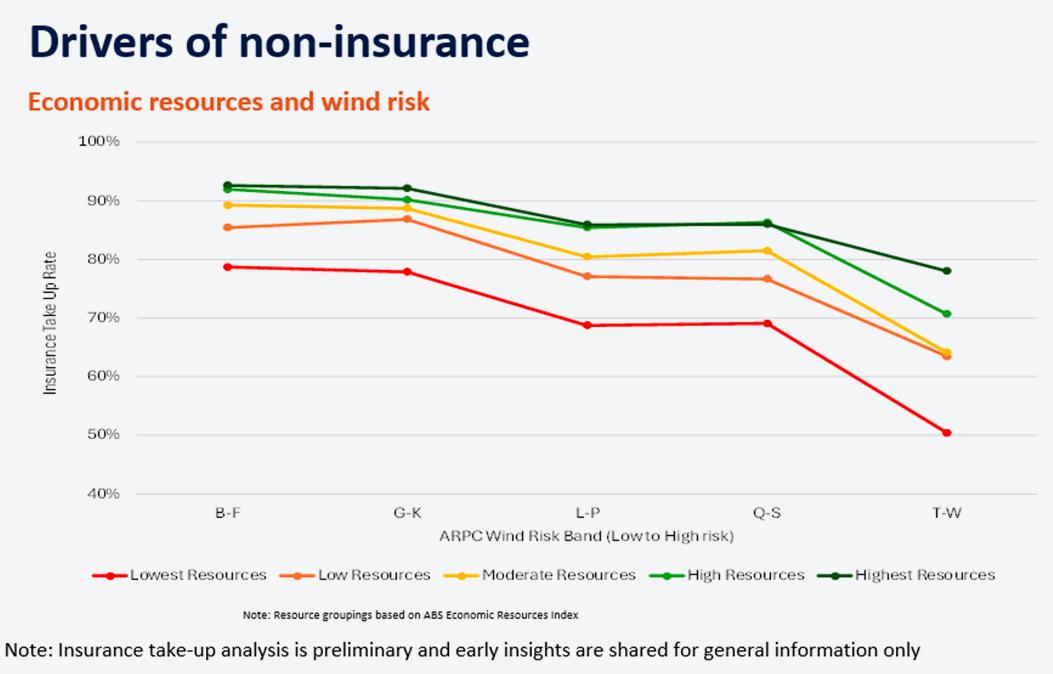

The early signs of this comparison suggest that northern Australia is significantly more under-insured than previously expected, and that this pattern occurs regardless of the economic resources of a region. This diagram (divided by ARPC Wind Risk Band, as defined on an alphabetical scale that correlates with the level of cyclone risk), shows the pattern.

Looking ahead: the future of the cyclone pool beyond 2024

Throughout 2024, the lack of affordable and accessible insurance in Australians have been the subject of three parallel parliamentary inquiries: the inquiry into insurers responses to 2022 major flood claims(A new window will open), the impact of climate risk on insurance premiums and availability(A new window will open) and the report on the operation and implementation of the Cyclone Reinsurance Pool(A new window will open). All the three inquiries have examined the cyclone pool, its effectiveness, and whether its remit should be changed.

The most common options for discussion have included whether the current 48-hour cyclone coverage period should be changed, or whether other natural perils should be added to the cyclone pool’s remit. Two of the three reports have suggested consideration for the government to add flood risk to the remit of the cyclone pool, possibly on a limited and temporary basis. The other report has yet to be finalised.

While these inquiries are not binding on the government of the day, they do reflect the thinking of key policymakers and care likely to be influential on those of their colleagues who serve as ministers in the government (and actually set policy).

Further, the Act requires a review of the cyclone pool in 2025. This work will be informed by a taskforce announced(A new window will open) by the minister responsible for ARPC, the Hon. Stephen Jones MP, as part of the 2024 Australian Budget. The Insurance Affordability and Natural Hazards Risk Reduction Taskforce seeks to help address insurance costs driven by more frequent and intense weather events, by improving affordability. The timeline for its recommendations to be released is not known at this time.

With the cyclone pool fully operational, more datapoints will become available for ARPC to share with the public. This will become an important tool for policymakers to assess the pools effectiveness. The provision of data and insights will also assist the work of other government agencies, such as the National Emergency Management Authority (NEMA) and their work on natural hazard management. Early assessments alluded to in this paper about the true scale of underinsurance in northern Australia are an early sign of how data gathered by ARPC can be utilised. With several reports to be released over the course of 2025, the effect of the cyclone pool will sharpen its focus and this clarity will help shape policy.

Conclusion

By pooling resources and risks at a national level, the cyclone pool is a mechanism that offers a buffer against significant cyclone events, ensuring that insurance remains a reliable tool for recovery and risk management even in the face of escalating climate impacts.

Like other parts of the world, Australia is experiencing elevated cost-of-living pressures at a time of relatively modest economic growth. Community expectations in northern Australia are high that the cyclone pool will deliver consumers tangible, significant relief to insurance premiums.

For some communities, cyclone risk can be the largest single component to calculate a home insurance premium, making this relief particularly important. Following an extended period of reporting on the pool’s performance, we will be able to gauge whether the pool is a sustainable solution that satisfies communities’ long-term expectations and strengthens our collective ability to respond to future cyclone risks.

Since 2003, the Australian Reinsurance Pool Corporation (ARPC) has been the Australian Government’s provider of catastrophic reinsurance cover – first, for terrorism risk, and since 2022, for cyclone and cyclone related flooding risk. This paper focuses on the cyclone pool – from the creation of ARPC over two decades ago, the nature of cyclone risk in Australia, the commencement of the cyclone pool in 2022, its accepting risk from customers for the first time in January 2023, and official and community responses to its operations since then.