Artificial Intelligence, Driving Change in the Insurance Industry

Head of AI Initiatives, TIREA

Quant AI Developer, Instituto BME

Our everyday lives have grown full of items connected with artificial intelligence. Recalling their names may be difficult at first, but today they are used so often that they have become a part of our lives. Using terms like deep learning, neural networks, and generative AI has become commonplace nearly everywhere.

Artificial intelligence’s mathematical underpinnings were laid down decades ago, and it is now expanding into every corner of today’s society and giving rise to sweeping changes in the business sphere. Some may look at it as just a technology fad, but we would seem to be in the midst of something that runs much deeper, comparable to the impact made by the Internet and widespread use of email in their day.

There is not just one reason for this expansion; rather, there are a whole series of causes. As might be expected, insurance companies are one of the businesses involved, and they do not have the luxury of staying on the sidelines in the face of these changes. They have no choice but to jump onto this new wave of transformation. For one thing, there are businesses that are building cutting-edge computing technology unthinkable just a few years ago. For another, technology giants are making infrastructure to use these resources open to everyone at very reasonable cost. What is more, there are businesses at work on creating artificial intelligence models with extremely advanced and easy to use development tools. All this is at the disposal of insurance companies, which are eager to acquire these solutions and to use them to expand the range of products and services they can offer their customers, all with the highest quality performance in the most favourable terms.

Artificial intelligence and insurance companies

Businesses have been caught up in a process of developing strategies at a reasonable pace to adapt to the new working environment that has emerged thanks to artificial intelligence. The main initiatives in the insurance sector chiefly focus on improving operational efficiency, supporting decision-making, personalising commercial offerings, enhancing interactions with customers and customer service, and including technology product development tools.

The units and departments concerned are mainly involved in the following projects:

- Customer service departments: Efforts in this area have concentrated on implementing virtual assistants to meet the growing volume of applications filed by users. Conversational AI models are also being used to help employees resolve customer enquiries and avoid potential mistakes from having to rely on memorising manuals, documents, and contracts. Other initiatives involve implementing artificial intelligence-driven recommendation engines to suggest personalised content, products, and services designed to meet user behaviour and preferences and enhance their platform experience.

- Legal departments: Reading documents that are often hard to understand takes up hours of work by legal departments. Using generative artificial intelligence to prepare summaries and synopses of documents of this type is one of the main initiatives to reduce this workload. Another area in which these models are coming into use is in implementing systems based on AI to manage and ensure compliance with the General Data Protection Regulation (GDPR).

- Finance departments: One of the goals that can be achieved through the use of artificial intelligence models is improving companies' financial planning. There are also a broad range of AI financial investing solutions. Environmental, social, and governance (ESG) initiatives usually have a direct impact on these departments and include implementing AI systems to optimise supply chains and promote sustainable practices, such as selecting ethical vendors and minimising carbon footprints.

- Sales departments: Artificial intelligence is providing solutions that sales departments can use to draw up personalised proposals. Simulating risk scenarios is another application that is used to assess proposals and take informed decisions. Furthermore, AI-based fraud detection models are useful in enabling sales departments to refine their customer and product portfolio management.

- Technology development departments: Many companies are already using coding assistants to help software developers and speed up the creation of applications. Another implementation of this kind, one of the main uses for these new tools, is generating synthetic data for testing and report preparation.

Figure 1. AI application areas in the insurance sector.

Source: own production.

Industry solutions for insurance companies

Artificial intelligence models are being used in initiatives that provide insurance companies with solutions to improve the services supplied by the sector and even launch new services. By way of example, an initial version of a tool that helps processors handle medical claims is in the early stages of development. This tool uses the data in the file to return indicators to help processors more confidently perform billing procedures if no deviation from the norm in these cases is found. Where the indicators suggest that there may be a problem, claims handlers need to review the file in more detail. In the initial stage this tool is designed to analyse structured data only, but it is planned that forthcoming versions will be capable of analysing and extracting data from all the documents connected with a case and even of processing images. These indicators are a source of greatly improved efficiency, because claims handlers only need to perform detailed reviews of cases with red flags, allowing other cases to be processed more quickly and shortening processing times. Claims handler feedback will enable this tool to improve its predictions over time using approaches that have already been tried in the health line and can be extrapolated to other lines of business.

There are plans to undertake a series of initiatives aimed first and foremost at standardising data across the industry. Completing that standardisation will open up enormous opportunities to develop artificial intelligence models. However, it is essential for high-quality data to be available for subsequent use. Several ideas have been floated concerning projections of future expenses, which will enable better financial planning by insurance companies and thus have a positive impact on the other companies involved in collection processes.

Improved document handling is a key strategic part of adjusting to this new environment. Automatically classifying and retrieving information from documents will expedite all management, handling, and payment procedures, not only for insurance companies but also for medical centres, repair shops, brokers, intermediaries, lawyers, and basically everyone else involved in the insurance sector. This will substantially improve the provision of services that are used on a daily basis.

Rates of successful data extraction for documents with general identifying details are very high, and these processes can therefore be completely automated. However, more specific types of documents require preparatory standardisation work to be able to attain reasonable rates of success that make semiautomated processes possible.

Claims processing is one example of an area in which artificial intelligence can clearly bring improvements, from image processing to loss-related information processing. There is no industry-wide project, but companies are implementing individual bespoke solutions to expedite handling of this kind.

Like the preceding example, the different companies are developing their own customised models for automated policy recordal procedures designed to meet their own individual needs.

Artificial intelligence at TIREA

It is only natural for TIREA’s

(1)On 11 December 1997, TIREA, Tecnologías de la Información y Redes para las Entidades Aseguradoras S.A. (Information Technologies and Networks for Insurance Entities Co.), was set up with the support of the Spain's Insurers Association, UNESPA, and more than 165 insurance companies representing 80% of the sector's total turnover,with the aim of implementing sector services and solutions based on telecommunicationsand computing.

TIREA currently has 77 shareholders, almost all of which are insurance companies. Over the years, TIREA has managed to create a consolidated project that provides service, with high specialisation and a constant effort for security and technological innovation, tocritical business processes for insurance companies.

TIREA's main mission is to help improve the business of insurance companies through technology. Its services aim to increase the insurance sector operational efficiency, reducing its administrative and management costs.

More information: https://www.tirea.es current modernisation programme to include artificial intelligence initiatives. Many of its teams are involved in different projects, and some of those that have made the most progress are discussed below. A number of these projects involve internal improvements in the form of tasks that have up to now been carried out by hand but are capable of being entirely automated, while others are designed to improve services or specific applications.

In the past TIREA has developed a series of fraud detection models that have relied on automated processing. One of the company’s first steps towards transformation was to update these machine learning models using more modern technologies and to upgrade the classifier employed, making it into one of the most powerful on the market. That model is currently in the stage of validation testing and comparing its results with the results produced by previous models. The changes made during the migration process have improved scoring precision.

The help indicator management project for medical case file processing is currently in the pilot phase and uses that same technology and the same classifier. Despite having an F1 score above 90%, this project is considering a subsequent stage using generative artificial intelligence to improve inferences based on the destructured data in the available medical files. The feasibility of implementation is being evaluated, and a legal framework for regulatory compliance during use is being drawn up to ensure that there is no non-compliance on the part of TIREA when the data are used.

One of the most advanced projects the company is working on is related to natural language processing (NLP), namely, the personal data anonymisation project. Because of the nature of its work, processing of personal data is a priority for TIREA. In various areas of its day-to-day activities these data are obfuscated manually, and this poses a substantial workload. Not only do these procedures entail excessive amounts of manual labour that brings little value, their effectiveness can also be limited, especially where large volumes of documents are involved. There is thus a need to improve those processes. NLP enables these tasks to be automated. Just a few days after roll-out, the additional workload has been reduced substantially. Bringing generative artificial intelligence to bear in this project has been considered as a means of improving the precision of the data obfuscation. Nevertheless, given the reasonable level of confidence in the current solution, the model has been left unchanged.

TIREA receives quite a large range of different billing documents. The company finds semiautomated retrieval of data from invoices to be extremely useful, so it has gone to great efforts to implement various deep learning models intended specifically for that purpose. Instead of using standard solutions, it has been decided to label cases manually and to train the models to make predictions. This process has been time and labour consuming but has been made possible through the work of various teams, and a model offering a high degree of confidence will shortly be available. The level of precision will improve still further when it goes into operation thanks to the additional training to be carried out. The model has already started to be used in two applications and there is a good chance it will be used in other invoice handling tasks. With small tweaks and additional training, these applications could begin to see positive results in virtually no time.

Now that the ability to retrieve information from invoices has been validated, several initiatives have been launched to provide data classification and retrieval solutions for a broad range of documents. These include standard documents with personal identification details as well as with less structured data, like accident reports. There is reason to be optimistic, and bringing these generative artificial intelligence applications on stream in TIREA’s normal work looks very promising.

One route involving virtual assistant solutions is being explored. Several projects along those lines are currently being developed, but it is still too early to be able to say that the chatbots in development are sufficiently advanced to enable them to be brought on line in actual applications. These assistants are still too general purpose in nature and are not yet addressing the specific problems for which they have been conceived.

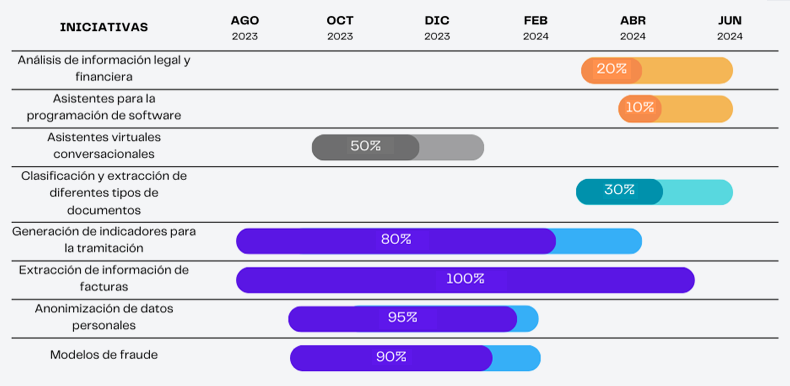

The following chart sets out the status of some of the projects that are already in progress, and the company is assessing numerous other proposals.

Figure 2. TIREA projects status (orange: analysis phase; gray: blocked; blue: development phase; purple: production phase).

Source: own production.

An unlimited future?

Uses of artificial intelligence are virtually infinite in scope. As an information technology company, it is imperative for TIREA to stay at the forefront in the development of these technologies. However, it is still being quite cautious about bringing generative artificial intelligence on stream in all the initiatives in which it could make sense to do so. The company takes the position that solutions must be developed in an environment that is both technically and legally secure. For that reason, the organisation is focused on bringing these applications on line in a structured manner. This is not to say that new solutions are not going to be put forward, just that this will be done gradually. TIREA is in constant flux, but it has no pretension of being a startup, which means that it is able to adapt to these changes at a suitable pace. All the initiatives being developed by the company are classified as general-purpose solutions under the recent European Artificial Intelligence Act, none of them would be considered high-risk or prohibited systems.

Implementing neural network models requires high computing power and large amounts of storage. For that reason, deploying these models in on-premise environments can be constraining. As a result, a range of options are being explored to operate solutions in powerful cloud environments that can provide the resources the applications require at reasonable cost. This can appreciably improve the time to market, though never losing sight of the legal regulations needed to be able to implement responsible policies for their use. The guidelines issued by EIOPA (European Insurance and Occupational Pensions Authority) are accordingly adhered to very closely.

In addition, new disruptive paradigms involving quantum computing are constantly emerging, and the company is therefore exploring how these technologies might improve artificial intelligence algorithms to be able to process mass data sets faster and more efficiently. This could entail developing quantum algorithms specifically for such AI tasks as machine learning and optimisation. Even though this field is still in development, the company is staying abreast of the advances being made in this area and needs to consider how intellectual property protection for quantum computing-based AI algorithms and patent and copyright protection of the specific quantum technologies used by AI applications might limit their use.

One way or another, TIREA is establishing a solid groundwork so that it will be ready and able to suitably adapt to the future breakthroughs that are still to come. This is embodied by its ongoing quest for innovation and its ability to get the jump on market changes. By exploring emerging technologies the company shows that it is committed to continuous improvement and is ready and able to embrace change. By investing in modernisation, TIREA is positioning itself to try to fully leverage the opportunities that arise in a technical setting that is in a constant state of flux. Furthermore, its focus on adapting to new trends and its ability to remain receptive to advances in technology enable the company to keep up its activities in the industry and to continue to offer its customers innovative and efficient solutions. The upshot is that TIREA is actively preparing for the future to ensure its position in a world of continuous technological change.

Businesses have been caught up in a process of developing strategies at a reasonable pace to adapt to the new working environment that has emerged thanks to artificial intelligence. The main initiatives in the insurance sector chiefly focus on improving operational efficiency, supporting decision-making, personalising commercial offerings, enhancing interactions with customers and customer service, and including technology product development tools.