Since its inception in 1954, the Consorcio de Compensación de Seguros (hereafter CCS) has helped to provide stability to the insurance industry by offering coverage under a system of indemnities for those losses which relate to risks assured that are not open to protection under an ordinary private policy, since they are caused by extraordinary phenomena occurring in Spain which affect risks located there.

All the perils or causes which are included within the Spanish system for covering extraordinary risks are defined in law taking account, not of their quantitative aspect (total amount of loss inflicted), nor of their geographical impact (extent of the area disturbed), but instead of their qualitative side and bearing in mind the very nature of such risks, which are generally typified by their relatively rare occurrence and their high intensity. This means that although such events are prone to producing huge losses, it is not a necessary condition that they should give rise to high-cost loss or damage for the insured victims to be entitled to compensation.

CCS publishes statistics on extraordinary risks on an annual basis including detailed information on exposure and the loss rate arising, for both events featuring high amounts claimed and those that are less significant. Against this backdrop, this article examines the comparatively major events which the CCS covered in the past 13 years, from 2009 to 2021.

For these purposes, an event is taken to mean any happening which prompts losses from a single cause (whether natural or human) or causes acting in combination (such as flooding and storms), where these are inflicted over a period of several successive days over a very extensive or very tightly concentrated geographical area (according to the circumstances) and involve substantial economic value.

The economic values given relate to indemnities paid out and/or provisioned for (pending settlement or payment) as at 30 April 2022. Thus, neither losses that have taken place yet not been reported, nor costs linked to processing claims, such as payments to adjusters or lawyers and other expenses, are included.

All of the economic values are updated to their worth in euros on 31 December 2021.

The loss or damage shown is for Property and Business Interruption coverage. Personal injury (number of victims) is exclusively reviewed in the section on coverage by type (property, pecuniary loss and personal injury).

Over the period under review (2009-2021) there have been seven very considerable events with an assortment of causes that make them particularly significant.

The causes of the seven events selected were natural phenomena; flooding (including sea-battering along coasts), atypical cyclonic storms (ACS), earthquake and volcanic eruption, no major event having been caused by humans.

Accordingly, the big events in the 2009–2021 dataset, in chronological order, were:

| Nº | Month and year of the event | Affected area | Peril/cause | Loss | Number of handling | Mean cost | Insured capital | ‰ |

|---|---|---|---|---|---|---|---|---|

| 1º | January 2009 | Widespread | Windstrom (Klaus) | 600,585,658 € | 27,1347 | 2,213 € | 1,669,312,181,115 € | 0.36 |

| 2º | May 2011 | Murcia Region | Earthquake (Lorca) | 552,298,293 € | 28,856 | 19,140 € | 66,223,141,561 € | 8.34 |

| 3º | September 2012 | Peninsular SE | Flood and windstorm | 238,983,502 € | 25,854 | 9,244 € | 160,194,784,948 € | 1.49 |

| 4º | September 2019 | Peninsular SE | Flood | 474,701,759 € | 56,067 | 8,467 € | 199,845,872,073 € | 2.38 |

| 5º | January 2020 | Widespread | Flood, coastal flood and windstorm | 217,368,110 € | 54,323 | 4,001 € | 212,964,399,614 € | 1.02 |

| 6º | December 2021 | Widespread | Flood | 91,707,101 € | 7,766 | 11,809 € | 34,431,307,823 € | 2.66 |

| 7º | Sept. To Dec. 2021 | La Palma | Volcanic eruption and earthquake | 223,189,828 € | 6,209 | 35,946 € | 5,181,852,345 € | 43.07 |

| Totals | 2,398,834,250 € | 450,422 | 5,326 € | 2,348,153,539,480 € | 1.02 | |||

Table 1. Details of events.

The causes were flooding, windstorm, or a combination of both, earthquakes and volcanic eruption (the eruption was accompanied by a few earth tremors, which produced comparatively minor losses).

The economic loss from these selected events ranges from 91.7 million euros to over 600 million euros.

The range for the number of claims handled runs from 6,209 for the La Palma eruption to 271,347 for storm Klaus.

The differences in the average cost per claim handled are mainly due to the cause of the event (which we shall go on to discuss below), where this ranges from 2,213 euros to 35,946 euros, with the extreme levels with respect to the number of claims being the other way round in this case, i.e., the smaller average cost was for storm Klaus, while the larger one was for the La Palma volcanic eruption.

The last columns show the sums assured in the claims policies (not including motor vehicles/autos, which have no sum associated with them) and the percentage (per mille or parts per thousand) of the loss indemnified compared to the sum assured, where once again the differences (between 0.36‰ and 43.07‰) are closely related to the cause of the loss. This percentage must be used solely to compare one event with another, since it is not the loss to sum exposed ratio, but rather the loss to sum assured in the policy, which can include risks from all over Spain.

To frame the aforementioned events in due context it is worth describing the relationship between the claims incurred by the selected events and the overall loss which the CCS covers for each of the years in the dataset under review:

| Year | Total | Event | Percentage | |||||

|---|---|---|---|---|---|---|---|---|

| Loss | Handlings number | Mean cost | Loss | Handlings number | Mean cost | Loss | Handling number | |

| 2009 | 862,938,599 € | 299,549 | 2,881 € | 600,585,658 € | 271,347 | 2,213 € | 70% | 91% |

| 2010 | 546,510,661 € | 124,804 | 4,379 € | --- | --- | --- | --- | --- |

| 2011 | 762,315,530 € | 54,408 | 14,011 € | 552,298,293 € | 28,856 | 19,140 € | 72% | 53% |

| 2012 | 309,079,230 € | 42,137 | 7,335 € | 238,983,502 € | 25,854 | 9,244 € | 77% | 61% |

| 2013 | 199,607,104 € | 62,705 | 3,183 € | --- | --- | --- | --- | --- |

| 2014 | 182,798,414 € | 53,589 | 3,411 € | --- | --- | --- | --- | --- |

| 2015 | 203,292,988 € | 46,109 | 4,409 € | --- | --- | --- | --- | --- |

| 2016 | 202,781,722 € | 38,559 | 5,259 € | --- | --- | --- | --- | --- |

| 2017 | 207,628,021 € | 100,067 | 2,075 € | --- | --- | --- | --- | --- |

| 2018 | 259,427,160 € | 47,469 | 5,465 € | --- | --- | --- | --- | --- |

| 2019 | 763,171,785 € | 137,594 | 5,547 € | 474,701,759 € | 56,067 | 8,467 € | 62% | 41% |

| 2020 | 370,334,596 € | 92,650 | 3,997 € | 217,368,110 € | 54,323 | 4,001 € | 59% | 59% |

| 2021 | 539,771,956 € | 81,423 | 6,629 € | 314,896,999 € | 13,975 | 22,533 € | 58% | 17% |

| Totals | 5,409,657,766 € | 1,181,063 | 4,580 € | 2,398,834,250 € | 450,422 | 5,326 € | 44% | 38% |

Table 2. Total loss covered by the CCS and claims incurred by the selected events that are representative for the year when they occurred.

The seven events selected together account for 44% of indemnities and 38% of claims handled by the CCS over the 2009–2021 period.

In 2021 two significant events accrued - the La Palma volcano and the December flooding.

We can also see the weight of events relative to the year when they occurred. For economic value this ranges from 58% in 2021 to 77% in 2012 while the interval for the number of claims handled runs from 17% in 2021 to 91% in 2009.

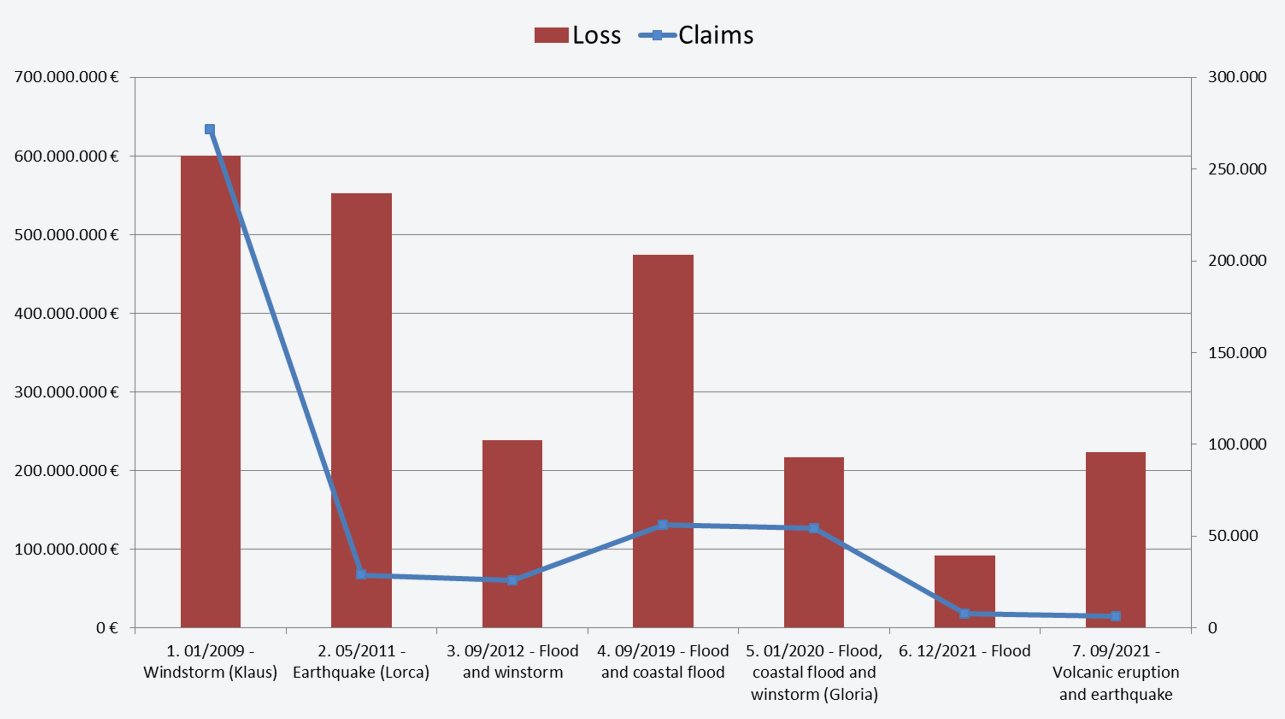

In graphic terms the seven events would be represented thus:

Figure 1. Loss and claims handled per event.

Figure 2. Percentage of loss and claims handled per event.

As can be appreciated, the event having the largest amount paid out is Klaus (January 2009), which tops 600 million euros, followed by the Lorca earthquake (May 2011) with over 550 million euros and the flooding (from a cut-off low) in the south-east of the Iberian Peninsula (September 2019) at 475 million euros. These events respectively account for 25%, 23% and 20% of the total for the selected events.

The events with the largest number of claims handled is (as mentioned) the windstorm named Klaus (January 2009), which had a widespread effect over a large part of Spain, surpassing 270,000 claims filed and representing 60% of those for the selected events.

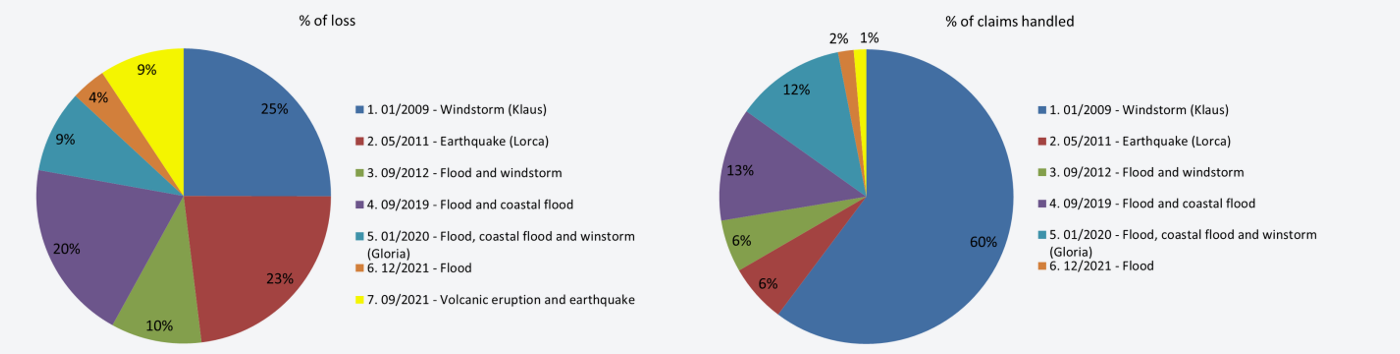

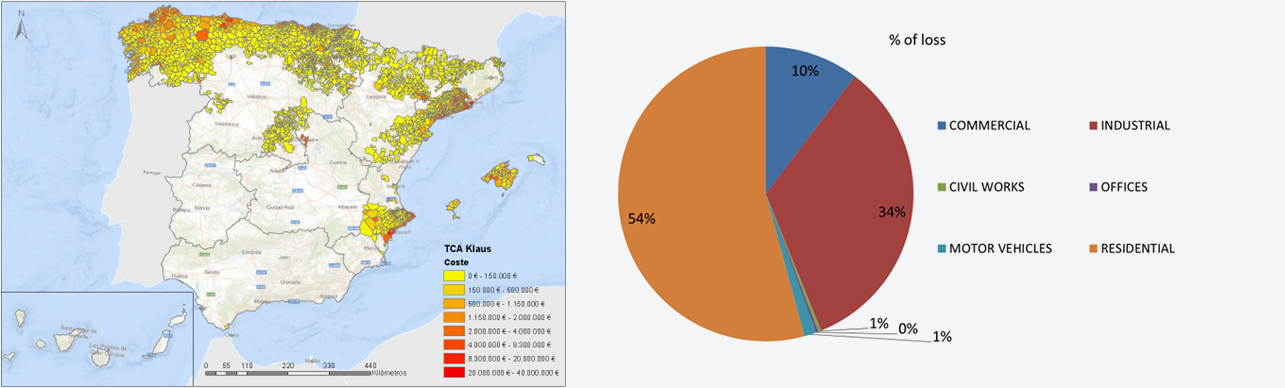

Figure 3. Average cost of indemnities per event.

The most substantial average costs occurred for geological risks, specifically the volcanic eruption on the island of La Palma, from September to December 2021, with a figure of in excess of 35,000 euros, followed by the Lorca earthquake of May 2011 with an average cost of more than 19,000 euros.

The next sections will examine the events from several different standpoints:

| Event | Loss | Claims handled | ||||||

|---|---|---|---|---|---|---|---|---|

| Property | % | Business interruption | % | Property | % | Business Interruption | % | |

| 1. 01/2009 - Windstorm (Klaus) | 590,290,147 € | 98.3% | 10,295,510 € | 1.7% | 271,177 | 99.9% | 170 | 0.1% |

| 2. 05/2011 - Earthquake (Lorca) | 532,988,250 € | 96.5% | 19,310,043 € | 3.5% | 26,060 | 90.3% | 2,796 | 9.7% |

| 3. 09/2012 - Flood and windstorm | 235,111,521 € | 98.4% | 3,871,981 € | 1.6% | 25,456 | 98.5% | 398 | 1.5% |

| 4. 09/2019 - Flood, coast flood | 464,975,050 € | 98.0% | 9,726,709 € | 2.0% | 55,593 | 99.2% | 474 | 0.8% |

| 5. 01/2020 - Flood, coast flood and windstorm (Gloria) | 208,145,540 € | 95.8% | 9,222,570 € | 4.2% | 54,189 | 99.8% | 134 | 0.2% |

| 6. 12/2021 - Flood | 88,310,490 € | 96.3% | 3,398,611 € | 3.7% | 7,635 | 98.3% | 131 | 1.7% |

| 7. 09/2021 - Volcanic eruption and earthquake | 216,592,813 € | 97.0% | 6,598,015 € | 3.0% | 5,597 | 90.1% | 612 | 9.9% |

| Totals | 2,336,412,811 € | 97.4% | 62,421,439 € | 2.6% | 445,707 | 99.0% | 4,715 | 1.0% |

Table 3. Amount of indemnities and number of claims handled which they account for by coverage.

Coverage for property is that which has the largest share in both indemnities (97.4%) and number of claims handled (99%), whereas the coverage for business interruption does not account for much with respect to total indemnities and total number of claims handled (2.6% and 1%, respectively).

As we can observe, events caused by geological phenomena —the Lorca earthquake and the volcano on the island of La Palma– have a different distribution as regards the number of claims handled relative to the other events studied, with a weight of around (90%) in property and (10%) in business interruption.

Turning to the form of coverage of personal injury, the next table gives us the number of victims who had CCS coverage itemised by the degree of seriousness of the harm caused (temporary injuries, permanent injuries or death):

| Event | Temporary injuries | Permanent injuries | Death | Total víctims |

|---|---|---|---|---|

| 1. 01/2009 - Windstorm (Klaus) | 1 | 5 | 1 | 7 |

| 2. 05/2011 - Earthquake (Lorca) | 1 | 4 | 4 | 9 |

| 3. 09/2012 - Flood and windstorm | 2 | 3 | 8 | 13 |

| 4. 09/2019 - Flood and coastal flood | 1 | - | 4 | 5 |

| 5. 01/2020 - Flood, coastal flood and windstorm | 3 | - | 3 | 6 |

| 6. 12/2021 - Flood | - | - | - | - |

| 7. 09/2021 - Colcanic eruption and earthquake | - | - | - | - |

| Totals | 8 | 12 | 20 | 40 |

| 20% | 30% | 50% | 100% |

Table 4. Number of victims indemnified as a result of each of the events.

The first five events did in fact lead to personal injury in the range of five to thirteen victims, whereas in the last two cases no personal injury covered by the CCS was caused.

In 20% of cases there were temporary injuries, in 30% permanent injuries and in the other 50% there were fatalities.

The table below shows the indemnities, number of claims handled by coverage and the average cost per cause for the seven events all taken together:

| Peril | Loss | % | Claims handled | % | Mean cost |

|---|---|---|---|---|---|

| COASTAL FLOOD | 47,062,399 € | 2.0% | 1,870 | 0.4% | 25,167 € |

| VOLCANIC ERUPTION | 223,125,133 € | 9.3% | 6,183 | 1.4% | 36,087€ |

| FLOOD | 904,624,306 € | 37.7% | 99,258 | 22.0% | 9,114 € |

| WINDSTORM | 671,659,425 € | 28.0% | 314,229 | 69.8% | 2,137 € |

| EARTHQUAKE | 552,362,987 € | 23.0% | 28,882 | 6.4% | 19,125 € |

| Totals | 2,398,834,250 € | 100% | 450,42 | 100% | 5,326 € |

Table 5. Indemnities, claims handled and average cost by peril/cause.

In this table the events originated by various different causes (flooding and windstorm or volcano and earthquake) have been separated out to show the causes in purer form.

The cause having the largest amount paid out is flooding, which tops 900 million euros, followed by the ACS with over 670 million euros and the earthquake at 552 million euros. These causes respectively account for 38%, 28% and 23% of total indemnities for the selected events.

The peril which unites the biggest volume of claims handled is windstorm, which saw over 314,000, speaking for 70% of the total. This was followed by flooding, with close to 100,000 claims handled, or 22% of the total. These two causes together account for 92% of overall claims handled for the events selected.

The cause with the highest average cost is the volcanic eruption with a figure of over 35,000 euros, followed by coastal flood (a special type of flood which above all affects marinas and infrastructure, largely with a high repair cost) at 25,000 euros, and the earthquake with an amount approaching 20,000 euros.

Although flooding and windstorm led the way in both amount indemnified and total claims handled, in respect of their average amount indemnified they are just shy of 9,200 euros and 2,200 euros, respectively.

To summarise, geological hazards or swells, which can easily cause structural damage to buildings, generally reap more expensive losses than flooding or gales, which bring about more localised damage which is seldom structural.

| Kind of property | Loss | % | Claims handled | % | Mean cost |

|---|---|---|---|---|---|

| SHOP, WEARHOUSES AND OTHER | 413,815,455 € | 17.3% | 28,433 | 6.3% | 14,554 € |

| INDUSTRIES | 369,157,486 € | 15.4% | 19,523 | 4.3% | 18,909 € |

| CIVIL WORKS | 46,586,099 € | 1.9% | 202 | 0.0% | 230,624 € |

| OFFICES | 22,416,407 € | 0.9% | 2,006 | 0.4% | 11,175 € |

| MOTOR VEHICLES | 128,475,320 € | 5.4% | 35,610 | 7.9% | 3,608 € |

| RESIDENTIAL | 1,418,383,483 € | 59.1% | 364,648 | 81.0% | 3,890 € |

| Totals | 2,398,834,250 € | 100% | 450,422 | 100% | 5,326 € |

Table 6. Indemnities, claims handled and average cost by kind of property.

The kind of property with the highest sum paid out are residential properties at more than 1,400 million euros, followed by shops, warehouses and other properties, at in excess of 400 million euros, and industries with verging on 370 million euros. These kind of properties respectively account for 59%, 17% and 16% of overall indemnities for the events selected.

The kind of property with the highest number of claims handled are residential properties at more than 369,000 and representing 81% of them.

The average cost of civil works appears very substantial and surpasses that for the other kinds of property.

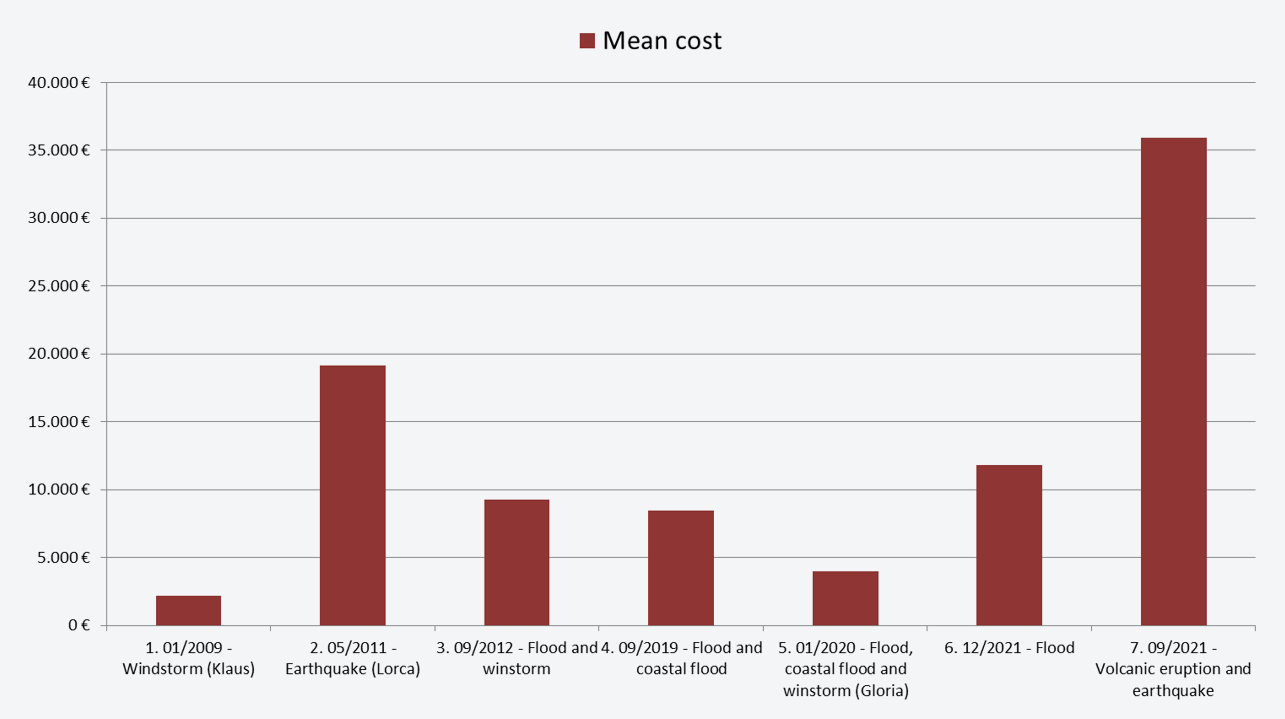

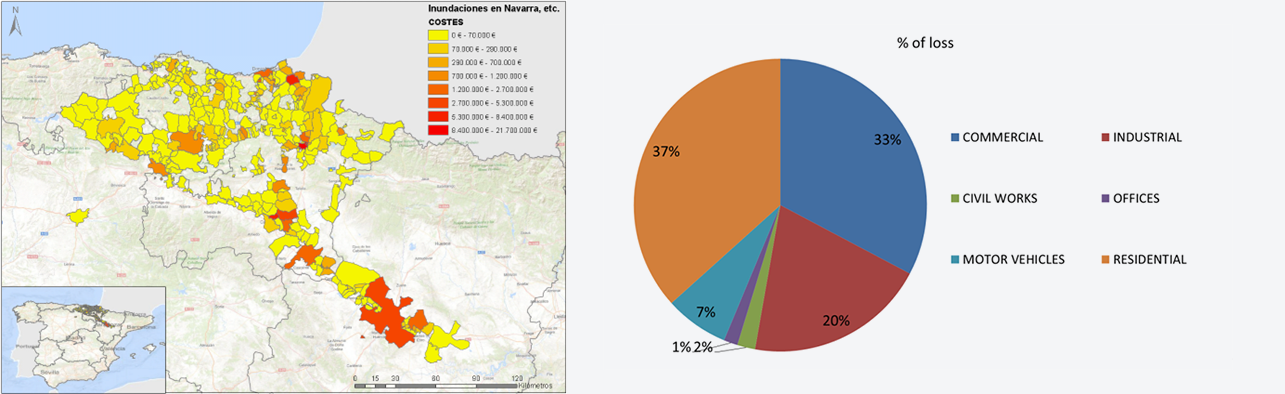

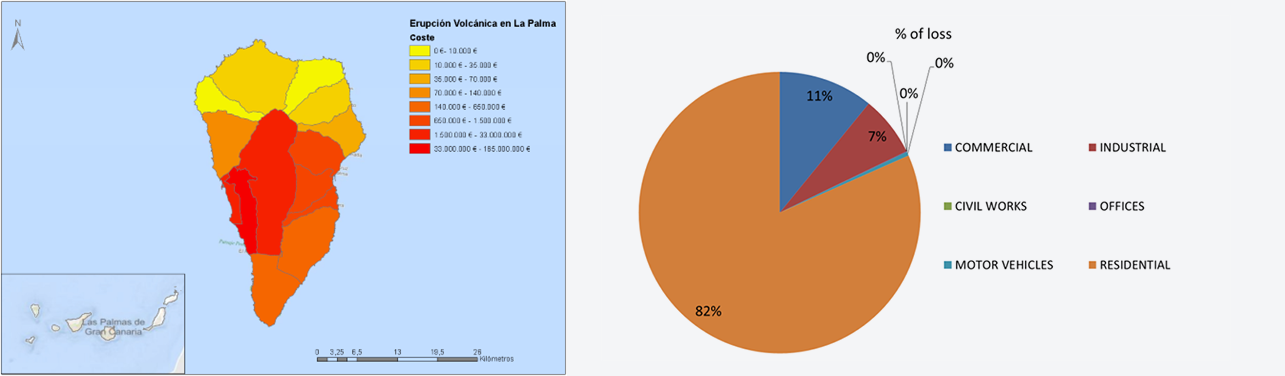

For each of the seven selected events we now go on to present a series of figures which depict the spatial distribution of the losses indemnified by municipal district and cost, as well as the affected percentage distribution according to each kind of property.

Figure 8. Windstorm Klaus, January 2009. Spatial and property class distribution for indemnities.

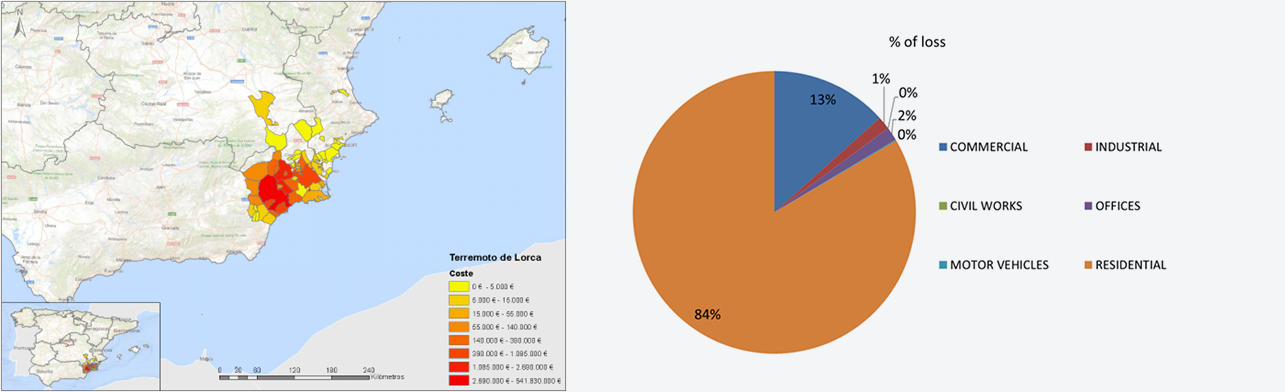

Figure 9. Lorca earthquake, May 2011. Spatial and property class distribution for indemnities.

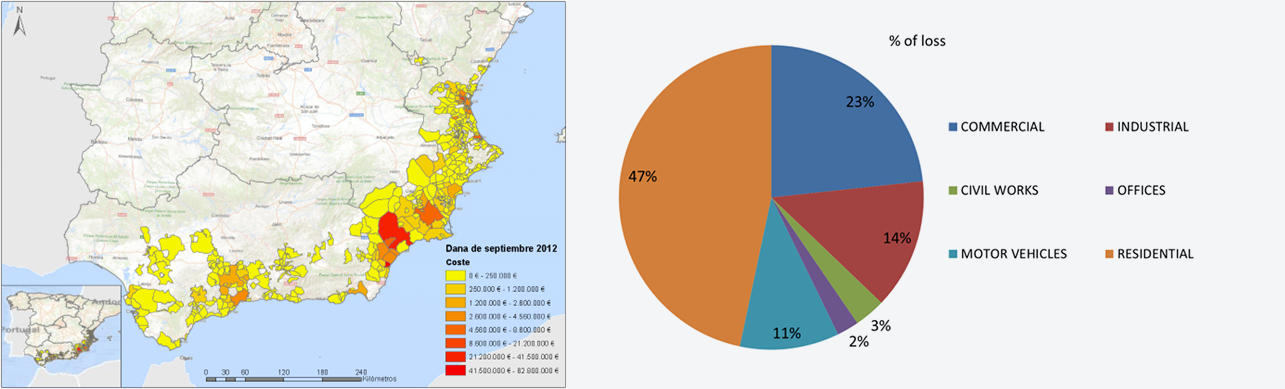

Figure 10. Cut-off low-caused flood of September 2012. Spatial and property class distribution for indemnities.

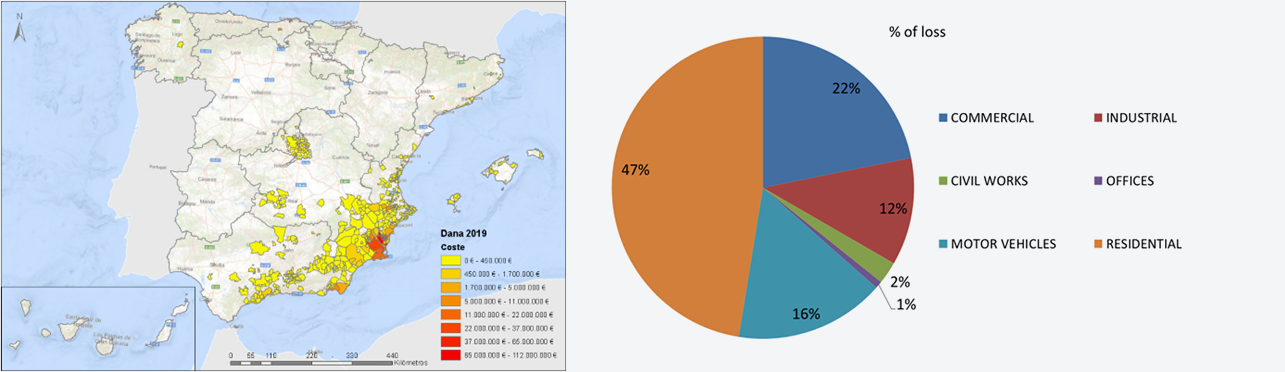

Figure 11. Cut-off low-caused flood of September 2019. Spatial and property class distribution for indemnities.

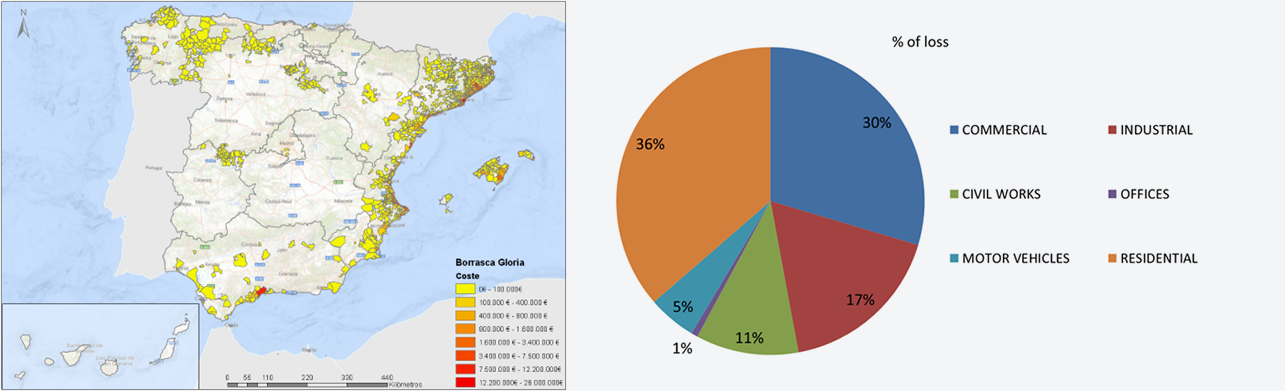

Figure 12. Storm Gloria of January 2020. Spatial and property class distribution for indemnities.

Figure 13. Floods in Navarre, the Basque Country, Burgos and Aragon, December 2021. Spatial and property class distribution for indemnities.

Figure 14. La Palma volcanic eruption of 19 September to 13 December 2021. Spatial and risk class distribution for indemnities.

In short, figures 8 to 14 perfectly summarise the composition of total losses according to property class: geological risks mainly affect residential properties (over 80% of them), whereas floods are more spread out among residential, commercial and industrial, with autos accounting for a notable share of losses, while episodes featuring sea-battering cause a relatively high percentage of loss and damage to civil works. Even so, we should point out that the percentage of insured civil works is lower than for other risk classes, since not much infrastructure is insured and instead it is the public authorities who repair damage which they charge to their own budgeting (in other words the authorities self-insure to a large extent). Thus, it is that the percentage of losses for civil works tends to be relatively lower than for other risk classes, which have a higher rate of insurance take-out.

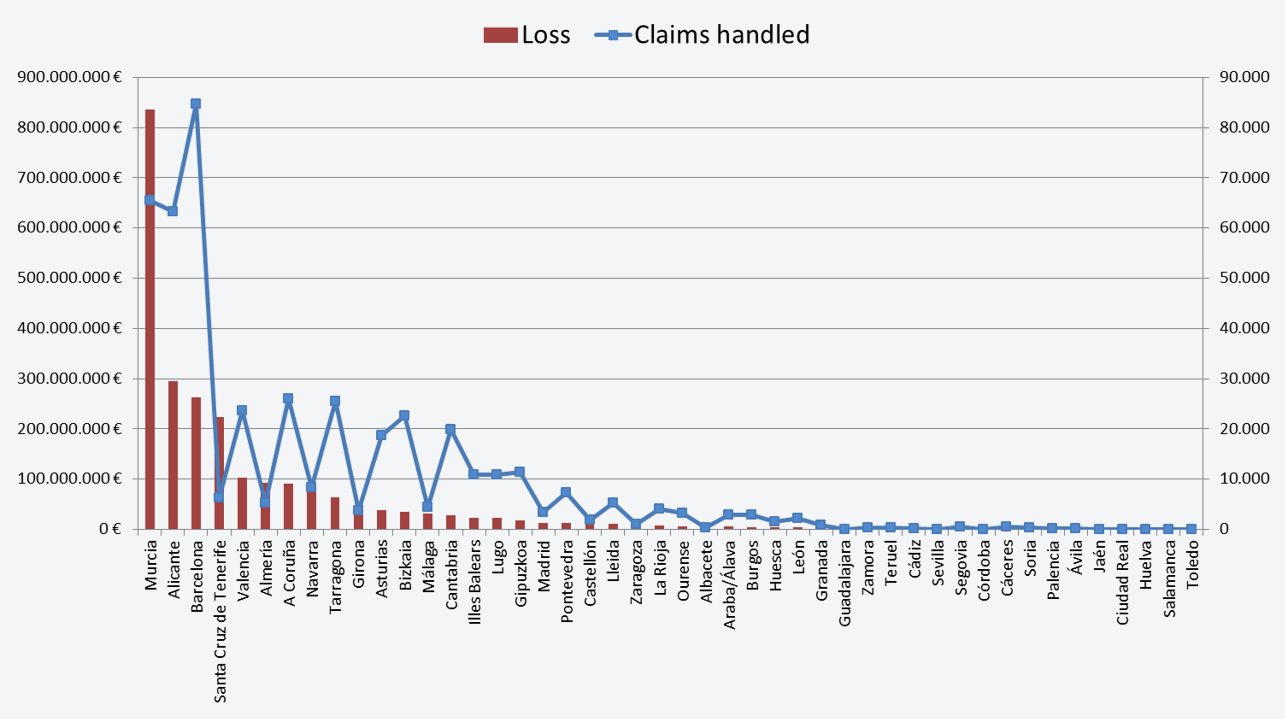

The degree of impact for the seven events taken together by province:

Figure 15. Indemnities and claims handled by province.

There was a notable build-up of losses from these major events in the Murcia Region, where several different causes all appeared, namely earthquake, flooding and windstorm activity.

After Murcia, the next most significant provinces by volume of indemnities were Alicante, Barcelona and Santa Cruz de Tenerife, and, to a lesser degree, Valencia, Almería, A Coruña, Navarra, Tarragona and Girona.

The concentration of losses in the south-east and north of the Peninsula is noticeable, as well as in the province of Santa Cruz de Tenerife.

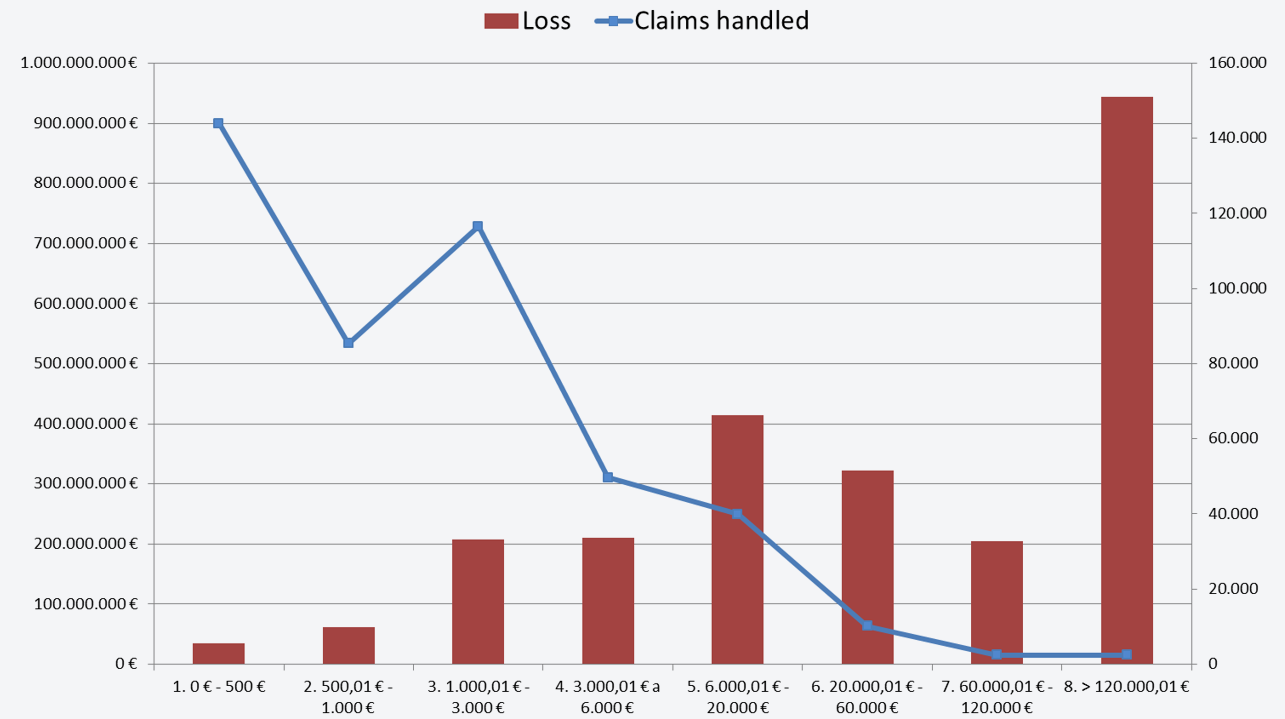

The following tables assess the distribution of loss according to bands for the amount in each claim handled for the whole set of seven events:

| Idemnity band | Loss | Accumulated loss % | Claims handled | % of accumulated claims handled | Mean cost |

|---|---|---|---|---|---|

| 1. 0 € - 500 € | 34,147,674 € | 1.4% | 143,985 | 32.0% | 237 € |

| 2. 500.01 € - 1,000 € | 61,702,851 € | 4.0% | 85,338 | 50.9% | 723 € |

| 3. 1,000.01 € - 3,000 € | 207,477,807 € | 12.6% | 116,557 | 76.8% | 1,780 € |

| 4. 3,000.01 € - 6,000 € | 210,285,327 € | 21.4% | 49,682 | 87.8% | 4,233 € |

| 5. 6,000.01 € - 20,000 € | 414,895,394 € | 38.7% | 39,962 | 96.7% | 10,382 € |

| 6. 20,000.01 € - 60,000 € | 322,630,715 € | 52.2% | 10,147 | 98.9% | 31,796 € |

| 7. 60,000.01 € - 120,000 € | 204,437,563 € | 60.7% | 2,372 | 99.5% | 86,188 € |

| 8. > 120,000.01 € | 943,256,919 € | 100% | 2,379 | 100% | 396,493 € |

| Totals | 2,398,834,250 € | 100% | 450,422 | 100% | 5,326 € |

Table 7. Indemnities, number of claims handled and average cost by band of indemnity.

In 87.8% of claims handled and opened with the CCS, the indemnity per case is at a cost of less than or equal to 6,000 euros; in 99.5% of claims handled the cost will come to less than or equal to 120,000 euros; and in less than 1% of claims handled the cost is over 120,000 euros.

Within the last band there are 137 claims handled where the indemnity is more than one million euros.

Figure 17. Indemnities and claims handled per band of indemnity.

The 2009-2021 period seems particularly significant to analysis of major events bearing in mind that over those 13 years seven events occurred out of the fifteen most significant of them within the full set of available data since records began (a 51-year series running from 1971 to 2021). Furthermore, the information on them is more complete given how recent they have been.

The analysis of the information in this article shows that the cause (flooding, windstorm, or an earthquake or volcano) will be decisive as regards the variables that come to define the event, chiefly as regards the geographical area affected and the average costs per claim handled, as well as, though to a lesser degree, with respect to other variables, such as the property class concerned and distinction between types of coverage (damage and pecuniary loss).